W 2gu Form

What is the W-2GU?

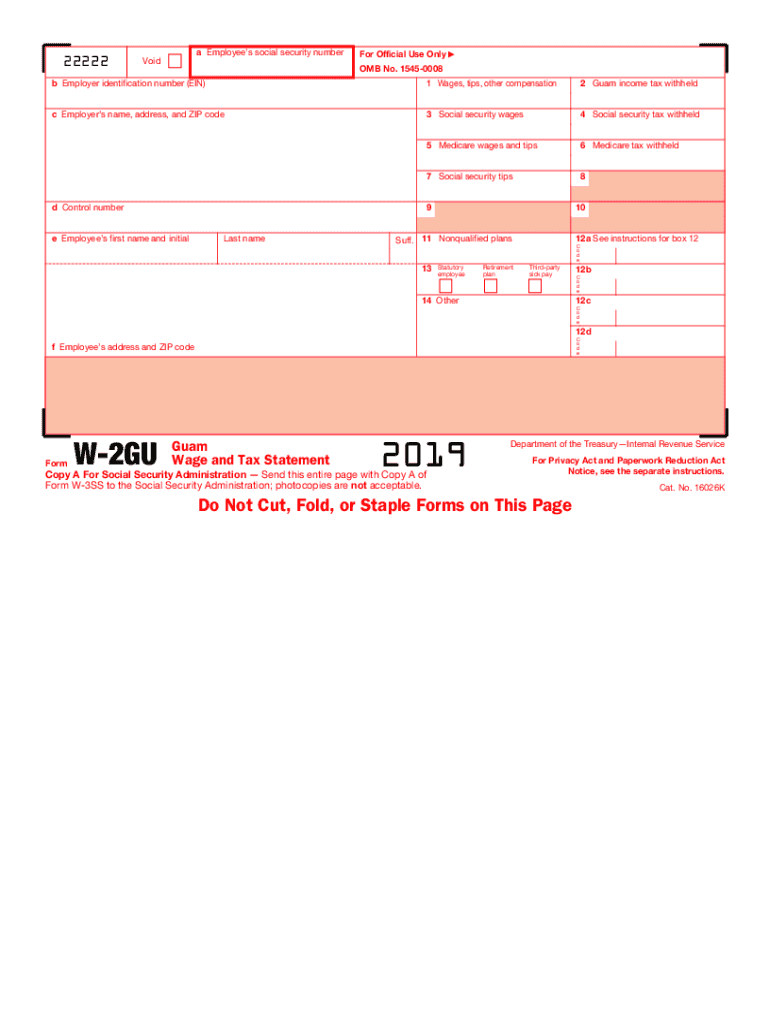

The W-2GU is a tax form used in Guam for reporting wages paid to employees. It serves a similar purpose as the federal W-2 form but is specifically tailored for the Guam tax system. Employers are required to complete this form to provide employees with a summary of their earnings and the taxes withheld during the year. The W-2GU includes essential information such as the employee's name, Social Security number, total wages, and the amount of taxes withheld for both federal and Guam tax purposes.

How to obtain the W-2GU

To obtain the W-2GU, employers must prepare the form based on their payroll records. The form can be generated using payroll software that complies with Guam's tax regulations. Additionally, employers can access the W-2GU form through the Guam Department of Revenue and Taxation's website. It is important for employers to ensure that they have the correct version of the form for the specific tax year, as updates may occur annually.

Steps to complete the W-2GU

Completing the W-2GU involves several key steps:

- Gather employee information, including full name, Social Security number, and address.

- Calculate total wages paid to the employee during the tax year.

- Determine the amount of federal and Guam taxes withheld from the employee's wages.

- Fill out the W-2GU form accurately, ensuring all information is correct.

- Provide copies of the completed form to the employee and submit the necessary copies to the Guam Department of Revenue and Taxation.

Legal use of the W-2GU

The W-2GU is legally binding and must be completed in compliance with Guam tax laws. Employers are obligated to provide this form to their employees by the deadline established by the Guam Department of Revenue and Taxation. Failure to provide accurate W-2GU forms can result in penalties for employers, including fines and additional scrutiny from tax authorities.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the W-2GU. Typically, the form must be issued to employees by January 31 of the following year. Additionally, employers are required to submit the W-2GU forms to the Guam Department of Revenue and Taxation by the end of February. Staying informed about these deadlines is crucial to avoid penalties and ensure compliance with tax regulations.

Examples of using the W-2GU

Consider an employer who has several employees working in Guam. At the end of the tax year, the employer must prepare W-2GU forms for each employee. For instance, if an employee earned $50,000 with $5,000 withheld for federal taxes and $2,500 for Guam taxes, the employer would report these amounts on the W-2GU. This documentation is essential for the employee to accurately file their tax return and claim any potential refunds or credits.

Quick guide on how to complete 2019 form w 2gu guam wage and tax statement

Complete W 2gu effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage W 2gu on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to alter and eSign W 2gu without stress

- Locate W 2gu and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign W 2gu to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form w 2gu guam wage and tax statement

How to make an eSignature for your 2019 Form W 2gu Guam Wage And Tax Statement in the online mode

How to create an eSignature for your 2019 Form W 2gu Guam Wage And Tax Statement in Google Chrome

How to create an electronic signature for signing the 2019 Form W 2gu Guam Wage And Tax Statement in Gmail

How to make an electronic signature for the 2019 Form W 2gu Guam Wage And Tax Statement straight from your smartphone

How to generate an electronic signature for the 2019 Form W 2gu Guam Wage And Tax Statement on iOS

How to generate an electronic signature for the 2019 Form W 2gu Guam Wage And Tax Statement on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to 2019 guam w?

airSlate SignNow is a digital solution that empowers businesses to send and eSign documents efficiently. It offers a user-friendly interface to streamline document workflows, making it an ideal choice for those searching for solutions related to 2019 guam w.

-

What features does airSlate SignNow offer for 2019 guam w users?

For users interested in 2019 guam w, airSlate SignNow provides features such as customizable templates, in-person signing, and advanced security options. These features ensure that users can manage documents with ease while maintaining compliance and safety.

-

How much does airSlate SignNow cost for businesses focused on 2019 guam w?

The pricing for airSlate SignNow is competitive, especially for businesses looking to address their 2019 guam w needs. Monthly subscriptions start with a basic plan that meets essential eSigning requirements, with more advanced plans available as your business grows.

-

Can airSlate SignNow integrate with other tools for 2019 guam w?

Yes, airSlate SignNow offers seamless integrations with various third-party applications. Businesses discussing 2019 guam w can connect to popular CRM systems, cloud storage services, and productivity tools, enhancing overall workflow efficiency.

-

What are the benefits of using airSlate SignNow in the context of 2019 guam w?

Using airSlate SignNow for 2019 guam w comes with notable benefits such as increased productivity, cost reduction, and enhanced collaboration. The platform allows teams to handle documents quickly and securely, thus improving overall efficiency.

-

Is airSlate SignNow secure for handling documents related to 2019 guam w?

Absolutely, airSlate SignNow prioritizes security with advanced encryption and compliance features when handling documents relating to 2019 guam w. This ensures that sensitive information remains protected during the signing process.

-

How does airSlate SignNow enhance the document signing experience for 2019 guam w?

airSlate SignNow enhances the signing experience by offering features like mobile access and real-time tracking for documents related to 2019 guam w. Signers can sign from anywhere, which facilitates quicker transactions and greater convenience.

Get more for W 2gu

Find out other W 2gu

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF