1042 S Form

What is the 1042-S?

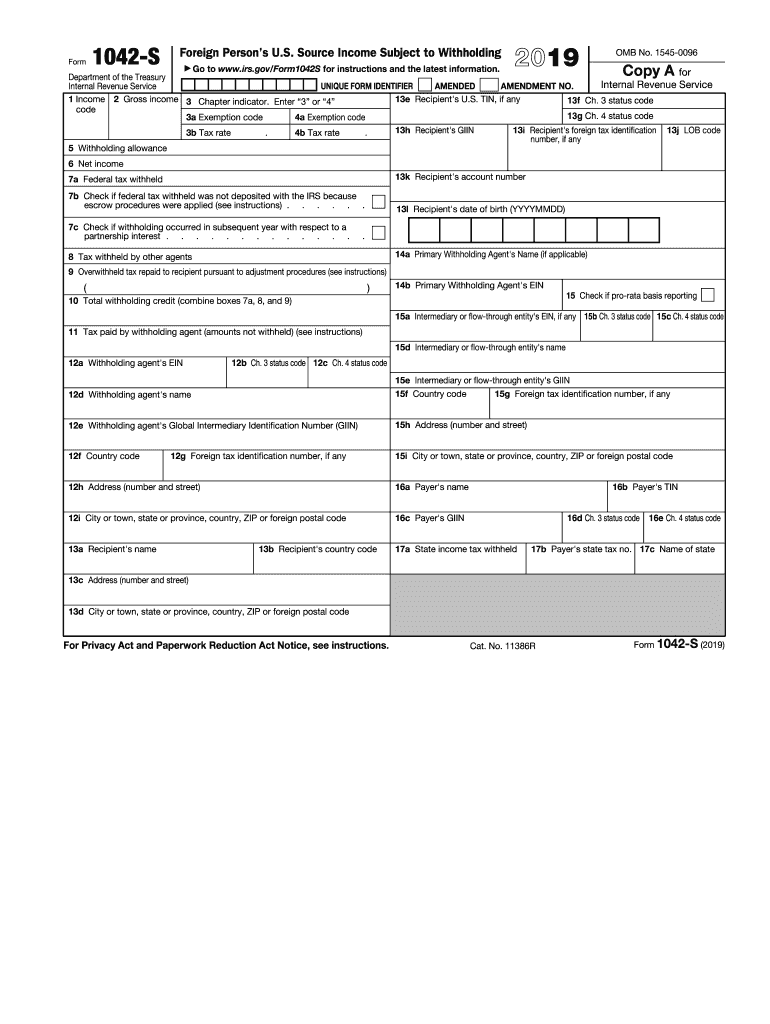

The 1042-S is an IRS form used to report income paid to foreign persons, including non-resident aliens and foreign entities. This form is essential for withholding agents to report amounts paid to these individuals, which may include interest, dividends, royalties, and other types of income. The information on the 1042-S helps the IRS ensure that the correct amount of tax is withheld from payments made to foreign persons, in compliance with U.S. tax laws.

Steps to Complete the 1042-S

Completing the 1042-S involves several key steps:

- Gather necessary information about the payee, including their name, address, and taxpayer identification number.

- Determine the type of income being reported and the appropriate withholding tax rate.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors before submission.

- Submit the completed form to the IRS and provide a copy to the payee.

Legal Use of the 1042-S

The 1042-S is legally binding when completed and submitted according to IRS guidelines. It serves as an official record of income payments made to foreign individuals and entities. To ensure its legal validity, it is crucial to comply with all reporting requirements, including accurate tax withholding and timely submission. Failure to adhere to these regulations can result in penalties and fines.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the 1042-S is vital for compliance. Generally, the form must be filed with the IRS by March 15 of the year following the calendar year in which the payments were made. Additionally, a copy of the form must be provided to the recipient by the same date. It is important to stay aware of any changes to these deadlines, as they can vary based on specific circumstances or IRS updates.

Who Issues the Form

The 1042-S is issued by withholding agents, which can include U.S. businesses, financial institutions, and other entities that make payments to foreign persons. These entities are responsible for accurately reporting the income paid and the taxes withheld on behalf of the payee. It is essential for withholding agents to understand their obligations under U.S. tax law to avoid potential liabilities.

Required Documents

To complete the 1042-S, certain documents are necessary:

- Form W-8BEN or W-8BEN-E, which certifies the foreign status of the payee.

- Documentation supporting the type of income being reported.

- Records of payments made to the foreign individual or entity throughout the tax year.

Examples of Using the 1042-S

Common scenarios for using the 1042-S include:

- A U.S. company paying royalties to a foreign author.

- An American bank paying interest to a non-resident alien account holder.

- A U.S. corporation distributing dividends to foreign shareholders.

In each case, the 1042-S serves to report the payments and ensure proper tax withholding is applied.

Quick guide on how to complete 1 income 2 gross income 3 chapter indicator

Effortlessly Complete 1042 S on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Handle 1042 S on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Edit and Electronically Sign 1042 S with Ease

- Locate 1042 S and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information using tools specifically offered by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form—via email, SMS, invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Edit and electronically sign 1042 S to ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1 income 2 gross income 3 chapter indicator

How to create an eSignature for the 1 Income 2 Gross Income 3 Chapter Indicator in the online mode

How to create an electronic signature for the 1 Income 2 Gross Income 3 Chapter Indicator in Chrome

How to create an eSignature for putting it on the 1 Income 2 Gross Income 3 Chapter Indicator in Gmail

How to create an eSignature for the 1 Income 2 Gross Income 3 Chapter Indicator straight from your smart phone

How to create an electronic signature for the 1 Income 2 Gross Income 3 Chapter Indicator on iOS devices

How to create an electronic signature for the 1 Income 2 Gross Income 3 Chapter Indicator on Android OS

People also ask

-

What pricing plans are available for airSlate SignNow in 2019?

airSlate SignNow offers several pricing plans in 2019, catering to businesses of all sizes. You can choose from a free trial, individual plans, and team packages that provide added features and user seats. Each plan is designed to ensure that companies have the necessary tools to manage their eSignature needs effectively.

-

What are the key features of airSlate SignNow in 2019?

In 2019, airSlate SignNow includes features such as document templates, in-person signing, and advanced security protocols. The platform also allows for customizable workflows, making it easier for users to automate their document processes. These features help streamline operations and enhance productivity across teams.

-

How does airSlate SignNow benefit small businesses in 2019?

For small businesses in 2019, airSlate SignNow provides an affordable and user-friendly solution for managing documents and signatures. This platform helps save time and reduce costs associated with printing, scanning, and mailing. Moreover, the easy integration with other tools enhances operational efficiency and business growth.

-

What integrations does airSlate SignNow support in 2019?

In 2019, airSlate SignNow supports integrations with various popular applications like Google Drive, Dropbox, and Microsoft Office. These integrations allow users to manage their documents seamlessly within their existing workflows. This versatility ensures that airSlate SignNow fits smoothly into any tech stack.

-

Is airSlate SignNow compliant with industry regulations in 2019?

Yes, in 2019 airSlate SignNow complies with major industry regulations such as ESIGN, UETA, and GDPR. This compliance ensures that documents signed using the platform are legally binding and secure. Businesses can therefore trust that their sensitive data is protected while using airSlate SignNow.

-

Can I access airSlate SignNow on mobile devices in 2019?

Absolutely! In 2019, airSlate SignNow offers a robust mobile application for both iOS and Android devices. This mobile access ensures that users can send, sign, and manage documents on-the-go, making it an ideal solution for busy professionals and remote teams.

-

What support options are available for airSlate SignNow users in 2019?

In 2019, airSlate SignNow offers various support options, including a comprehensive knowledge base, email support, and live chat assistance. This ensures that users can get help whenever they encounter issues or have questions. The goal is to provide a smooth user experience and help customers maximize the platform's potential.

Get more for 1042 S

- 1st copy lein if applicable form

- Personal representative for genesee county mi form

- Requestor s information birth records

- Dmv de govformsvehservformsapplication for gold star family license plate

- Ohio certificate of trust by individual form

- Grantor whose marital status is for valuable form

- Motion to redact form

- Form it 601 claim for ez wage tax credit including the zea wage tax credittax year

Find out other 1042 S

- Sign Tennessee Joint Venture Agreement Template Free

- How Can I Sign South Dakota Budget Proposal Template

- Can I Sign West Virginia Budget Proposal Template

- Sign Alaska Debt Settlement Agreement Template Free

- Help Me With Sign Alaska Debt Settlement Agreement Template

- How Do I Sign Colorado Debt Settlement Agreement Template

- Can I Sign Connecticut Stock Purchase Agreement Template

- How Can I Sign North Dakota Share Transfer Agreement Template

- Sign Oklahoma Debt Settlement Agreement Template Online

- Can I Sign Oklahoma Debt Settlement Agreement Template

- Sign Pennsylvania Share Transfer Agreement Template Now

- Sign Nevada Stock Purchase Agreement Template Later

- Sign Arkansas Indemnity Agreement Template Easy

- Sign Oklahoma Stock Purchase Agreement Template Simple

- Sign South Carolina Stock Purchase Agreement Template Fast

- Sign California Stock Transfer Form Template Online

- How Do I Sign California Stock Transfer Form Template

- How Can I Sign North Carolina Indemnity Agreement Template

- How Do I Sign Delaware Stock Transfer Form Template

- Help Me With Sign Texas Stock Purchase Agreement Template