Oregon 800 2015-2026

What is the Oregon 800?

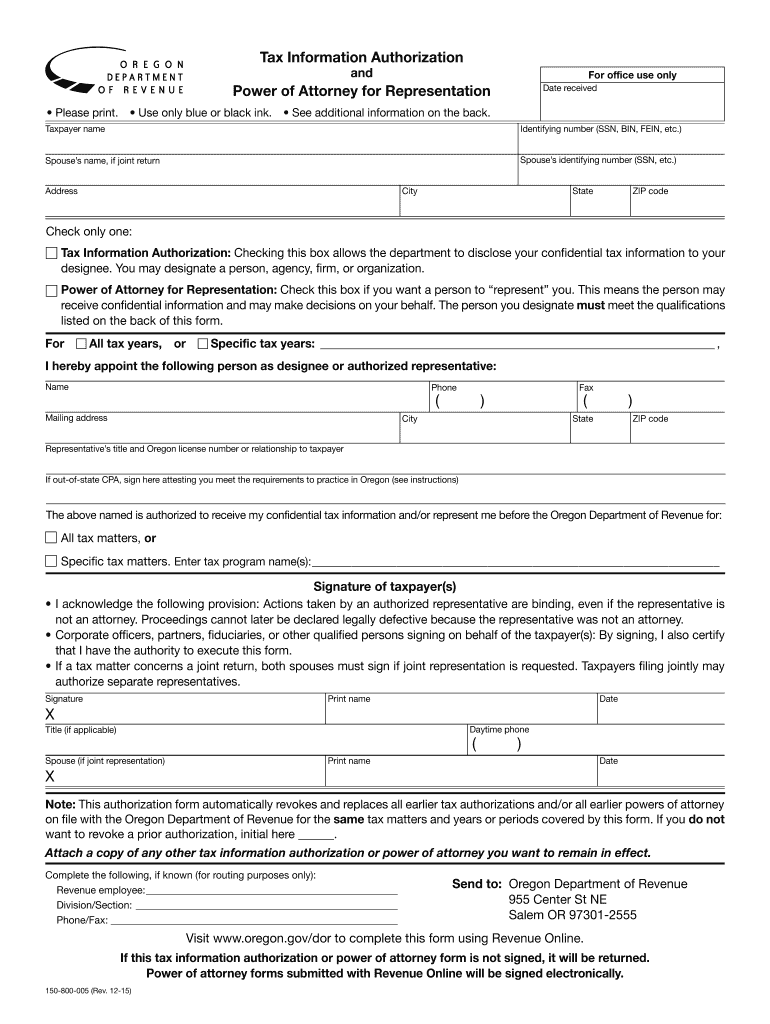

The Oregon 800 refers to the Oregon tax power of attorney form, specifically designed for individuals to authorize another person to act on their behalf regarding tax matters. This form allows taxpayers to grant authority to a designated representative, known as an attorney-in-fact, to handle their tax-related issues with the Oregon Department of Revenue (DOR). The form is crucial for ensuring that the appointed individual can access necessary tax information, represent the taxpayer during audits, and communicate with the DOR effectively.

Steps to Complete the Oregon 800

Completing the Oregon 800 form involves several straightforward steps:

- Obtain the Oregon 800 form from the Oregon Department of Revenue or a trusted source.

- Fill in the taxpayer's information, including name, address, and Social Security number.

- Provide details for the attorney-in-fact, including their name, address, and relationship to the taxpayer.

- Specify the powers granted to the attorney-in-fact, which may include access to tax records, filing returns, and representing the taxpayer in discussions with the DOR.

- Sign and date the form to validate it, ensuring compliance with Oregon's legal requirements.

Legal Use of the Oregon 800

The Oregon 800 form is legally binding once properly completed and signed. It complies with state laws governing powers of attorney, ensuring that the designated representative has the authority to act on behalf of the taxpayer. This form must be executed in accordance with Oregon law to be recognized by the DOR and other relevant entities. It is essential to ensure that the form is filled out accurately to avoid any potential legal issues or misunderstandings regarding the powers granted.

Key Elements of the Oregon 800

Several key elements must be included in the Oregon 800 form for it to be effective:

- Taxpayer Information: Complete details of the taxpayer, including full name and address.

- Attorney-in-Fact Information: Name and contact information of the person being authorized.

- Scope of Authority: A clear description of the powers being granted, such as filing returns or accessing records.

- Signatures: Both the taxpayer's and the attorney-in-fact's signatures are required to validate the form.

Form Submission Methods

The Oregon 800 form can be submitted in various ways, providing flexibility for taxpayers. The submission methods include:

- Online: The form may be submitted electronically through the Oregon Department of Revenue's online portal, ensuring quick processing.

- Mail: Taxpayers can print the completed form and send it via postal mail to the appropriate DOR address.

- In-Person: The form can also be delivered in person to a local DOR office for immediate processing.

Who Issues the Form

The Oregon 800 form is issued by the Oregon Department of Revenue. This state agency is responsible for managing tax-related matters, including the processing of power of attorney forms. The DOR provides guidelines and resources to assist taxpayers in completing and submitting the form correctly, ensuring compliance with state regulations.

Quick guide on how to complete oregon 800

Complete Oregon 800 effortlessly on any device

Online document management has become increasingly favored among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and safely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Oregon 800 on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign Oregon 800 without effort

- Find Oregon 800 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important parts of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Modify and eSign Oregon 800 and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct oregon 800

Create this form in 5 minutes!

People also ask

-

What is an OR power attorney and how can it be beneficial for my business?

An OR power attorney is a legal document allowing one person to act on behalf of another in specific matters. This tool can streamline decision-making processes in your business by providing flexibility in appointing representatives. Using airSlate SignNow to manage your OR power attorney documents ensures security and compliance while making the entire process more efficient.

-

How does airSlate SignNow facilitate the creation of an OR power attorney?

AirSlate SignNow offers an intuitive platform that simplifies the creation of an OR power attorney. With customizable templates and guided workflows, you can quickly generate legally binding documents that meet your specific needs. Our user-friendly interface ensures that you can set up your OR power attorney document without any legal expertise.

-

Is airSlate SignNow a cost-effective solution for managing OR power attorney documents?

Yes, airSlate SignNow provides a cost-effective solution for managing your OR power attorney documents. Our pricing plans are designed to cater to various business sizes, allowing you to choose an option that fits your budget. Additionally, automating the eSigning process can save time and reduce administrative overhead.

-

What features does airSlate SignNow offer for handling my OR power attorney?

AirSlate SignNow includes a variety of features tailored for handling OR power attorney documents. These features include template creation, electronic signature capabilities, document tracking, and secure storage. With these tools at your disposal, you can ensure that your important legal documents are managed effectively.

-

Can I integrate airSlate SignNow with other tools to manage my OR power attorney workflow?

Absolutely! AirSlate SignNow offers integrations with various third-party applications such as CRM systems and productivity tools. These integrations can enhance your workflow, allowing you to seamlessly manage your OR power attorney alongside other business processes and documents.

-

How can airSlate SignNow ensure the security of my OR power attorney documents?

AirSlate SignNow prioritizes security and compliance for all your documents, including your OR power attorney. We implement end-to-end encryption, secure access controls, and detailed audit trails to keep your information safe. Rest assured that your sensitive legal documents are protected within our platform.

-

What benefits do I gain by using airSlate SignNow for my OR power attorney needs?

Using airSlate SignNow for your OR power attorney needs simplifies the entire process of document management. You gain access to a user-friendly interface, fast eSigning, and enhanced collaboration features. This ultimately saves time, reduces stress, and ensures that your legal documents are handled with care and professionalism.

Get more for Oregon 800

- Request to terminate gun violence form

- How can i respond to a petition for a form

- Request to terminate gun violence restraining order form

- Obtained a temporary restraining order voice of san diego form

- Gv 100 info can a gun violence restraining order help me form

- Default and judgment to establish a parental relationship form

- Fl 290 order after hearing on motion to cancel set aside voluntary declaration of parentage or paternity family law form

- Pass through entity taxes 2025maine revenue services form

Find out other Oregon 800

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter