Va State Tax Form

What is the Virginia State Tax Form?

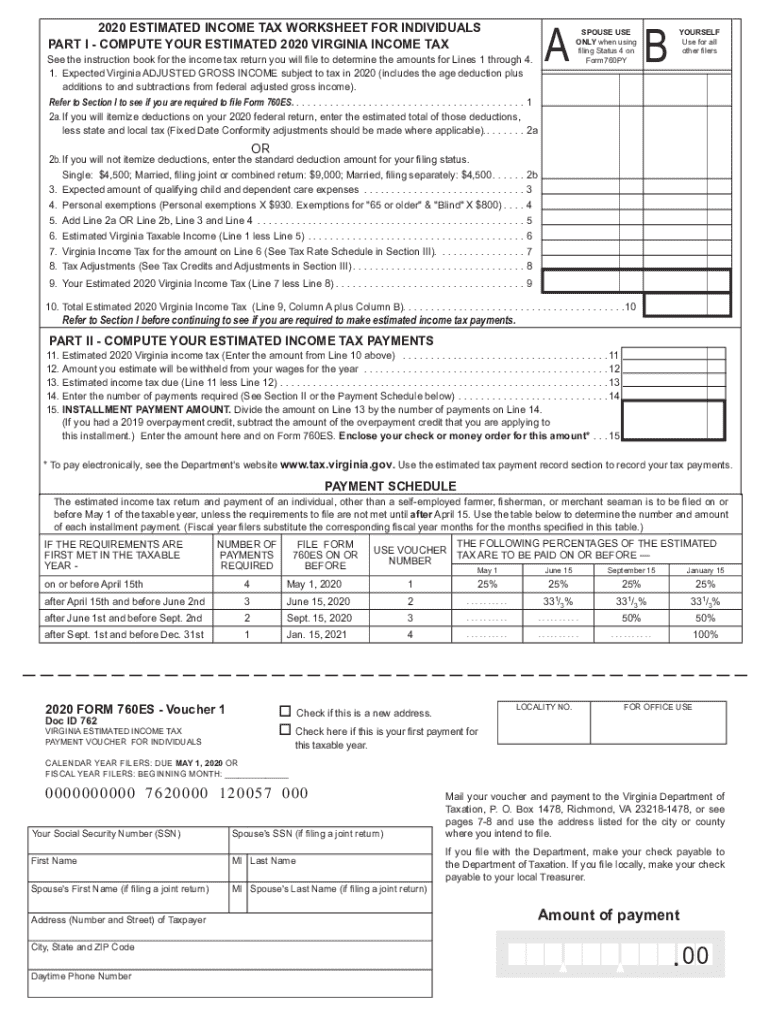

The Virginia State Tax Form is a document used by residents of Virginia to report their income and calculate their state tax obligations. This form is essential for individuals and businesses to ensure compliance with state tax laws. The primary form for individual income tax is the Form 760, which is specifically designed for residents. For those who need to make estimated tax payments, the 2020 Virginia estimated tax forms include the Form 760ES, which allows taxpayers to submit their estimated tax payments throughout the year.

How to Complete the Virginia State Tax Form

Completing the Virginia State Tax Form involves several steps. First, gather all necessary financial documents, including W-2s, 1099s, and other income statements. Next, determine your filing status and any deductions or credits you may qualify for. Fill out the form accurately, ensuring all income is reported and deductions are claimed. For estimated tax payments, use the 2020 Form 760ES to calculate and submit your payments. Finally, review the completed form for accuracy before submission.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines for the Virginia State Tax Form to avoid penalties. Typically, the deadline for filing individual income tax returns is May 1. For estimated tax payments using the 2020 Virginia estimated tax forms, payments are generally due quarterly, with specific dates set by the Virginia Department of Taxation. Mark these dates on your calendar to ensure timely submissions.

Required Documents for Filing

When preparing to file the Virginia State Tax Form, certain documents are essential. These include:

- W-2 forms from employers

- 1099 forms for other income

- Documentation for deductions, such as mortgage interest statements

- Records of estimated tax payments made during the year

- Any relevant receipts for tax credits

Having these documents ready will streamline the filing process and help ensure accuracy.

Form Submission Methods

There are several methods available for submitting the Virginia State Tax Form. Taxpayers can choose to file online through the Virginia Department of Taxation's website, which offers a convenient and efficient way to submit electronically. Alternatively, forms can be mailed to the appropriate tax office, or submitted in person at designated locations. For those using the 2020 Virginia estimated tax forms, ensure that payments are sent to the correct address to avoid delays.

Legal Use of the Virginia State Tax Form

The Virginia State Tax Form, including the 2020 Form 760ES, is legally binding once completed and submitted according to state regulations. It is essential to provide accurate information, as discrepancies can lead to audits or penalties. Utilizing a reliable platform for electronic signatures, like signNow, can enhance the legal standing of your submitted documents by ensuring compliance with eSignature laws.

Quick guide on how to complete 2020 form 760es estimated income tax payment vouchers for individuals 2020 form 760es estimated income tax payment vouchers for

Effortlessly Prepare Va State Tax Form on Any Device

Digital document management has gained traction with both businesses and individuals. It offers a sustainable alternative to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Va State Tax Form across any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and eSign Va State Tax Form Effortlessly

- Find Va State Tax Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to finalize your modifications.

- Choose your method of delivering the form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form retrieval, or inaccuracies that require new document prints. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign Va State Tax Form to ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 760es estimated income tax payment vouchers for individuals 2020 form 760es estimated income tax payment vouchers for

How to create an eSignature for your 2020 Form 760es Estimated Income Tax Payment Vouchers For Individuals 2020 Form 760es Estimated Income Tax Payment Vouchers For online

How to create an electronic signature for your 2020 Form 760es Estimated Income Tax Payment Vouchers For Individuals 2020 Form 760es Estimated Income Tax Payment Vouchers For in Chrome

How to generate an eSignature for putting it on the 2020 Form 760es Estimated Income Tax Payment Vouchers For Individuals 2020 Form 760es Estimated Income Tax Payment Vouchers For in Gmail

How to generate an eSignature for the 2020 Form 760es Estimated Income Tax Payment Vouchers For Individuals 2020 Form 760es Estimated Income Tax Payment Vouchers For right from your mobile device

How to generate an electronic signature for the 2020 Form 760es Estimated Income Tax Payment Vouchers For Individuals 2020 Form 760es Estimated Income Tax Payment Vouchers For on iOS

How to create an electronic signature for the 2020 Form 760es Estimated Income Tax Payment Vouchers For Individuals 2020 Form 760es Estimated Income Tax Payment Vouchers For on Android devices

People also ask

-

What are the 2020 Virginia estimated tax forms?

The 2020 Virginia estimated tax forms are documents that individuals and businesses use to calculate and submit their estimated tax payments to the state. These forms are crucial for taxpayers who expect to owe tax on income that isn't subject to withholding. It's essential to have the correct 2020 Virginia estimated tax forms to ensure compliance with state tax regulations.

-

How can airSlate SignNow help with 2020 Virginia estimated tax forms?

airSlate SignNow provides an efficient platform to prepare, send, and eSign your 2020 Virginia estimated tax forms. Our user-friendly interface allows for seamless document management, making it easier to collaborate with tax professionals. With SignNow, you can complete the entire process electronically, ensuring your forms are submitted accurately and promptly.

-

Are there any fees associated with using airSlate SignNow for my 2020 Virginia estimated tax forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The costs depend on factors such as the number of users and features required. Signing up provides access to an affordable and effective way to handle your 2020 Virginia estimated tax forms without breaking the bank.

-

Can I integrate airSlate SignNow with other applications for filing my 2020 Virginia estimated tax forms?

Absolutely! airSlate SignNow integrates with various popular applications to streamline your workflow for 2020 Virginia estimated tax forms. Whether you use accounting software or CRM tools, our platform offers a flexible solution to connect with your existing systems, ensuring smooth data transfer and enhanced productivity.

-

What features does airSlate SignNow offer for managing 2020 Virginia estimated tax forms?

airSlate SignNow offers features such as template creation, document tracking, and team collaboration to enhance your experience with 2020 Virginia estimated tax forms. These tools simplify the signing process and help you monitor the status of your documents effectively. Our platform ensures secure and organized handling of all essential tax documentation.

-

Is it safe to use airSlate SignNow for my 2020 Virginia estimated tax forms?

Yes, security is a top priority at airSlate SignNow. We implement advanced encryption methods and comply with industry standards to safeguard your data. You can run your 2020 Virginia estimated tax forms through our platform confidently, knowing that your sensitive information remains protected.

-

How do I get started with airSlate SignNow for my 2020 Virginia estimated tax forms?

Getting started with airSlate SignNow is easy! Simply sign up for an account on our website, and you'll have access to all the tools you need to manage your 2020 Virginia estimated tax forms efficiently. Our onboarding resources and customer support team are available to guide you through the process.

Get more for Va State Tax Form

Find out other Va State Tax Form

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later