Form Property

What is the Form Property

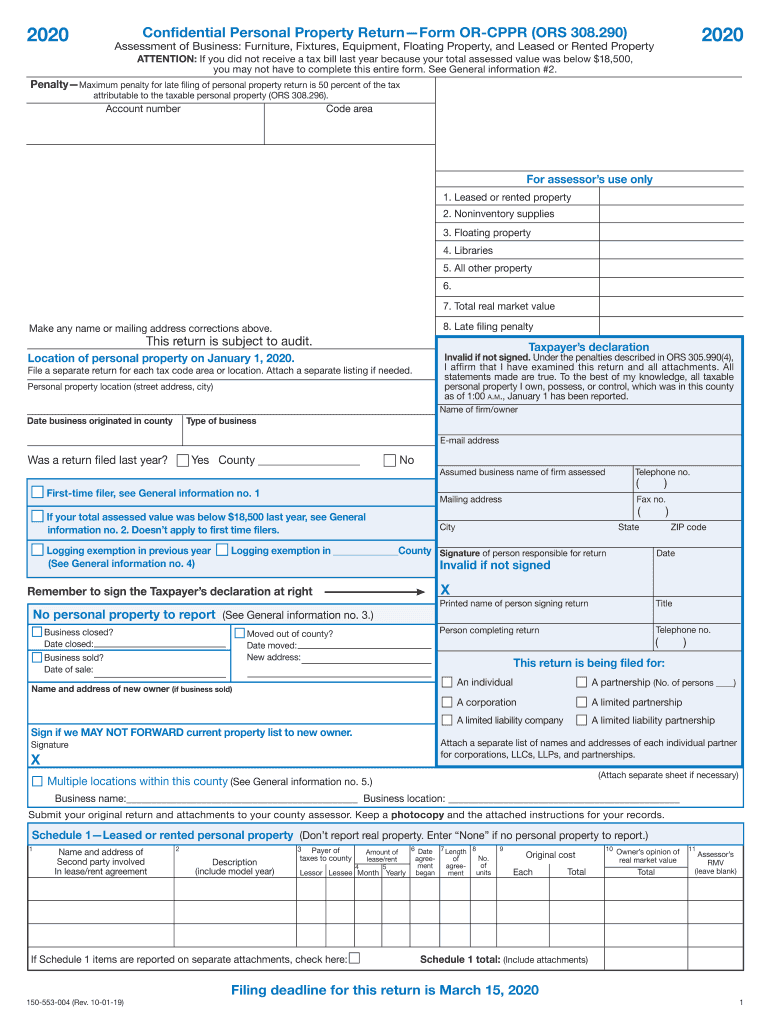

The 2020 Oregon property form is a document used to report property values for tax purposes. This form is essential for property owners in Oregon, as it helps local governments assess property taxes accurately. The form requires detailed information about the property, including its location, size, and any improvements made. Understanding this form is crucial for ensuring compliance with local tax regulations and for accurately reporting property values.

How to use the Form Property

Using the 2020 Oregon property form involves several steps. First, gather all necessary information about your property, such as its address, parcel number, and any recent changes in value. Next, complete the form by filling in the required fields accurately. It is important to double-check all entries for accuracy to avoid potential issues with tax assessments. Once completed, the form can be submitted electronically or via traditional mail, depending on your preference.

Steps to complete the Form Property

To complete the 2020 Oregon property form, follow these steps:

- Gather property details, including location and size.

- Review any recent property improvements or changes in value.

- Fill out the form, ensuring all required fields are completed.

- Verify the accuracy of the information provided.

- Submit the form by the deadline, either online or by mail.

Legal use of the Form Property

The legal use of the 2020 Oregon property form is vital for ensuring compliance with state tax laws. This form must be filled out accurately to reflect the true value of the property, which directly affects property tax assessments. Failure to submit this form correctly can lead to penalties or an inaccurate tax assessment, which may result in overpayment or legal disputes. It is advisable to consult with a tax professional if there are uncertainties regarding the form's completion.

Filing Deadlines / Important Dates

Filing deadlines for the 2020 Oregon property form are critical for property owners to note. Typically, the form must be submitted by a specific date each year to ensure timely processing and avoid penalties. It is essential to check the Oregon Department of Revenue's official guidelines for the exact deadlines, as these can vary based on local regulations and any changes in state law.

Required Documents

When completing the 2020 Oregon property form, certain documents may be required. These can include:

- Proof of property ownership, such as a deed.

- Previous property tax statements.

- Documentation of any recent improvements or changes to the property.

- Any relevant appraisal reports that indicate property value.

Having these documents on hand can facilitate a smoother completion process and ensure that all necessary information is accurately reported.

Quick guide on how to complete 2020 confidential personal property return oregongov

Complete Form Property effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, edit, and eSign your documents promptly without any hold-ups. Manage Form Property across any device with airSlate SignNow Android or iOS applications and streamline any document-related workflow today.

The easiest way to modify and eSign Form Property without hassle

- Obtain Form Property and then click Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your adjustments.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form Property and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2020 confidential personal property return oregongov

How to create an eSignature for your 2020 Confidential Personal Property Return Oregongov in the online mode

How to create an electronic signature for your 2020 Confidential Personal Property Return Oregongov in Chrome

How to generate an eSignature for putting it on the 2020 Confidential Personal Property Return Oregongov in Gmail

How to make an electronic signature for the 2020 Confidential Personal Property Return Oregongov straight from your smartphone

How to create an eSignature for the 2020 Confidential Personal Property Return Oregongov on iOS devices

How to generate an eSignature for the 2020 Confidential Personal Property Return Oregongov on Android OS

People also ask

-

What is the 2020 return ors308290?

The 2020 return ors308290 refers to a specific tax document that businesses need to file in a timely manner. airSlate SignNow offers a streamlined process to eSign and manage such documents, ensuring compliance and accuracy while facilitating the submission of the 2020 return ors308290.

-

How can airSlate SignNow help with the 2020 return ors308290?

airSlate SignNow provides users with an easy-to-use platform to eSign essential documents, including the 2020 return ors308290. By leveraging our digital signature technology, you can ensure your documents are signed securely and quickly, signNowly improving your workflow.

-

What are the pricing options for airSlate SignNow in relation to the 2020 return ors308290?

airSlate SignNow offers competitive pricing plans designed to fit various business needs. Whether you are managing individual or multiple submissions of the 2020 return ors308290, our cost-effective solutions help you save both time and money.

-

Does airSlate SignNow integrate with other software for managing the 2020 return ors308290?

Yes, airSlate SignNow integrates seamlessly with multiple software platforms, enhancing your ability to manage the 2020 return ors308290. Our integrations help streamline your workflow, making the entire process of document management more efficient.

-

What are the key features of airSlate SignNow for handling the 2020 return ors308290?

Key features of airSlate SignNow include secure eSigning, customizable templates, and automated workflows for the 2020 return ors308290. These features simplify the document management process, allowing businesses to operate more efficiently while ensuring compliance.

-

Can I track the status of my 2020 return ors308290 with airSlate SignNow?

Absolutely! airSlate SignNow provides tracking capabilities that allow you to monitor the status of your 2020 return ors308290 in real-time. This feature enhances accountability and ensures that all parties stay informed throughout the signing process.

-

Is airSlate SignNow secure for signing the 2020 return ors308290?

Yes, security is a top priority at airSlate SignNow. Our platform employs encryption and authentication measures to ensure the security of your sensitive information while signing documents like the 2020 return ors308290.

Get more for Form Property

Find out other Form Property

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form