Irs Form 4506t

What is the IRS Form 4506-T?

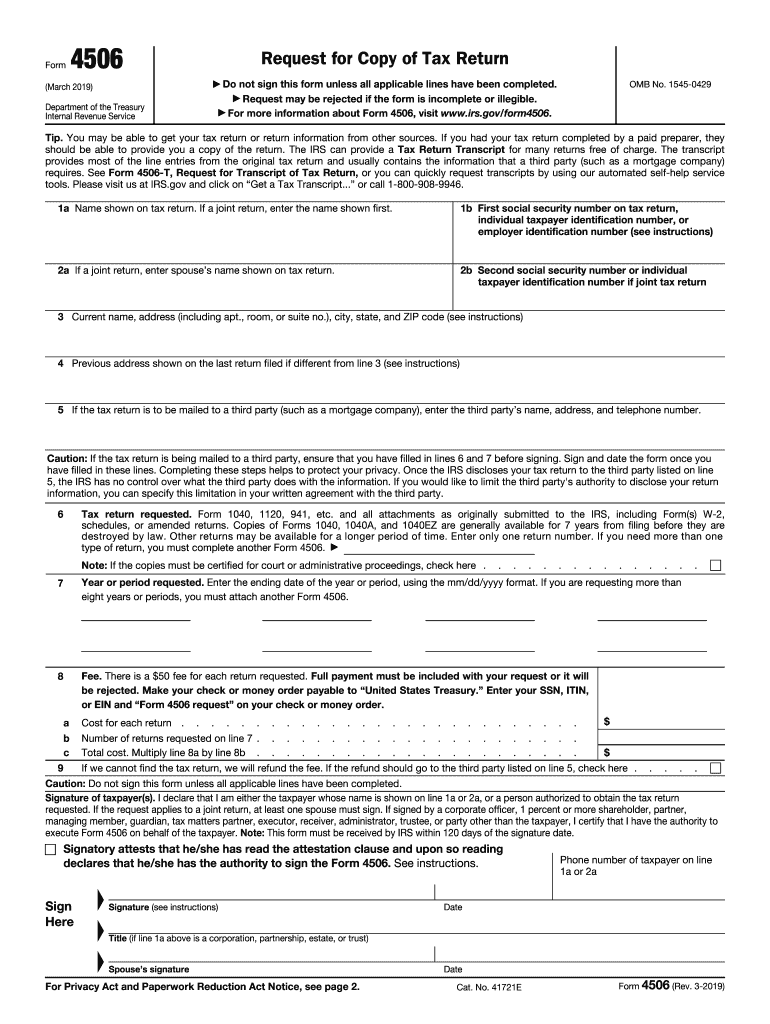

The IRS Form 4506-T, also known as the Request for Transcript of Tax Return, is a document that allows taxpayers to request a transcript of their tax return information from the Internal Revenue Service (IRS). This form is commonly used to obtain a copy of a 2019 tax return copy or other tax years, providing essential information for various purposes, including loan applications, mortgage processes, and verifying income. The form can be used to request transcripts for individual income tax returns, business tax returns, and other tax-related documents.

How to Use the IRS Form 4506-T

Using the IRS Form 4506-T is straightforward. First, download the form from the IRS website or obtain a physical copy. Fill out the required sections, including your name, Social Security number, and the tax year for which you are requesting a transcript, such as the 2019 tax return copy. Indicate the type of transcript you need, whether it is a tax return transcript or an account transcript. Once completed, submit the form to the IRS via mail or fax, depending on your preference and urgency. Ensure that you provide accurate information to avoid delays in processing your request.

Steps to Complete the IRS Form 4506-T

Completing the IRS Form 4506-T involves several key steps:

- Download the form from the IRS website or obtain a paper version.

- Fill in your personal information, including your name, address, and Social Security number.

- Specify the tax year for which you are requesting the transcript, such as 2019.

- Indicate the type of transcript you need, such as a tax return transcript or account transcript.

- Provide the name and address of the third party (if applicable) who will receive the transcript.

- Sign and date the form to certify that the information provided is accurate.

After completing the form, submit it to the IRS using the appropriate mailing address or fax number provided in the form instructions.

Legal Use of the IRS Form 4506-T

The legal use of the IRS Form 4506-T is governed by IRS regulations. This form is recognized as a valid request for tax information and is often required for financial transactions, such as applying for loans or mortgages. When using the form, it is important to ensure compliance with privacy laws and regulations, as the information contained in tax transcripts is sensitive. Properly completed forms can be used in legal proceedings, financial assessments, and other official matters where proof of income or tax history is necessary.

Form Submission Methods

The IRS Form 4506-T can be submitted through various methods, allowing flexibility based on the taxpayer's needs:

- Mail: Send the completed form to the address specified in the form instructions for your state.

- Fax: If you need a quicker response, you can fax the completed form to the designated fax number provided in the instructions.

Choose the submission method that best suits your needs, keeping in mind the processing times associated with each option.

Required Documents

When submitting the IRS Form 4506-T, it is essential to have certain documents ready to ensure a smooth process. Typically, you will need:

- Your completed Form 4506-T with accurate information.

- A valid form of identification, such as your Social Security number.

- Any additional documentation that may be required for third-party requests, if applicable.

Having these documents prepared can help expedite the processing of your request for a copy of the 2019 tax return or other tax years.

Quick guide on how to complete form 4506 rev 3 2019

Effortlessly Prepare Irs Form 4506t on Any Device

The management of online documents has become increasingly favored by companies and individuals alike. It serves as a fantastic eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it in the cloud. airSlate SignNow provides you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Handle Irs Form 4506t on any platform using the airSlate SignNow apps for Android or iOS, and enhance any document-centric operation today.

Steps to Modify and eSign Irs Form 4506t with Ease

- Locate Irs Form 4506t and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of your documents or redact sensitive information with the tools airSlate SignNow specifically provides for that task.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Decide how you want to send your form, whether via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require new document copies to be printed. airSlate SignNow fulfills all your document management needs within a few clicks from your chosen device. Edit and eSign Irs Form 4506t while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4506 rev 3 2019

How to make an electronic signature for your Form 4506 Rev 3 2019 online

How to make an eSignature for the Form 4506 Rev 3 2019 in Google Chrome

How to create an electronic signature for signing the Form 4506 Rev 3 2019 in Gmail

How to make an eSignature for the Form 4506 Rev 3 2019 straight from your mobile device

How to generate an eSignature for the Form 4506 Rev 3 2019 on iOS devices

How to make an eSignature for the Form 4506 Rev 3 2019 on Android devices

People also ask

-

What is IRS Form 4506-T and how is it used?

IRS Form 4506-T is a request form used by taxpayers to obtain a transcript of their tax return or to authorize the release of their tax information to a third party. This form is essential for individuals or businesses needing to verify their income or tax status, especially when applying for loans or other financial services.

-

How can airSlate SignNow help with IRS Form 4506-T?

With airSlate SignNow, you can easily prepare, send, and eSign IRS Form 4506-T securely online. Our platform streamlines the process, allowing you to fill out the form quickly and ensure that your documents are signed and stored safely in the cloud.

-

Is airSlate SignNow compliant with IRS regulations for IRS Form 4506-T?

Yes, airSlate SignNow is fully compliant with IRS regulations for handling IRS Form 4506-T. We prioritize security and data protection, ensuring that your sensitive information is managed according to the highest industry standards.

-

What are the pricing options for using airSlate SignNow for IRS Form 4506-T?

airSlate SignNow offers flexible pricing plans, including a free trial, making it accessible for businesses of all sizes. Our plans are designed to provide value by allowing unlimited document signing, including IRS Form 4506-T, at competitive rates.

-

Can I integrate airSlate SignNow with other software for processing IRS Form 4506-T?

Absolutely! airSlate SignNow integrates seamlessly with various applications, such as CRM systems and cloud storage services, making it easier to manage IRS Form 4506-T and other documents. This integration enhances workflow efficiency and simplifies document handling.

-

What features does airSlate SignNow offer for signing IRS Form 4506-T?

airSlate SignNow includes powerful features like customizable templates, mobile signing, and advanced security options for signing IRS Form 4506-T. Our user-friendly interface ensures that you can complete your forms quickly and efficiently, saving you time.

-

How does airSlate SignNow ensure the security of my IRS Form 4506-T?

We take security seriously at airSlate SignNow. Our platform uses encryption, secure data storage, and compliance with industry regulations to protect your IRS Form 4506-T and other documents, ensuring that your information remains confidential and secure.

Get more for Irs Form 4506t

- Uniform residential loan application fillable

- Bank customer information form

- Fidelity simple ira account application form

- Blank ira statement form

- Inherited ira for spouses application fidelity form

- Use this form to pledge fidelity mutual fund shares only

- Bank of america application pdf form

- For the year january 1 december 31 or fiscal tax year beginning form

Find out other Irs Form 4506t

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online