Begin an Endowment, Add to an Existing Fund or Make a Donation 2024-2026

Understanding the Purpose of the Form

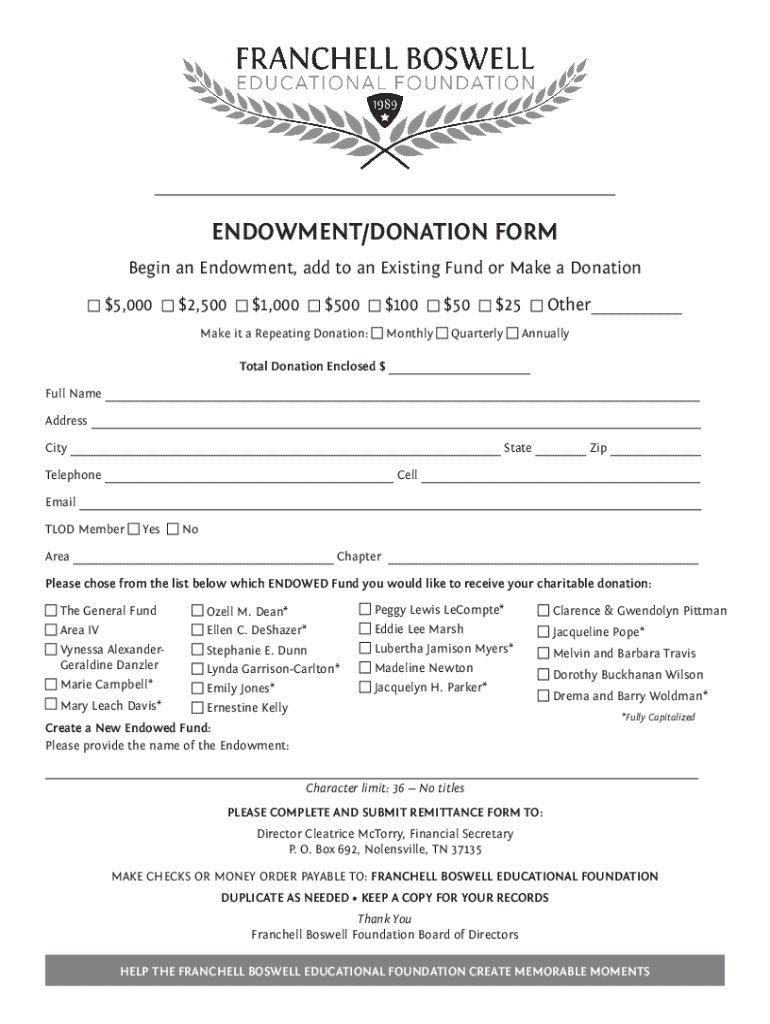

The form to begin an endowment, add to an existing fund, or make a donation serves as a formal mechanism for individuals or organizations to contribute financially to a cause or institution. This form is essential for establishing new endowments, enhancing existing funds, or facilitating donations, ensuring that contributions are documented and processed correctly. By using this form, donors can specify their intentions, whether they are creating a new fund to support a specific initiative or augmenting an existing one to increase its impact.

Steps to Complete the Form

Completing the form involves several straightforward steps:

- Gather necessary information, including your personal details and the specifics of the fund or endowment.

- Clearly indicate the amount you wish to contribute and whether it is a one-time donation or a recurring commitment.

- Provide any additional instructions or preferences related to the use of your donation.

- Review the form for accuracy before submission to ensure all details are correct.

- Submit the form through the designated method, whether online, by mail, or in person.

Required Documents for Submission

When submitting the form to begin an endowment, add to an existing fund, or make a donation, certain documents may be required to verify your identity and intentions. These may include:

- A government-issued identification, such as a driver's license or passport.

- Proof of address, which could be a utility bill or bank statement.

- Any previous correspondence related to the fund or endowment, if applicable.

Having these documents ready can facilitate a smoother submission process.

Legal Considerations for Donations

Understanding the legal implications of making a donation or establishing an endowment is crucial. Donations may be subject to specific regulations and tax implications, including:

- Tax deductibility, which allows donors to claim a deduction on their income taxes for charitable contributions.

- Compliance with state and federal laws governing charitable donations.

- Disclosure requirements that may necessitate informing the recipient organization about the intended use of funds.

Consulting with a legal or tax professional can provide clarity on these matters.

Examples of Fund Usage

Donations made through this form can support various initiatives, including:

- Scholarships for students pursuing higher education.

- Research projects aimed at advancing knowledge in specific fields.

- Community programs that provide essential services to underserved populations.

These examples illustrate the potential impact of contributions, highlighting the importance of thoughtful giving.

IRS Guidelines for Charitable Contributions

The Internal Revenue Service (IRS) provides guidelines that govern charitable contributions, which donors should be aware of. Key points include:

- Eligibility criteria for tax deductions, including the requirement that donations be made to qualified organizations.

- Documentation needed for claiming deductions, such as receipts or acknowledgment letters from the recipient organization.

- Limits on the amount that can be deducted based on the donor's income and the type of contribution.

Staying informed about these guidelines can help ensure compliance and maximize the benefits of charitable giving.

Quick guide on how to complete begin an endowment add to an existing fund or make a donation

Effortlessly Prepare Begin An Endowment, Add To An Existing Fund Or Make A Donation on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It serves as a perfect environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the right forms and securely store them online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without any hold-ups. Handle Begin An Endowment, Add To An Existing Fund Or Make A Donation on any device using the airSlate SignNow Android or iOS applications and enhance your document-based workflows today.

How to Edit and eSign Begin An Endowment, Add To An Existing Fund Or Make A Donation with Ease

- Locate Begin An Endowment, Add To An Existing Fund Or Make A Donation and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of your documents or conceal sensitive information using the tools that airSlate SignNow offers specifically for these tasks.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate reprinting document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Edit and eSign Begin An Endowment, Add To An Existing Fund Or Make A Donation and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct begin an endowment add to an existing fund or make a donation

Create this form in 5 minutes!

How to create an eSignature for the begin an endowment add to an existing fund or make a donation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What options do I have to support my cause?

You can choose to begin an endowment, add to an existing fund, or make a donation. Each option allows you to contribute in a way that best suits your financial situation and philanthropic goals. By selecting the right option, you can maximize your impact on the cause you care about.

-

How do I begin an endowment?

To begin an endowment, you can contact our support team or fill out the online form on our website. We will guide you through the process, ensuring that your endowment aligns with your vision and goals. Starting an endowment is a meaningful way to create a lasting legacy.

-

Can I add to an existing fund easily?

Yes, adding to an existing fund is a straightforward process. Simply log into your account and navigate to the fund you wish to contribute to. You can quickly make a donation or adjust your contribution as needed, making it easy to support ongoing initiatives.

-

What are the benefits of making a donation?

Making a donation allows you to support important causes and initiatives directly. Your contribution can help fund projects, provide resources, and create opportunities for those in need. Additionally, donations may be tax-deductible, providing you with financial benefits while making a positive impact.

-

Are there any fees associated with beginning an endowment?

There may be minimal administrative fees associated with beginning an endowment, but these are typically outlined during the setup process. Our goal is to ensure that as much of your contribution as possible goes directly to the intended cause. We strive to provide a cost-effective solution for all your philanthropic needs.

-

What features does airSlate SignNow offer for managing donations?

airSlate SignNow offers a user-friendly platform that allows you to manage donations efficiently. You can track contributions, generate reports, and communicate with donors seamlessly. Our features are designed to simplify the process of beginning an endowment, adding to an existing fund, or making a donation.

-

How can I integrate airSlate SignNow with other tools?

airSlate SignNow provides various integration options with popular tools and platforms. This allows you to streamline your donation processes and enhance your fundraising efforts. By integrating with your existing systems, you can easily manage your endowment and donations in one place.

Get more for Begin An Endowment, Add To An Existing Fund Or Make A Donation

- Texas dental board application form

- Arc specialist exam question pool form

- Schwab simple ira participant notice and summary description form

- Nv realtor earnest money contract form

- City of escondido business license application form

- Jsums form

- Business certificate for partners blumberg legal forms online

- City of edgewater ymca wind retrofit project form

Find out other Begin An Endowment, Add To An Existing Fund Or Make A Donation

- How To Sign Illinois Product Defect Notice

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe