Form 8283

What is the Form 8283

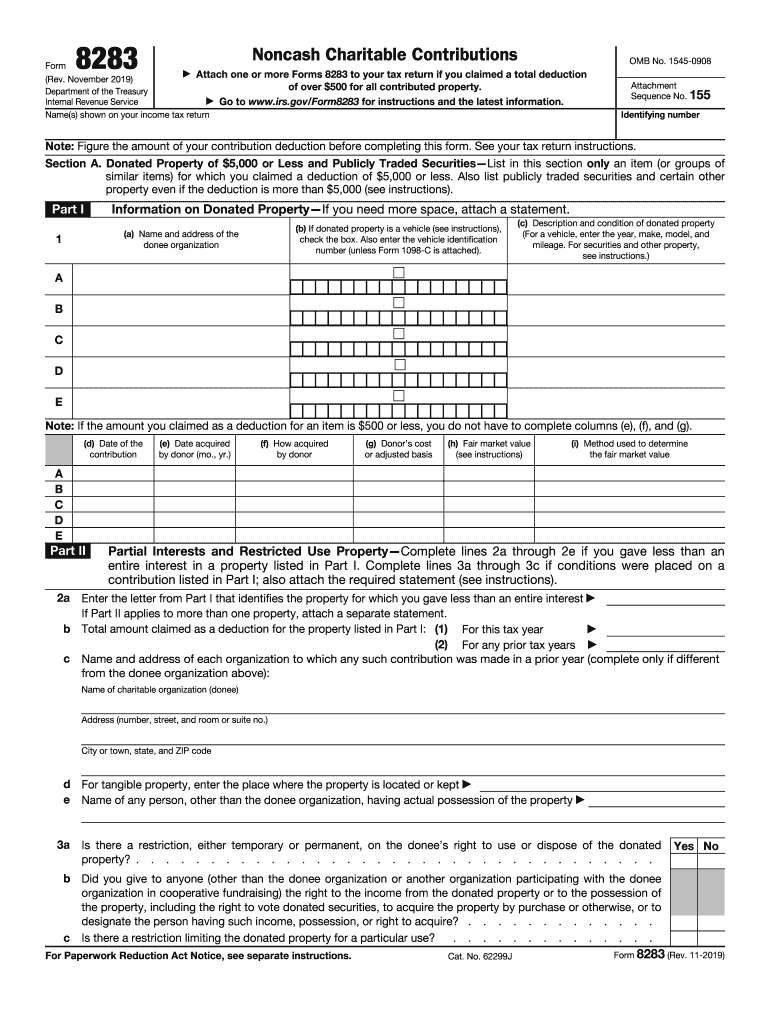

The Form 8283 is a tax form used by individuals and businesses in the United States to report noncash charitable contributions. This form captures details about the donated property, including its fair market value and the recipient organization. It is essential for taxpayers who claim a deduction for noncash donations exceeding five hundred dollars. Proper completion of this form is crucial for ensuring that the charitable donations 2019 are accurately reported and compliant with IRS regulations.

How to use the Form 8283

To use the Form 8283, taxpayers must first gather all necessary information regarding their noncash charitable contributions. This includes the description of the property, the date of the contribution, and the fair market value at the time of donation. Once the information is compiled, the form can be filled out, ensuring that all sections are completed accurately. Taxpayers should keep a copy of the form and any supporting documentation for their records, as these may be required in case of an IRS audit.

Steps to complete the Form 8283

Completing the Form 8283 involves several key steps:

- Gather all relevant information about the donated property, including its description and fair market value.

- Fill out the form, ensuring that all required fields are completed, including the name and address of the charitable organization.

- If the total value of the donation exceeds five thousand dollars, an appraisal may be required, and the appraiser's details must be included.

- Review the completed form for accuracy before submission.

- Attach the Form 8283 to your tax return when filing.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 8283. Taxpayers must adhere to these guidelines to ensure compliance and avoid penalties. It is important to note that the IRS requires documentation for noncash contributions, including receipts from the charitable organization and appraisals for high-value items. Familiarizing oneself with these guidelines can help taxpayers navigate the process of reporting charitable donations 2019 effectively.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8283 align with the standard tax return deadlines. Typically, individual taxpayers must file their tax returns by April fifteenth of the following year. If additional time is needed, an extension can be requested, but the Form 8283 must still be submitted with the tax return. Keeping track of these important dates is essential for ensuring that charitable contributions are reported timely and accurately.

Required Documents

When completing the Form 8283, certain documents are required to substantiate the claimed charitable donations 2019. These documents include:

- Receipts or written acknowledgments from the charitable organization.

- Appraisals for donated property valued over five thousand dollars.

- Any additional documentation that supports the fair market value of the donated items.

Having these documents ready can facilitate a smoother filing process and help avoid potential issues with the IRS.

Quick guide on how to complete about form 8283 noncash charitable contributions

Complete Form 8283 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the right template and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Form 8283 on any device using the airSlate SignNow Android or iOS applications and streamline any document-centric procedure today.

The easiest way to modify and electronically sign Form 8283 without hassle

- Locate Form 8283 and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize relevant sections of your documents or redact sensitive details with tools offered by airSlate SignNow specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes moments and holds the same legal significance as a conventional handwritten signature.

- Review the information and click on the Done button to store your modifications.

- Choose how you wish to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow manages all your document administration needs in just a few clicks from any device of your preference. Alter and electronically sign Form 8283 and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the about form 8283 noncash charitable contributions

How to make an electronic signature for your About Form 8283 Noncash Charitable Contributions online

How to generate an electronic signature for your About Form 8283 Noncash Charitable Contributions in Chrome

How to create an electronic signature for signing the About Form 8283 Noncash Charitable Contributions in Gmail

How to generate an eSignature for the About Form 8283 Noncash Charitable Contributions from your mobile device

How to make an eSignature for the About Form 8283 Noncash Charitable Contributions on iOS

How to generate an eSignature for the About Form 8283 Noncash Charitable Contributions on Android

People also ask

-

What features does airSlate SignNow offer for managing charitable donations 2019?

airSlate SignNow offers a range of features specifically designed to streamline the process of managing charitable donations 2019. With customizable templates, eSignature capabilities, and real-time tracking, you can efficiently collect and manage donation agreements. Additionally, our platform makes it easy to organize documents and retrieve donor information at any time.

-

How does airSlate SignNow ensure the security of charitable donations 2019 documentation?

Security is a top priority when dealing with charitable donations 2019 documentation. airSlate SignNow employs advanced encryption methods to protect sensitive data and complies with industry standards. Our solution ensures that all electronic signatures and documents are securely stored and accessible only to authorized users.

-

What is the pricing structure for utilizing airSlate SignNow for charitable donations 2019?

airSlate SignNow provides a flexible pricing structure that can fit different budgets and needs associated with charitable donations 2019. We offer various subscription plans, including options for nonprofits, which may include discounts. This makes it an affordable choice for organizations looking to enhance their donation management process.

-

Can I integrate airSlate SignNow with other tools to manage charitable donations 2019?

Yes, airSlate SignNow seamlessly integrates with a variety of third-party applications that can enhance your management of charitable donations 2019. Whether you're using CRM systems, payment processors, or project management tools, our integration capabilities ensure that all aspects of your donation process are connected and efficient.

-

How can airSlate SignNow benefit my organization when processing charitable donations 2019?

By using airSlate SignNow for charitable donations 2019, your organization can signNowly streamline the donation process. The easy-to-use platform reduces paperwork, minimizes errors, and speeds up donor engagement through efficient eSigning. This leads to improved donor satisfaction and increased chances of receiving donations.

-

Is there a mobile app for airSlate SignNow to manage charitable donations 2019 on the go?

Yes, airSlate SignNow offers a mobile application that allows you to manage charitable donations 2019 from anywhere. The app provides all the essential features, enabling you to send documents for signature and track their status in real-time while on the move. This flexibility ensures you can engage with donors anytime, enhancing overall efficiency.

-

What support options are available for users of airSlate SignNow focused on charitable donations 2019?

airSlate SignNow provides various support options to assist users managing charitable donations 2019. Our resources include comprehensive online tutorials, FAQs, and dedicated customer support via chat and email. This ensures that you can get timely assistance and maximize the potential of our eSignature solution.

Get more for Form 8283

Find out other Form 8283

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template