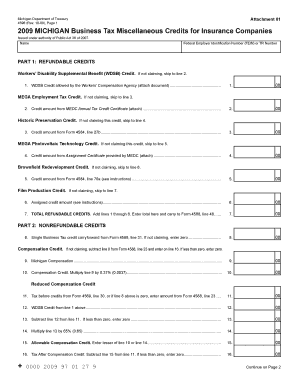

MICHIGAN Business Tax Miscellaneous Credits for Insurance Companies Form

What is the MICHIGAN Business Tax Miscellaneous Credits For Insurance Companies

The MICHIGAN Business Tax Miscellaneous Credits for Insurance Companies is a specific tax provision designed to provide financial relief to insurance companies operating within the state of Michigan. These credits aim to reduce the overall tax burden by allowing eligible companies to offset certain business expenses against their tax liabilities. This program is part of Michigan's broader efforts to support the insurance sector and encourage economic growth within the state.

How to use the MICHIGAN Business Tax Miscellaneous Credits For Insurance Companies

To utilize the MICHIGAN Business Tax Miscellaneous Credits, insurance companies must first determine their eligibility based on the specific criteria outlined by the Michigan Department of Treasury. Once eligibility is confirmed, companies can apply the credits against their business tax obligations when filing their tax returns. It is crucial for businesses to maintain accurate records of all qualifying expenses to substantiate their claims for these credits.

Eligibility Criteria

Eligibility for the MICHIGAN Business Tax Miscellaneous Credits is primarily based on the type of insurance business conducted and the specific expenses incurred. Companies must be licensed to operate in Michigan and must meet certain revenue thresholds. Additionally, the expenses for which credits are claimed must be directly related to the operation of the insurance business and must comply with state regulations.

Steps to complete the MICHIGAN Business Tax Miscellaneous Credits For Insurance Companies

Completing the MICHIGAN Business Tax Miscellaneous Credits involves several steps:

- Review eligibility requirements to ensure compliance.

- Gather documentation for all qualifying expenses, including invoices and receipts.

- Complete the necessary forms as provided by the Michigan Department of Treasury.

- Calculate the total amount of credits based on eligible expenses.

- File the completed forms along with the business tax return by the designated deadline.

Required Documents

When applying for the MICHIGAN Business Tax Miscellaneous Credits, insurance companies must prepare and submit specific documentation, including:

- Proof of business registration and licensing in Michigan.

- Detailed records of qualifying business expenses.

- Completed tax forms as specified by the Michigan Department of Treasury.

- Any additional documentation required to substantiate claims for credits.

Filing Deadlines / Important Dates

It is essential for insurance companies to be aware of filing deadlines related to the MICHIGAN Business Tax Miscellaneous Credits. Typically, businesses must submit their tax returns, including claims for credits, by the annual tax deadline. Companies should also keep track of any changes to state tax laws that may affect these deadlines to ensure compliance and avoid penalties.

Quick guide on how to complete michigan business tax miscellaneous credits for insurance companies

Effortlessly Prepare [SKS] on Any Device

Managing documents online has become increasingly favored by both businesses and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Handle [SKS] on any device with airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The simplest method to modify and electronically sign [SKS] with ease

- Obtain [SKS] and then click Get Form to initiate.

- Use the tools available to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from your chosen device. Modify and electronically sign [SKS] to ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to MICHIGAN Business Tax Miscellaneous Credits For Insurance Companies

Create this form in 5 minutes!

How to create an eSignature for the michigan business tax miscellaneous credits for insurance companies

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are MICHIGAN Business Tax Miscellaneous Credits For Insurance Companies?

MICHIGAN Business Tax Miscellaneous Credits For Insurance Companies are incentives designed to reduce the tax burden on insurance companies operating in Michigan. These credits allow businesses to offset their tax liabilities based on various qualifications and contributions, enhancing their financial position.

-

How can airSlate SignNow assist in managing MICHIGAN Business Tax Miscellaneous Credits?

airSlate SignNow simplifies the management of MICHIGAN Business Tax Miscellaneous Credits For Insurance Companies by providing an intuitive platform for sending and electronically signing documents. This streamlines the paperwork required for claiming these credits, ensuring timely compliance and record-keeping.

-

What features does airSlate SignNow offer for insurance companies?

airSlate SignNow offers features tailored for insurance companies, including secure eSignature capabilities, document templates, and integration options. These tools enhance workflow efficiency when handling MICHIGAN Business Tax Miscellaneous Credits For Insurance Companies, allowing for quick submissions and approvals.

-

Are there any costs associated with using airSlate SignNow?

Yes, airSlate SignNow provides several pricing plans to accommodate different business needs. The pricing is competitive, making it a cost-effective solution for insurance companies looking to manage MICHIGAN Business Tax Miscellaneous Credits without compromising on quality and features.

-

How does airSlate SignNow improve document workflow for insurance companies?

By using airSlate SignNow, insurance companies can signNowly improve their document workflow. The platform allows for easy tracking of document status, quick routing for signatures, and a centralized repository for all relevant documents related to MICHIGAN Business Tax Miscellaneous Credits.

-

What benefits do MICHIGAN Business Tax Miscellaneous Credits bring to insurance companies?

MICHIGAN Business Tax Miscellaneous Credits can lead to substantial savings for insurance companies, improving their overall financial health. Additionally, these credits can enhance your company's competitive advantage and allow for more resources to be allocated toward growth and service enhancement.

-

Can airSlate SignNow integrate with other systems for better efficiency?

Absolutely! airSlate SignNow integrates seamlessly with various business systems and applications. This integration supports insurance companies in managing their MICHIGAN Business Tax Miscellaneous Credits efficiently by connecting data across platforms.

Get more for MICHIGAN Business Tax Miscellaneous Credits For Insurance Companies

Find out other MICHIGAN Business Tax Miscellaneous Credits For Insurance Companies

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe