Irs Form 4506t

What is the IRS Form 4506-T?

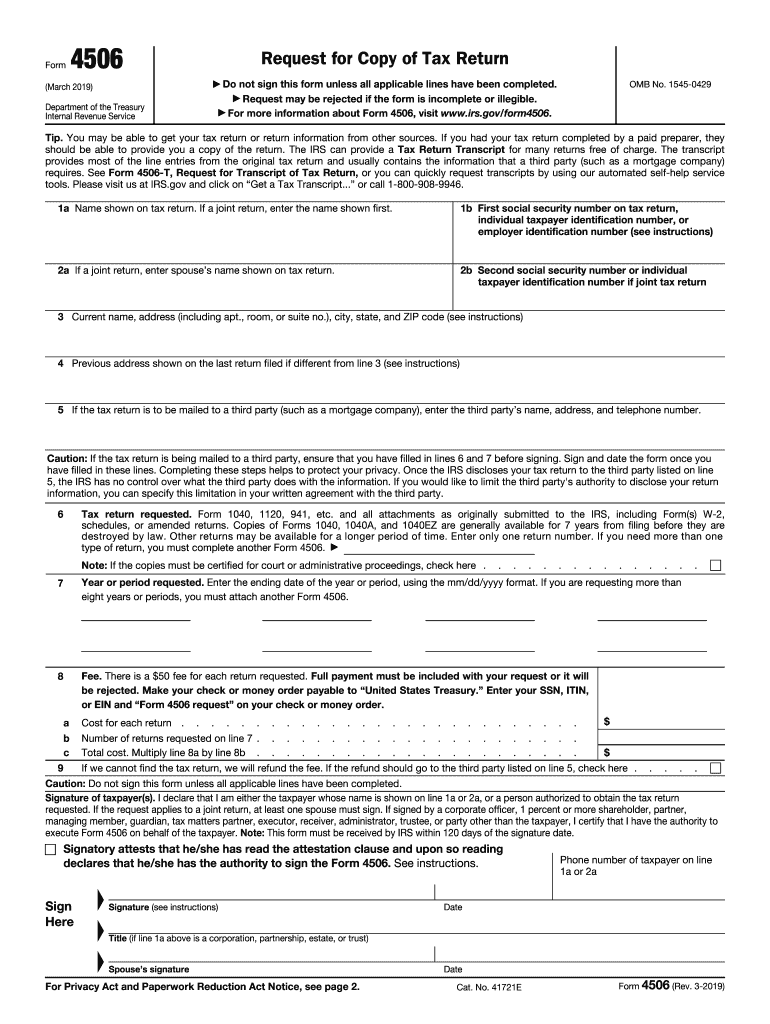

The IRS Form 4506-T, also known as the Request for Transcript of Tax Return, is a document that allows taxpayers to request a transcript of their tax return information from the Internal Revenue Service (IRS). This form is commonly used to obtain a copy of a 2019 tax return copy or other tax years, providing essential information for various purposes, including loan applications, mortgage processes, and verifying income. The form can be used to request transcripts for individual income tax returns, business tax returns, and other tax-related documents.

How to Use the IRS Form 4506-T

Using the IRS Form 4506-T is straightforward. First, download the form from the IRS website or obtain a physical copy. Fill out the required sections, including your name, Social Security number, and the tax year for which you are requesting a transcript, such as the 2019 tax return copy. Indicate the type of transcript you need, whether it is a tax return transcript or an account transcript. Once completed, submit the form to the IRS via mail or fax, depending on your preference and urgency. Ensure that you provide accurate information to avoid delays in processing your request.

Steps to Complete the IRS Form 4506-T

Completing the IRS Form 4506-T involves several key steps:

- Download the form from the IRS website or obtain a paper version.

- Fill in your personal information, including your name, address, and Social Security number.

- Specify the tax year for which you are requesting the transcript, such as 2019.

- Indicate the type of transcript you need, such as a tax return transcript or account transcript.

- Provide the name and address of the third party (if applicable) who will receive the transcript.

- Sign and date the form to certify that the information provided is accurate.

After completing the form, submit it to the IRS using the appropriate mailing address or fax number provided in the form instructions.

Legal Use of the IRS Form 4506-T

The legal use of the IRS Form 4506-T is governed by IRS regulations. This form is recognized as a valid request for tax information and is often required for financial transactions, such as applying for loans or mortgages. When using the form, it is important to ensure compliance with privacy laws and regulations, as the information contained in tax transcripts is sensitive. Properly completed forms can be used in legal proceedings, financial assessments, and other official matters where proof of income or tax history is necessary.

Form Submission Methods

The IRS Form 4506-T can be submitted through various methods, allowing flexibility based on the taxpayer's needs:

- Mail: Send the completed form to the address specified in the form instructions for your state.

- Fax: If you need a quicker response, you can fax the completed form to the designated fax number provided in the instructions.

Choose the submission method that best suits your needs, keeping in mind the processing times associated with each option.

Required Documents

When submitting the IRS Form 4506-T, it is essential to have certain documents ready to ensure a smooth process. Typically, you will need:

- Your completed Form 4506-T with accurate information.

- A valid form of identification, such as your Social Security number.

- Any additional documentation that may be required for third-party requests, if applicable.

Having these documents prepared can help expedite the processing of your request for a copy of the 2019 tax return or other tax years.

Quick guide on how to complete form 4506 rev 3 2019

Effortlessly Prepare Irs Form 4506t on Any Device

The management of online documents has become increasingly favored by companies and individuals alike. It serves as a fantastic eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it in the cloud. airSlate SignNow provides you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Handle Irs Form 4506t on any platform using the airSlate SignNow apps for Android or iOS, and enhance any document-centric operation today.

Steps to Modify and eSign Irs Form 4506t with Ease

- Locate Irs Form 4506t and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of your documents or redact sensitive information with the tools airSlate SignNow specifically provides for that task.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Decide how you want to send your form, whether via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require new document copies to be printed. airSlate SignNow fulfills all your document management needs within a few clicks from your chosen device. Edit and eSign Irs Form 4506t while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4506 rev 3 2019

How to make an electronic signature for your Form 4506 Rev 3 2019 online

How to make an eSignature for the Form 4506 Rev 3 2019 in Google Chrome

How to create an electronic signature for signing the Form 4506 Rev 3 2019 in Gmail

How to make an eSignature for the Form 4506 Rev 3 2019 straight from your mobile device

How to generate an eSignature for the Form 4506 Rev 3 2019 on iOS devices

How to make an eSignature for the Form 4506 Rev 3 2019 on Android devices

People also ask

-

How can I obtain a copy of tax return 2019 using airSlate SignNow?

To obtain a copy of tax return 2019 using airSlate SignNow, simply upload your document for e-signature. Our easy-to-use platform allows you to securely share, sign, and store your tax returns, ensuring that you have access to a digital copy whenever you need it.

-

What features does airSlate SignNow offer for handling documents like a copy of tax return 2019?

airSlate SignNow offers features like customizable templates, in-app editing, and secure cloud storage to effectively manage documents such as a copy of tax return 2019. With these features, users can streamline their document workflow and ensure their tax return is easily accessible and legally recognized.

-

Is airSlate SignNow cost-effective for obtaining a copy of tax return 2019?

Yes, airSlate SignNow provides a cost-effective solution for obtaining documents like a copy of tax return 2019. With flexible pricing plans, businesses can choose a plan that suits their needs without breaking the bank while enjoying robust features.

-

Can airSlate SignNow integrate with other tools to manage a copy of tax return 2019?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage a copy of tax return 2019 alongside other important business tools. This integration helps streamline your workflow and improve overall efficiency when dealing with tax documents.

-

What security measures does airSlate SignNow have for storing a copy of tax return 2019?

AirSlate SignNow prioritizes your data security, providing advanced encryption and secure storage options for documents like a copy of tax return 2019. Our platform complies with industry standards to protect your information and ensure that only authorized users can access your sensitive documents.

-

How does eSigning a copy of tax return 2019 work with airSlate SignNow?

eSigning a copy of tax return 2019 with airSlate SignNow is a straightforward process. Once your document is uploaded, you can invite others to sign electronically, making it quick and efficient to complete your tax forms without the hassle of printing and scanning.

-

What benefits can I expect from using airSlate SignNow for my copy of tax return 2019?

By using airSlate SignNow for your copy of tax return 2019, you gain benefits such as faster turnaround times, reduced paperwork, and enhanced accessibility. This allows you to focus more on your business while ensuring your important tax documents are managed effectively.

Get more for Irs Form 4506t

- U s dod form dod psapac 7220 7 download

- Royal caribbean special needs form

- Name under 18 date of birth mdyr form

- Abl 934 south carolina department of revenue sc gov form

- Telemetering service manual for national fuel gas form

- Hoa welcome packet template form

- Fpsc account sign up online form

- Home buy contract template form

Find out other Irs Form 4506t

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free