Form BT 115 C Address Change Notice

What is the Form BT 115 C Address Change Notice

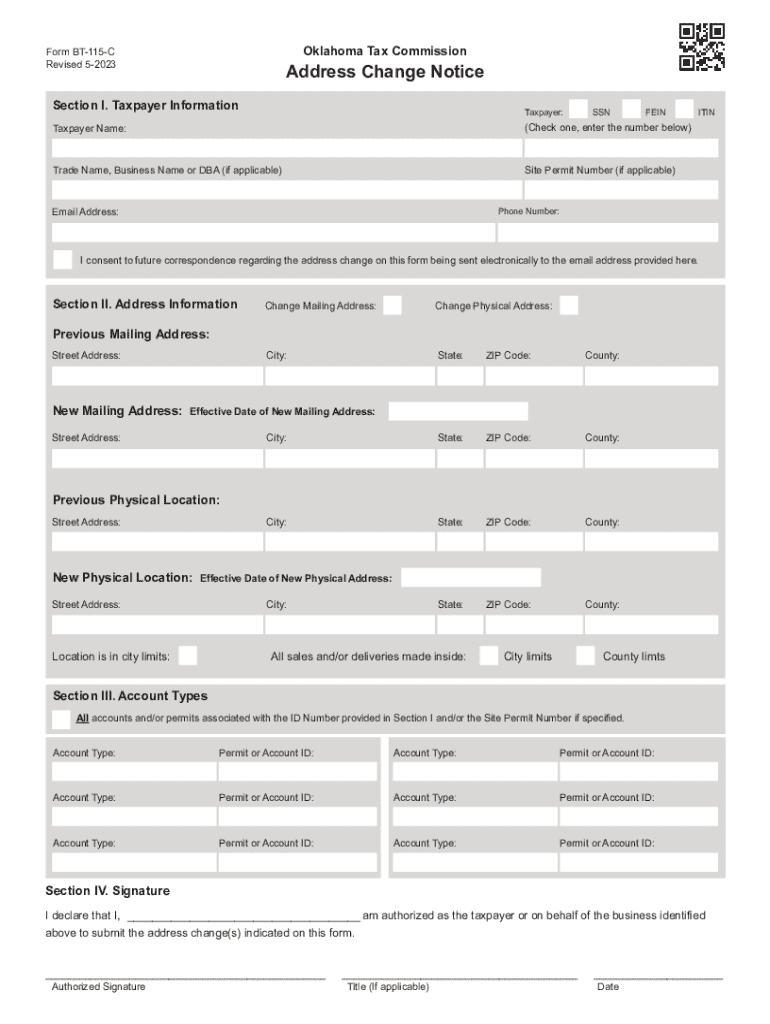

The Form BT 115 C Address Change Notice is an official document used in Oklahoma for notifying the state tax commission of a change in business address. This form is essential for maintaining accurate records with the Oklahoma Tax Commission, ensuring that all correspondence and tax-related documents are sent to the correct location. Businesses must use this form to update their address details promptly to avoid any disruptions in communication or potential penalties.

How to use the Form BT 115 C Address Change Notice

To use the Form BT 115 C Address Change Notice, businesses must first obtain the form from the Oklahoma Tax Commission's website or other authorized sources. Once the form is acquired, it should be filled out with the current business name, old address, new address, and any other required information. After completing the form, it can be submitted online, by mail, or in person, depending on the preferred submission method. Ensuring that the form is filled out accurately is crucial to prevent delays in processing.

Steps to complete the Form BT 115 C Address Change Notice

Completing the Form BT 115 C Address Change Notice involves several straightforward steps:

- Obtain the form from the Oklahoma Tax Commission.

- Fill in the business name and old address accurately.

- Provide the new address where correspondence should be sent.

- Include any additional required information as specified on the form.

- Review the form for accuracy and completeness.

- Submit the form through the chosen method: online, by mail, or in person.

Legal use of the Form BT 115 C Address Change Notice

The legal use of the Form BT 115 C Address Change Notice is crucial for compliance with Oklahoma state law. Businesses are required to inform the Oklahoma Tax Commission of any changes to their address to ensure that they remain in good standing. Failure to submit this form may result in missed communications regarding tax obligations, which could lead to penalties or fines. Therefore, using this form correctly is a legal obligation for all businesses operating within the state.

Required Documents

When submitting the Form BT 115 C Address Change Notice, businesses may need to provide additional documentation to verify the change of address. This can include:

- Proof of the new address, such as a utility bill or lease agreement.

- Identification documents of the business owner or authorized representative.

- Any previous correspondence from the Oklahoma Tax Commission that may be relevant.

Having these documents ready can facilitate a smoother submission process and help avoid any delays.

Form Submission Methods (Online / Mail / In-Person)

The Form BT 115 C Address Change Notice can be submitted through various methods. Businesses can choose to:

- Submit the form online via the Oklahoma Tax Commission's official website.

- Mail the completed form to the address specified on the form.

- Deliver the form in person to the local office of the Oklahoma Tax Commission.

Each method has its advantages, and businesses should select the one that best fits their needs and timeline for processing.

Examples of using the Form BT 115 C Address Change Notice

Examples of situations where the Form BT 115 C Address Change Notice is necessary include:

- A business relocating to a new physical location within Oklahoma.

- Changing the mailing address for a business that operates in multiple locations.

- Updating the address due to a change in ownership or management.

In each case, timely submission of the form is essential to ensure that the Oklahoma Tax Commission has the most current information on file.

Quick guide on how to complete form bt 115 c address change notice

Complete Form BT 115 C Address Change Notice effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow provides you with all the tools you need to create, edit, and eSign your documents swiftly without any holdups. Handle Form BT 115 C Address Change Notice on any platform with airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to edit and eSign Form BT 115 C Address Change Notice with ease

- Find Form BT 115 C Address Change Notice and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign Form BT 115 C Address Change Notice and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form bt 115 c address change notice

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for making an oklahoma change using airSlate SignNow?

To make an oklahoma change using airSlate SignNow, simply upload your document, add the necessary fields for signatures, and send it to the relevant parties. The platform allows for easy tracking of the document's status, ensuring that all parties are informed throughout the process. This streamlined approach saves time and enhances efficiency.

-

How much does airSlate SignNow cost for making oklahoma changes?

airSlate SignNow offers various pricing plans that cater to different business needs, including options for making oklahoma changes. The plans are designed to be cost-effective, ensuring that you get the best value for your investment. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for oklahoma change management?

airSlate SignNow provides a range of features for effective oklahoma change management, including customizable templates, real-time tracking, and secure eSigning capabilities. These features help streamline the document workflow, making it easier to manage changes efficiently. Additionally, the platform is user-friendly, ensuring a smooth experience for all users.

-

Can I integrate airSlate SignNow with other tools for oklahoma changes?

Yes, airSlate SignNow offers integrations with various tools and applications to facilitate oklahoma changes. This includes popular platforms like Google Drive, Dropbox, and CRM systems. These integrations enhance productivity by allowing you to manage documents seamlessly across different applications.

-

What are the benefits of using airSlate SignNow for oklahoma changes?

Using airSlate SignNow for oklahoma changes provides numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security for your documents. The platform's intuitive design makes it easy for users to navigate and complete tasks quickly. Additionally, the ability to track document status ensures transparency throughout the process.

-

Is airSlate SignNow secure for handling sensitive oklahoma changes?

Absolutely, airSlate SignNow prioritizes security, making it a reliable choice for handling sensitive oklahoma changes. The platform employs advanced encryption and complies with industry standards to protect your data. You can confidently manage your documents, knowing that they are secure and protected from unauthorized access.

-

How can I get support for making oklahoma changes with airSlate SignNow?

airSlate SignNow offers comprehensive support for users needing assistance with making oklahoma changes. You can access a variety of resources, including a knowledge base, video tutorials, and customer support via chat or email. This ensures that you have the help you need to navigate the platform effectively.

Get more for Form BT 115 C Address Change Notice

- Letter from tenant to landlord with demand that landlord remove garbage and vermin from premises iowa form

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles iowa form

- Letter from tenant to landlord about landlords failure to make repairs iowa form

- Letter from landlord to tenant as notice that rent was voluntarily lowered in exchange for tenant agreeing to make repairs 497304942 form

- Letter from tenant to landlord about landlord using unlawful self help to gain possession iowa form

- Letter from tenant to landlord about illegal entry by landlord iowa form

- Letter from landlord to tenant about time of intent to enter premises iowa form

- Ia tenant landlord notice form

Find out other Form BT 115 C Address Change Notice

- Sign South Dakota Sales Invoice Template Free

- How Can I Sign Nevada Sales Proposal Template

- Can I Sign Texas Confirmation Of Reservation Or Order

- How To Sign Illinois Product Defect Notice

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal