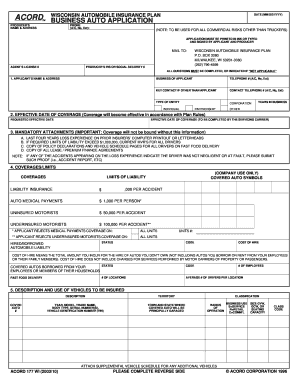

WISCONSIN AUTOMOBILE INSURANCE PLAN Form

What is the WISCONSIN AUTOMOBILE INSURANCE PLAN

The Wisconsin Automobile Insurance Plan (WAIP) is a state-mandated program designed to provide automobile insurance coverage to individuals who may have difficulty obtaining insurance through standard channels. This plan ensures that all drivers in Wisconsin can secure the necessary coverage to operate their vehicles legally. It serves as a safety net for high-risk drivers and aims to promote responsible driving habits across the state.

How to use the WISCONSIN AUTOMOBILE INSURANCE PLAN

Using the Wisconsin Automobile Insurance Plan involves several steps. First, individuals must determine their eligibility by reviewing the criteria set forth by the state. Once eligibility is confirmed, applicants can contact participating insurance companies that offer coverage through the WAIP. It is essential to provide accurate information about driving history and vehicle details to ensure proper coverage. After selecting a provider, individuals will complete the application process, which may include submitting necessary documentation and paying any required premiums.

Key elements of the WISCONSIN AUTOMOBILE INSURANCE PLAN

The Wisconsin Automobile Insurance Plan includes several key elements that are crucial for understanding its function and benefits. These elements include:

- Eligibility Criteria: Specific guidelines that determine who can apply for coverage under the plan.

- Coverage Types: Various insurance options available, such as liability, collision, and comprehensive coverage.

- Participating Insurers: A list of insurance companies authorized to provide coverage through the WAIP.

- Application Process: Steps required to apply for coverage, including necessary documentation and timelines.

Steps to complete the WISCONSIN AUTOMOBILE INSURANCE PLAN

Completing the Wisconsin Automobile Insurance Plan involves a systematic approach. The following steps outline the process:

- Review eligibility criteria to ensure qualification.

- Gather necessary documentation, such as proof of identity and driving history.

- Contact participating insurance providers to inquire about coverage options.

- Submit an application along with any required information and documentation.

- Receive confirmation of coverage and review policy details.

Legal use of the WISCONSIN AUTOMOBILE INSURANCE PLAN

The legal use of the Wisconsin Automobile Insurance Plan is governed by state regulations. All drivers in Wisconsin are required to maintain a minimum level of automobile insurance coverage. The WAIP ensures that those who may struggle to find insurance through traditional means can still comply with state laws. It is important for policyholders to understand their rights and responsibilities under the plan, including the need to maintain continuous coverage and the implications of non-compliance.

Eligibility Criteria

Eligibility for the Wisconsin Automobile Insurance Plan is primarily determined by an individual's driving history and insurance needs. Factors that may affect eligibility include:

- Previous insurance cancellations or non-renewals.

- Driving record, including accidents and traffic violations.

- Type of vehicle owned and its usage.

- Residency status in Wisconsin.

Individuals who meet the criteria can apply for coverage through the WAIP, ensuring they have access to necessary automobile insurance.

Quick guide on how to complete wisconsin automobile insurance plan

Prepare WISCONSIN AUTOMOBILE INSURANCE PLAN seamlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without interruptions. Handle WISCONSIN AUTOMOBILE INSURANCE PLAN on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign WISCONSIN AUTOMOBILE INSURANCE PLAN with ease

- Locate WISCONSIN AUTOMOBILE INSURANCE PLAN and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or conceal sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign tool, which takes seconds and holds the same legal authority as a traditional wet ink signature.

- Review the details and click on the Done button to preserve your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from a device of your preference. Modify and electronically sign WISCONSIN AUTOMOBILE INSURANCE PLAN and ensure exceptional communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wisconsin automobile insurance plan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the WISCONSIN AUTOMOBILE INSURANCE PLAN?

The WISCONSIN AUTOMOBILE INSURANCE PLAN is a state-mandated program designed to provide automobile insurance coverage to drivers who may have difficulty obtaining insurance through traditional means. It ensures that all drivers in Wisconsin have access to necessary coverage, promoting safer roads and responsible driving.

-

How does the WISCONSIN AUTOMOBILE INSURANCE PLAN work?

The WISCONSIN AUTOMOBILE INSURANCE PLAN operates by assigning applicants to insurance companies that participate in the program. This ensures that even those with poor driving records or other challenges can secure coverage. The plan is designed to be fair and accessible, helping drivers meet their insurance needs.

-

What are the benefits of the WISCONSIN AUTOMOBILE INSURANCE PLAN?

The primary benefit of the WISCONSIN AUTOMOBILE INSURANCE PLAN is that it provides essential coverage for drivers who might otherwise be uninsured. Additionally, it helps stabilize the insurance market by ensuring that all drivers contribute to the risk pool, ultimately leading to more affordable rates for everyone.

-

What types of coverage are included in the WISCONSIN AUTOMOBILE INSURANCE PLAN?

The WISCONSIN AUTOMOBILE INSURANCE PLAN typically includes liability coverage, which is mandatory in Wisconsin, as well as options for uninsured/underinsured motorist coverage and personal injury protection. This comprehensive approach ensures that drivers are protected in various scenarios, enhancing overall safety.

-

How much does the WISCONSIN AUTOMOBILE INSURANCE PLAN cost?

The cost of the WISCONSIN AUTOMOBILE INSURANCE PLAN can vary based on several factors, including the driver's history, the type of vehicle, and the coverage selected. Generally, the plan aims to provide competitive rates to ensure that all drivers can afford the necessary insurance to comply with state laws.

-

Can I integrate the WISCONSIN AUTOMOBILE INSURANCE PLAN with other insurance products?

Yes, the WISCONSIN AUTOMOBILE INSURANCE PLAN can often be integrated with other insurance products, such as homeowners or renters insurance. This allows drivers to streamline their insurance needs and potentially benefit from multi-policy discounts, making it a cost-effective solution.

-

How do I apply for the WISCONSIN AUTOMOBILE INSURANCE PLAN?

To apply for the WISCONSIN AUTOMOBILE INSURANCE PLAN, you can contact participating insurance companies directly or visit the Wisconsin Department of Insurance website for guidance. The application process is straightforward, and assistance is available to help you navigate the requirements.

Get more for WISCONSIN AUTOMOBILE INSURANCE PLAN

Find out other WISCONSIN AUTOMOBILE INSURANCE PLAN

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free

- eSignature Pennsylvania Sales Invoice Template Secure