Tax Estates Trusts Form

What is the Tax Estates Trusts

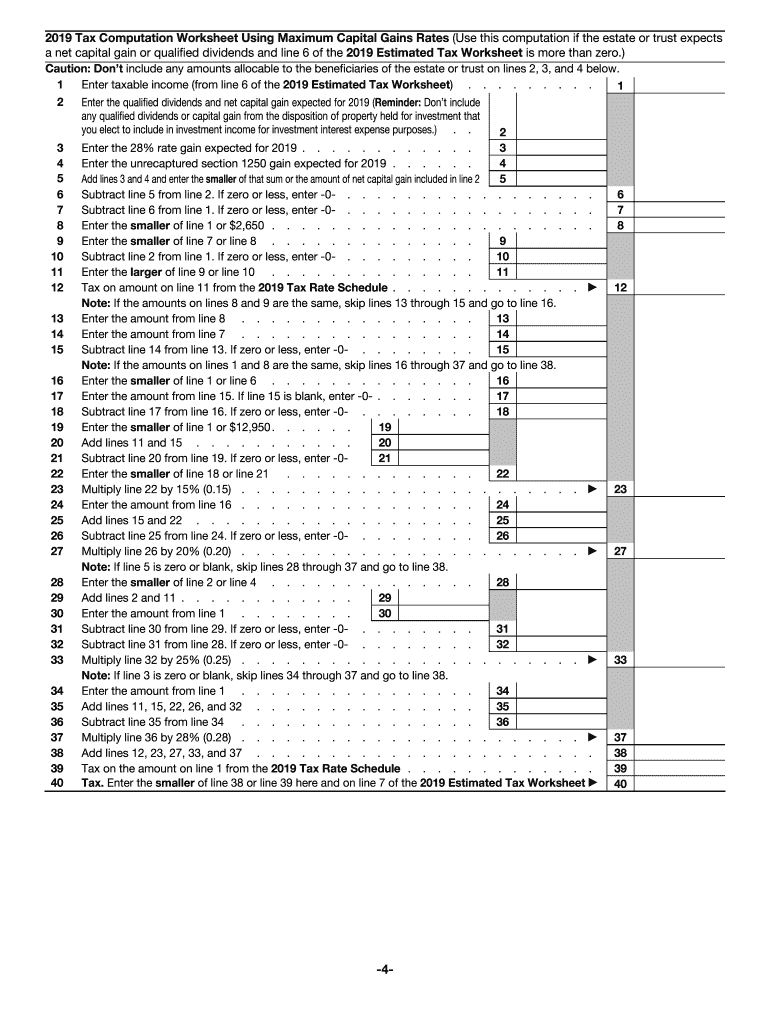

The Tax Estates Trusts, often referred to in the context of the 1041 es form, pertains to the taxation of estates and trusts in the United States. This form is primarily used by fiduciaries to report income, deductions, gains, and losses of estates and trusts. It is essential for ensuring that the income generated by these entities is accurately reported to the IRS, allowing for proper tax assessment and compliance.

Steps to complete the Tax Estates Trusts

Completing the Tax Estates Trusts involves several key steps to ensure accuracy and compliance. First, gather all relevant financial documents related to the estate or trust, including income statements, expenses, and prior tax returns. Next, fill out the 1041 es form with detailed information about the income and deductions. It is crucial to report all income accurately, as this will affect the tax liability. After completing the form, review it for errors and ensure all required signatures are included. Finally, submit the form to the IRS by the designated deadline, either electronically or by mail.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Tax Estates Trusts is vital for compliance. Typically, the 1041 es form is due on the fifteenth day of the fourth month following the end of the tax year for the estate or trust. For estates and trusts operating on a calendar year, this means the form is due by April fifteenth. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is important to keep track of these dates to avoid penalties for late filing.

Legal use of the Tax Estates Trusts

The legal use of the Tax Estates Trusts is governed by federal tax laws, which stipulate how estates and trusts must report their income and pay taxes. The 1041 es form serves as the official document for this process. Proper use of this form ensures compliance with IRS regulations, allowing fiduciaries to fulfill their legal obligations. Failure to accurately complete and submit the form may result in penalties or legal repercussions for the fiduciary managing the estate or trust.

Required Documents

To successfully complete the Tax Estates Trusts, several documents are required. These include the trust or estate's financial statements, records of income received, receipts for expenses incurred, and any previous tax returns related to the estate or trust. Additionally, it may be necessary to have documentation supporting deductions claimed on the 1041 es form. Having all these documents organized and accessible will facilitate a smoother filing process.

Who Issues the Form

The 1041 es form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and tax law enforcement in the United States. The IRS provides specific guidelines and instructions for completing the form, ensuring that fiduciaries understand their responsibilities when reporting the income of estates and trusts. It is essential to refer to the IRS resources for the most current information and updates regarding the form.

Penalties for Non-Compliance

Non-compliance with the requirements of the Tax Estates Trusts can lead to significant penalties. If the 1041 es form is not filed by the deadline, the IRS may impose late filing penalties, which can accumulate over time. Additionally, inaccuracies in reporting income or deductions can result in further penalties, including interest on unpaid taxes. It is important for fiduciaries to understand these potential consequences and ensure timely and accurate filing to avoid financial repercussions.

Quick guide on how to complete 2019 form 1041 es estimated income tax for estates and trusts

Easily prepare Tax Estates Trusts on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Access Tax Estates Trusts on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

An effortless way to edit and electronically sign Tax Estates Trusts

- Obtain Tax Estates Trusts and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from your preferred device. Modify and electronically sign Tax Estates Trusts, ensuring effective communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 1041 es estimated income tax for estates and trusts

How to generate an electronic signature for your 2019 Form 1041 Es Estimated Income Tax For Estates And Trusts online

How to make an electronic signature for your 2019 Form 1041 Es Estimated Income Tax For Estates And Trusts in Google Chrome

How to create an electronic signature for putting it on the 2019 Form 1041 Es Estimated Income Tax For Estates And Trusts in Gmail

How to generate an electronic signature for the 2019 Form 1041 Es Estimated Income Tax For Estates And Trusts right from your smartphone

How to generate an eSignature for the 2019 Form 1041 Es Estimated Income Tax For Estates And Trusts on iOS devices

How to create an eSignature for the 2019 Form 1041 Es Estimated Income Tax For Estates And Trusts on Android OS

People also ask

-

What is the 1041 es form and who needs it?

The 1041 es form is a tax form used for estates and trusts to report income and distribute earnings to beneficiaries. It is essential for fiduciaries who manage an estate or trust, ensuring compliance with IRS regulations. Understanding the 1041 es form is crucial to avoid penalties and streamlined processes.

-

How can airSlate SignNow help with the 1041 es form?

airSlate SignNow offers a seamless way to electronically sign and send the 1041 es form, facilitating a faster and more efficient workflow. With our user-friendly interface, you can easily prepare, share, and secure your tax documents. Leveraging airSlate SignNow helps ensure that your 1041 es form is processed quickly and securely.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow's pricing is competitive and tailored to fit various business needs, including options specifically designed for those managing the 1041 es form. We offer subscription plans that cater to different volume requirements, ensuring you only pay for what you use. With our cost-effective pricing, managing your documents becomes not only efficient but budget-friendly.

-

What features does airSlate SignNow offer for managing tax documents like the 1041 es?

AirSlate SignNow provides a comprehensive suite of features for managing documents, including templates for the 1041 es form, automated workflows, and integration with various applications. Document tracking ensures you never lose sight of your 1041 es submissions, while customizable signing workflows enhance efficiency. These features make airSlate SignNow an essential tool for handling tax-related documentation.

-

Is airSlate SignNow secure for signing sensitive forms such as 1041 es?

Yes, airSlate SignNow prioritizes your security with advanced encryption technologies to keep your 1041 es and other documents safe. Our platform complies with industry standards and regulations, ensuring that your data remains confidential and secure. Trust airSlate SignNow to protect your sensitive tax documents throughout the signing process.

-

Can airSlate SignNow integrate with other accounting software for 1041 es management?

Absolutely! AirSlate SignNow integrates seamlessly with popular accounting and tax software, making it easier to manage the 1041 es form alongside your other financial documents. This integration allows for effortless sharing of data between platforms, enhancing your overall workflow. By utilizing these integrations, you can optimize the efficiency of handling your estate and trust documents.

-

What benefits can businesses expect from using airSlate SignNow for the 1041 es form?

Using airSlate SignNow for the 1041 es form offers numerous benefits, including increased efficiency, faster turnaround times, and improved compliance with tax regulations. The ease of use ensures that both senders and recipients can navigate the signing process without hassle. Additionally, the cost-effective solution provides value by streamlining document management.

Get more for Tax Estates Trusts

Find out other Tax Estates Trusts

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later