Who Gets a 1099 Form

Who Gets A 1099

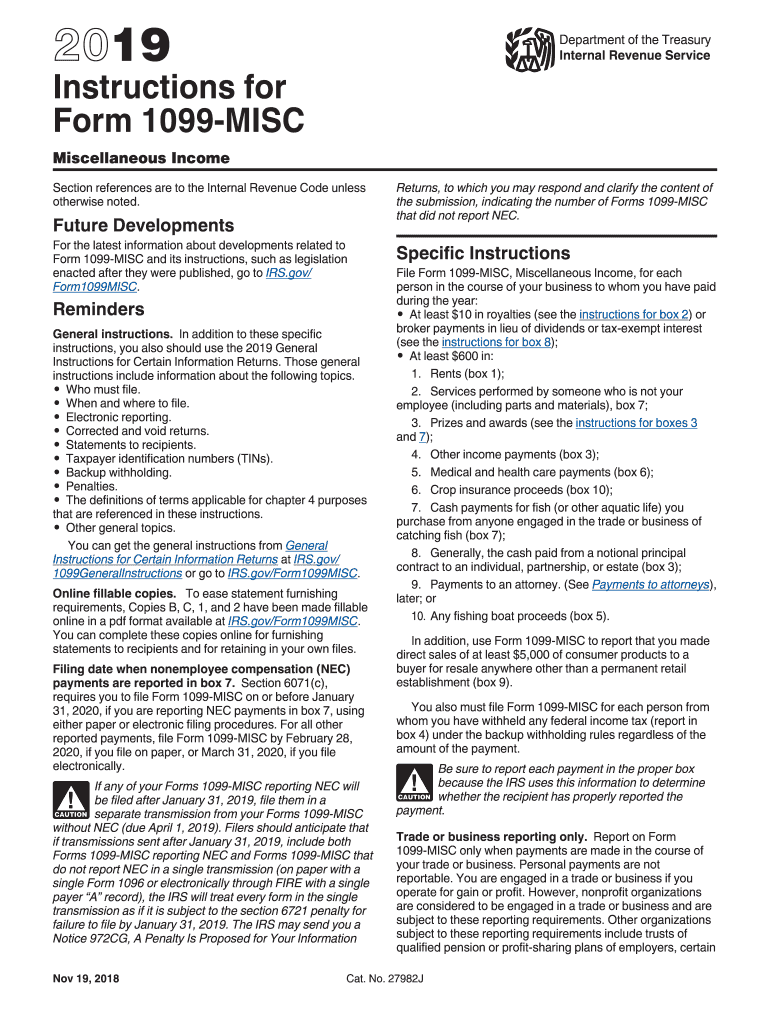

The 1099-MISC form is primarily issued to independent contractors, freelancers, and other non-employees who receive payments for services rendered. If you paid someone $600 or more in a calendar year for services related to your trade or business, you are required to issue a 1099-MISC to that individual. This includes payments made to:

- Independent contractors

- Freelancers

- Consultants

- Rent payments to landlords

- Prizes and awards

Additionally, certain payments made to corporations may also require a 1099-MISC, depending on the nature of the service provided. It's essential to understand who qualifies to receive this form to ensure compliance with IRS regulations.

Steps to Complete the 1099-MISC Form

Filling out the 1099-MISC form requires careful attention to detail. Here are the steps to complete it accurately:

- Gather Information: Collect the necessary details about the recipient, including their name, address, and taxpayer identification number (TIN).

- Fill Out the Form: Enter your business information in the payer section and the recipient's information in the payee section. Include the total amount paid in the appropriate box, such as Box 3 for other income.

- Check for Accuracy: Review all entries for correctness. Mistakes can lead to penalties or delays in processing.

- Submit the Form: Send the completed form to the IRS and provide a copy to the recipient by the required deadline.

Following these steps ensures that you fulfill your reporting obligations and helps the recipient accurately report their income.

IRS Guidelines for 1099-MISC

The IRS has specific guidelines regarding the use of the 1099-MISC form. It is crucial to adhere to these rules to avoid penalties:

- Ensure that the form is issued for the correct tax year.

- Provide the correct TIN for both the payer and the payee.

- File the form by the IRS deadline, typically January thirty-first of the following year for paper submissions.

- Maintain accurate records of all payments made that require a 1099-MISC.

Staying informed about these guidelines will help you navigate the filing process smoothly and maintain compliance with IRS regulations.

Filing Deadlines for 1099-MISC

Understanding the filing deadlines for the 1099-MISC form is essential for compliance. The key dates include:

- January 31: Deadline to provide the recipient with their copy of the 1099-MISC.

- February 28: Deadline for submitting paper forms to the IRS.

- March 31: Deadline for electronic submissions to the IRS.

Missing these deadlines can result in penalties, so it is important to plan ahead and ensure timely filing.

Penalties for Non-Compliance

Failing to file the 1099-MISC form or providing incorrect information can lead to significant penalties. The IRS imposes fines based on the length of time the form is late:

- Up to $50: If filed within thirty days of the due date.

- $100: If filed after thirty days but before August first.

- $260: If filed after August first or not filed at all.

Additionally, if the IRS determines that the failure to file was intentional, the penalties can increase substantially. Maintaining accurate records and timely submissions is essential to avoid these consequences.

Eligibility Criteria for 1099-MISC Recipients

To determine eligibility for receiving a 1099-MISC, consider the following criteria:

- Individuals must have received $600 or more in payments for services during the tax year.

- Payments made to corporations generally do not require a 1099-MISC unless for specific types of services.

- Recipients must provide their TIN to ensure proper reporting.

Understanding these criteria helps ensure that you issue the form correctly and comply with IRS requirements.

Quick guide on how to complete 2019 instructions for form 1099 misc irsgov

Effortlessly Complete Who Gets A 1099 on Any Device

Digital document management has gained immense traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the essential tools to create, modify, and eSign your documents swiftly without hold-ups. Manage Who Gets A 1099 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and eSign Who Gets A 1099 with Ease

- Find Who Gets A 1099 and click on Get Form to initiate the process.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with specialized tools provided by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal standing as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, time-consuming form searches, or errors necessitating the printing of new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you select. Edit and eSign Who Gets A 1099 and guarantee excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 instructions for form 1099 misc irsgov

How to generate an eSignature for your 2019 Instructions For Form 1099 Misc Irsgov in the online mode

How to make an eSignature for the 2019 Instructions For Form 1099 Misc Irsgov in Google Chrome

How to generate an electronic signature for signing the 2019 Instructions For Form 1099 Misc Irsgov in Gmail

How to make an eSignature for the 2019 Instructions For Form 1099 Misc Irsgov right from your smartphone

How to generate an eSignature for the 2019 Instructions For Form 1099 Misc Irsgov on iOS

How to generate an electronic signature for the 2019 Instructions For Form 1099 Misc Irsgov on Android OS

People also ask

-

Who Gets A 1099 and why is it important?

A 1099 form is typically issued to independent contractors, freelancers, and other non-employees who are paid $600 or more in a year. Understanding who gets a 1099 is crucial for both businesses and individuals to ensure proper tax reporting and compliance. This form helps the IRS track income that might not be reported on a W-2 form.

-

What are the benefits of using airSlate SignNow for 1099 documents?

Using airSlate SignNow for 1099 documents streamlines the signing process, making it easy to send and eSign forms quickly. This not only saves time but also enhances organization and compliance by keeping all documents in one secure location. Knowing who gets a 1099 helps you ensure all necessary forms are sent out efficiently through our platform.

-

How does airSlate SignNow simplify the 1099 filing process?

airSlate SignNow simplifies the 1099 filing process by allowing businesses to quickly send out eSign requests to all eligible recipients. By integrating our solution into your workflow, you can easily manage who gets a 1099 and keep track of signed documents. This ensures that your filing is accurate and timely, reducing the risk of penalties.

-

Can I integrate airSlate SignNow with accounting software for 1099 management?

Yes, airSlate SignNow can seamlessly integrate with various accounting software solutions, enhancing your ability to manage 1099 forms. This integration allows you to easily track payments and identify who gets a 1099, ensuring that your records are always up-to-date. It streamlines your accounting processes and helps maintain compliance.

-

What features does airSlate SignNow offer for managing 1099 forms?

airSlate SignNow offers features like customizable templates, secure storage, and automated reminders to help manage 1099 forms effectively. You can quickly create and send forms to recipients, ensuring that everyone who gets a 1099 receives their documents promptly. These features enhance the efficiency of your document management process.

-

Is there a cost associated with using airSlate SignNow for 1099 forms?

Yes, there is a cost associated with using airSlate SignNow, but our pricing plans are designed to be cost-effective for businesses of all sizes. The investment is worthwhile, especially when you consider the time saved and the assurance that you're accurately managing who gets a 1099. Check our pricing page for details on the best plan for your needs.

-

What security measures does airSlate SignNow have for 1099 documents?

airSlate SignNow implements robust security measures to protect your sensitive 1099 documents, including encryption, secure cloud storage, and compliance with industry standards. With our platform, you can confidently manage who gets a 1099 without worrying about unauthorized access or data bsignNowes. Your documents are safe with us.

Get more for Who Gets A 1099

Find out other Who Gets A 1099

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself