Md Sdat Personal Property Form

What is the MD SDAT Personal Property?

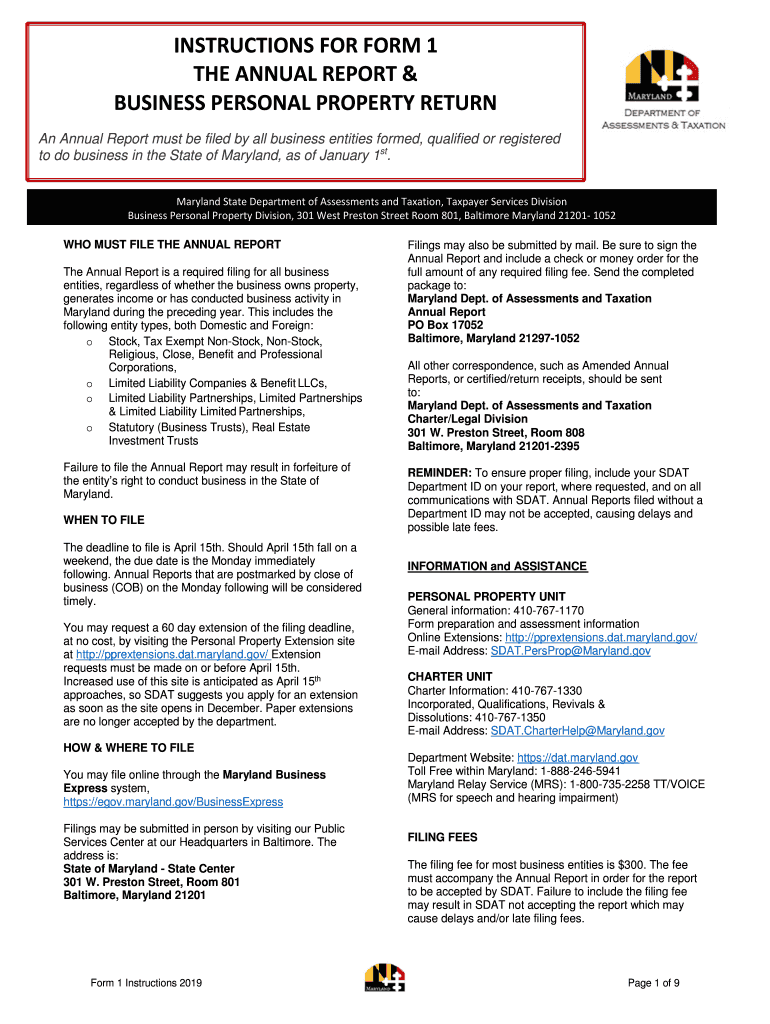

The Maryland State Department of Assessments and Taxation (MD SDAT) manages personal property assessments for businesses and individuals. Personal property generally includes items that are movable and not permanently affixed to land or buildings, such as equipment, furniture, and inventory. Understanding the classification of personal property is essential for compliance with state tax regulations. The MD SDAT personal property form is crucial for reporting these assets accurately to ensure proper taxation.

Steps to Complete the MD SDAT Personal Property

Completing the MD SDAT personal property form requires careful attention to detail. Here are the key steps to follow:

- Gather all relevant information about your personal property, including descriptions, purchase dates, and values.

- Obtain the correct form from the MD SDAT website or your local office.

- Fill out the form, ensuring that all sections are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the specified deadline, either online, by mail, or in person.

Legal Use of the MD SDAT Personal Property

The MD SDAT personal property form serves a legal purpose in the state of Maryland. It is used to report personal property for tax assessment, ensuring compliance with state laws. Accurate reporting is essential, as failure to submit the form or providing incorrect information can lead to penalties. The form must be completed annually, reflecting any changes in personal property holdings to maintain legal standing.

Filing Deadlines / Important Dates

Filing deadlines for the MD SDAT personal property form are critical for compliance. Typically, the deadline for submitting the form is April 15 of each year. It is important to be aware of any changes or extensions that may apply. Missing the deadline can result in penalties and interest on unpaid taxes, so timely submission is essential.

Required Documents

To complete the MD SDAT personal property form, specific documents may be required. These can include:

- Purchase invoices or receipts for personal property.

- Previous year’s personal property tax return, if applicable.

- Any documentation supporting the valuation of the property.

Having these documents readily available can streamline the completion process and ensure accuracy in reporting.

Form Submission Methods

The MD SDAT personal property form can be submitted through various methods to accommodate different preferences. Options include:

- Online submission via the MD SDAT website, which is often the quickest method.

- Mailing a printed copy of the completed form to the appropriate MD SDAT office.

- In-person submission at a local MD SDAT office for those who prefer face-to-face assistance.

Choosing the right submission method can help ensure that your form is processed efficiently.

Quick guide on how to complete 2019 form 1 instructions department of assessments and taxation

Complete Md Sdat Personal Property effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and eSign your documents rapidly without delays. Handle Md Sdat Personal Property on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to alter and eSign Md Sdat Personal Property seamlessly

- Find Md Sdat Personal Property and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools provided specifically for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign Md Sdat Personal Property and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 1 instructions department of assessments and taxation

How to create an eSignature for your 2019 Form 1 Instructions Department Of Assessments And Taxation in the online mode

How to create an electronic signature for your 2019 Form 1 Instructions Department Of Assessments And Taxation in Google Chrome

How to generate an electronic signature for putting it on the 2019 Form 1 Instructions Department Of Assessments And Taxation in Gmail

How to generate an electronic signature for the 2019 Form 1 Instructions Department Of Assessments And Taxation straight from your smart phone

How to create an electronic signature for the 2019 Form 1 Instructions Department Of Assessments And Taxation on iOS devices

How to make an electronic signature for the 2019 Form 1 Instructions Department Of Assessments And Taxation on Android

People also ask

-

What is airSlate SignNow's role in managing 2019 personal property documents?

airSlate SignNow provides a seamless platform to manage 2019 personal property documents by allowing users to easily send, sign, and store necessary paperwork electronically. This ensures that documents related to your personal property are organized and accessible from anywhere, optimizing time management and enhancing convenience.

-

How does airSlate SignNow ensure secure signing of 2019 personal property documents?

With airSlate SignNow, security is paramount. Our platform encrypts all data, ensuring that your 2019 personal property documents are safe during transmission and storage, giving you peace of mind as you eSign important agreements.

-

What are the pricing plans available for managing 2019 personal property documents with airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to various needs, whether you're an individual or part of a business team. Each plan is designed to help effectively manage and sign 2019 personal property documents while remaining budget-friendly.

-

Can I integrate airSlate SignNow with existing tools for handling 2019 personal property transactions?

Yes, airSlate SignNow integrates effortlessly with numerous business tools, enhancing your workflow. You can easily connect it with CRM systems or storage solutions, thereby streamlining the management of your 2019 personal property transactions.

-

What features does airSlate SignNow offer for optimizing 2019 personal property transactions?

airSlate SignNow offers a range of features such as templates for common 2019 personal property agreements, audit trails, and automatic reminders. These features help simplify the signing process, reduce errors, and ensure timely completion of your documents.

-

How can airSlate SignNow benefit my business in handling 2019 personal property?

By using airSlate SignNow, businesses can signNowly increase efficiency when handling 2019 personal property documents. The solution allows for rapid signing, improved organization, and a better response time, ultimately leading to enhanced customer satisfaction.

-

Is there a mobile app for airSlate SignNow for managing 2019 personal property documents?

Yes, airSlate SignNow offers a mobile app that allows users to manage their 2019 personal property documents on-the-go. This convenience helps you stay productive and ensures that essential paperwork can be handled anytime and anywhere.

Get more for Md Sdat Personal Property

Find out other Md Sdat Personal Property

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe