Md Estimated Form

What is the Md Estimated

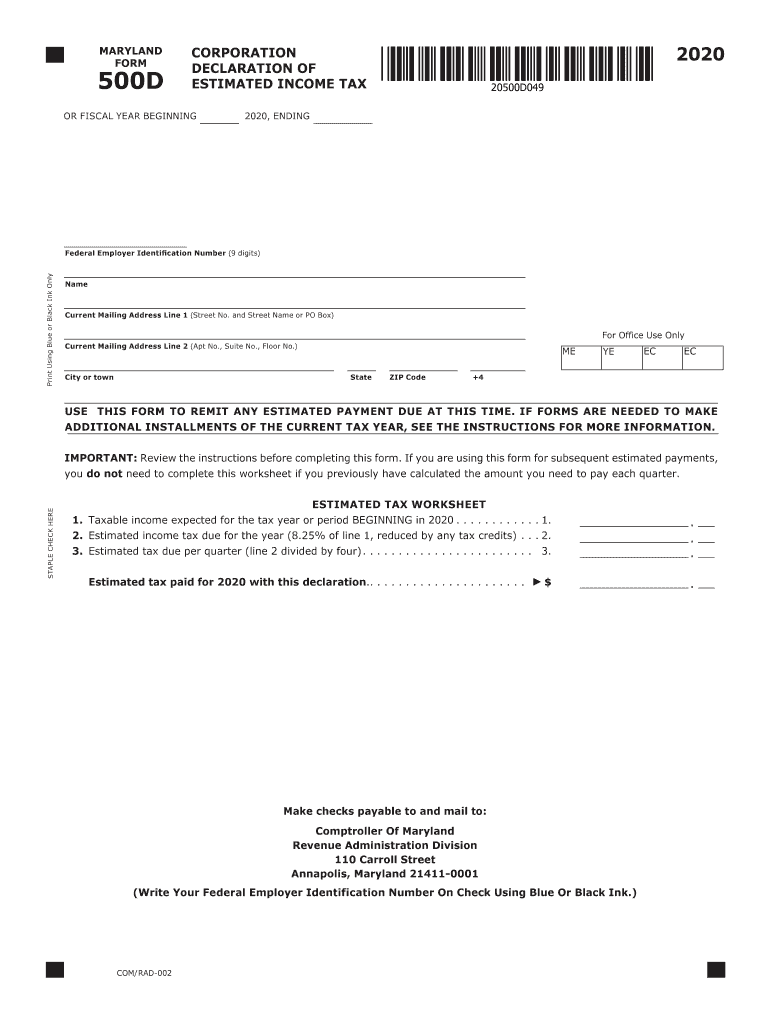

The 2020 MD Estimated form, officially known as the Maryland 500D, is a tax document used by individuals and businesses in Maryland to report estimated income tax liabilities. This form is essential for taxpayers who expect to owe tax of $500 or more when filing their annual return. It allows taxpayers to make quarterly payments throughout the year, ensuring they meet their tax obligations and avoid penalties.

How to use the Md Estimated

To effectively use the 2020 MD Estimated form, taxpayers must first determine their expected income for the year. This includes wages, self-employment income, and any other sources of revenue. Once the estimated income is calculated, taxpayers can use the Maryland tax tables to determine their estimated tax liability. The form is then filled out with the calculated amounts and submitted according to the specified deadlines.

Steps to complete the Md Estimated

Completing the 2020 MD Estimated form involves several steps:

- Gather all necessary financial documents, including previous tax returns and income statements.

- Estimate your total income for the year, including all sources of revenue.

- Calculate your estimated tax liability using the Maryland tax tables.

- Fill out the Maryland 500D form with your estimated income and tax amounts.

- Submit the completed form along with any required payments by the due dates.

Filing Deadlines / Important Dates

For the 2020 MD Estimated form, it is crucial to adhere to the filing deadlines to avoid penalties. The estimated tax payments are typically due in four installments throughout the year. The specific due dates for 2020 were April 15, June 15, September 15, and January 15 of the following year. Taxpayers should mark these dates on their calendars to ensure timely submissions.

Required Documents

Before completing the 2020 MD Estimated form, taxpayers should prepare the following documents:

- Previous year’s tax return for reference.

- Income statements, such as W-2s or 1099s.

- Records of any other income sources.

- Documentation of deductions and credits that may apply.

Penalties for Non-Compliance

Failing to file the 2020 MD Estimated form or making insufficient payments can result in penalties. Maryland imposes interest on underpayments, and taxpayers may face additional fines if they do not meet their estimated tax obligations. It is essential to stay compliant to avoid these financial repercussions.

Digital vs. Paper Version

The 2020 MD Estimated form can be completed either digitally or on paper. The digital version offers the convenience of electronic filing, which can expedite processing times and reduce the risk of errors. Conversely, some taxpayers may prefer the traditional paper method. Regardless of the chosen format, it is important to ensure that all information is accurate and submitted on time.

Quick guide on how to complete maryland declaration of estimated corporation income tax

Easily Prepare Md Estimated on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the appropriate form and securely save it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly without unnecessary delays. Handle Md Estimated on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

Effortlessly Modify and eSign Md Estimated

- Obtain Md Estimated and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Review the information and click on the Done button to finalize your changes.

- Choose how you would like to send your form—via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or inaccuracies that necessitate reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and eSign Md Estimated to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the maryland declaration of estimated corporation income tax

How to make an eSignature for your Maryland Declaration Of Estimated Corporation Income Tax online

How to generate an eSignature for your Maryland Declaration Of Estimated Corporation Income Tax in Chrome

How to make an eSignature for signing the Maryland Declaration Of Estimated Corporation Income Tax in Gmail

How to generate an eSignature for the Maryland Declaration Of Estimated Corporation Income Tax from your smart phone

How to create an electronic signature for the Maryland Declaration Of Estimated Corporation Income Tax on iOS

How to generate an electronic signature for the Maryland Declaration Of Estimated Corporation Income Tax on Android OS

People also ask

-

What is the 2020 md estimated pricing for airSlate SignNow?

The 2020 md estimated pricing for airSlate SignNow is designed to be budget-friendly, allowing businesses of all sizes to access our eSigning solutions. We offer various pricing tiers that cater to different needs, ensuring that you find a plan that fits your budget without sacrificing features.

-

How does the 2020 md estimated features of airSlate SignNow compare to competitors?

The 2020 md estimated features of airSlate SignNow include a robust set of tools that enhance document workflow efficiency. Compared to competitors, our platform offers unique integrations and flexibility, making it easier to streamline processes and boost productivity.

-

What are the benefits of using airSlate SignNow as per the 2020 md estimated?

The benefits of using airSlate SignNow, based on the 2020 md estimated, include improved document turnaround times and enhanced security measures. These advantages not only expedite transactions, but also foster trust with clients through reliable eSigning solutions.

-

Can I customize my 2020 md estimated plan with airSlate SignNow?

Absolutely! You can customize your 2020 md estimated plan with airSlate SignNow to include features that best suit your business requirements. This flexibility allows businesses to only pay for what they need while still benefiting from a full suite of tools.

-

Is airSlate SignNow easy to integrate with existing systems based on the 2020 md estimated?

Yes, airSlate SignNow is designed to seamlessly integrate with a variety of existing systems as part of the 2020 md estimated approach. Our API and integration capabilities make it easy to connect with your current software, enhancing overall functionality.

-

How secure is my data with airSlate SignNow in the 2020 md estimated framework?

Data security is a top priority for airSlate SignNow, ensuring that your documents are protected as part of the 2020 md estimated framework. We employ industry-standard encryption and compliance protocols to keep your information safe from unauthorized access.

-

What types of documents can I send and eSign with airSlate SignNow as indicated in the 2020 md estimated?

You can send and eSign a variety of documents with airSlate SignNow, including contracts, agreements, and forms, as indicated in the 2020 md estimated. Our platform accommodates numerous document types, making it versatile for different business needs.

Get more for Md Estimated

- Blank death certificate bihar form

- Ct form

- Connecticut eviction form

- Dps 799 form

- Special order plate application the state of connecticut website form

- Naic uniform application for third party administrator

- Fy 2009 1 connecticut state troubadour application fy 2009 ct form

- Seec form cep 12 the state of connecticut website

Find out other Md Estimated

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF