Annualized Estimated Tax Worksheet Oklahoma Digital Prairie 2024

What is the Annualized Estimated Tax Worksheet Oklahoma Digital Prairie

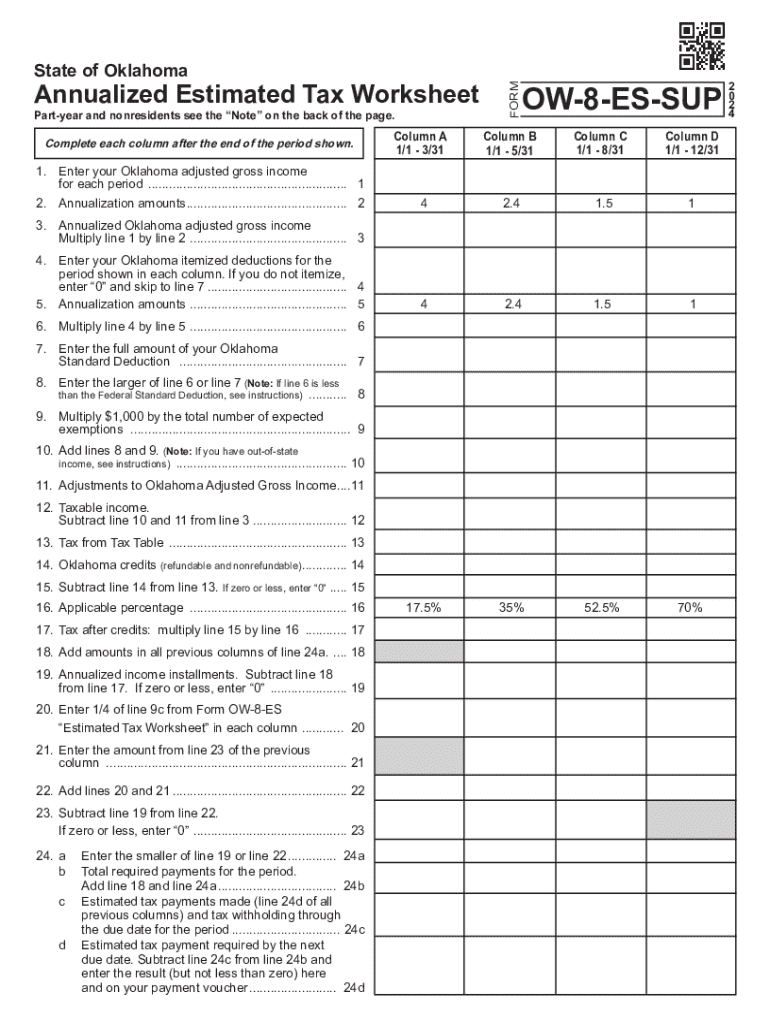

The Annualized Estimated Tax Worksheet Oklahoma Digital Prairie is a specific form used by taxpayers in Oklahoma to calculate their estimated tax payments based on their annual income. This worksheet helps individuals and businesses determine the amount of tax they need to pay throughout the year, rather than waiting until the end of the tax year. It is especially useful for those with fluctuating income, such as self-employed individuals, allowing them to estimate their tax liability more accurately.

How to use the Annualized Estimated Tax Worksheet Oklahoma Digital Prairie

To utilize the Annualized Estimated Tax Worksheet, taxpayers should first gather their income information for the year, including wages, self-employment income, and any other sources of revenue. The worksheet provides a structured format to input this data, allowing users to calculate their estimated tax based on their projected annual income. It is essential to follow the instructions carefully, ensuring that all figures are accurately reported to avoid underpayment penalties.

Steps to complete the Annualized Estimated Tax Worksheet Oklahoma Digital Prairie

Completing the Annualized Estimated Tax Worksheet involves several key steps:

- Gather income statements and documentation for the year.

- Input your income figures into the appropriate sections of the worksheet.

- Calculate your estimated tax liability based on the provided formulas.

- Review the completed worksheet for accuracy.

- Submit the worksheet along with any required estimated tax payments.

Key elements of the Annualized Estimated Tax Worksheet Oklahoma Digital Prairie

The key elements of the Annualized Estimated Tax Worksheet include sections for reporting various types of income, deductions, and credits. Taxpayers must provide detailed information about their earnings throughout the year, as well as any applicable adjustments. Understanding these elements is crucial for accurately estimating tax obligations and ensuring compliance with state tax regulations.

Filing Deadlines / Important Dates

Timely filing is critical when using the Annualized Estimated Tax Worksheet. Taxpayers must adhere to specific deadlines for submitting their estimated tax payments, typically due quarterly. Important dates may vary slightly each year, so it is advisable to check the Oklahoma tax authority's calendar for the most current filing deadlines to avoid penalties.

Penalties for Non-Compliance

Failure to accurately complete and submit the Annualized Estimated Tax Worksheet can result in penalties imposed by the state of Oklahoma. These penalties may include fines for underpayment of taxes or late payment fees. Taxpayers should ensure they understand the implications of non-compliance and take proactive steps to meet their tax obligations.

Quick guide on how to complete annualized estimated tax worksheet oklahoma digital prairie

Complete Annualized Estimated Tax Worksheet Oklahoma Digital Prairie effortlessly on any device

Online document administration has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Annualized Estimated Tax Worksheet Oklahoma Digital Prairie on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

How to modify and eSign Annualized Estimated Tax Worksheet Oklahoma Digital Prairie with ease

- Find Annualized Estimated Tax Worksheet Oklahoma Digital Prairie and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or conceal sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, text message (SMS), or an invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, and mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Adjust and eSign Annualized Estimated Tax Worksheet Oklahoma Digital Prairie and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct annualized estimated tax worksheet oklahoma digital prairie

Create this form in 5 minutes!

How to create an eSignature for the annualized estimated tax worksheet oklahoma digital prairie

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Annualized Estimated Tax Worksheet Oklahoma Digital Prairie?

The Annualized Estimated Tax Worksheet Oklahoma Digital Prairie is a tool designed to help individuals and businesses calculate their estimated tax payments throughout the year. It simplifies the process of estimating taxes based on income fluctuations, ensuring compliance with Oklahoma tax regulations.

-

How can I access the Annualized Estimated Tax Worksheet Oklahoma Digital Prairie?

You can easily access the Annualized Estimated Tax Worksheet Oklahoma Digital Prairie through the airSlate SignNow platform. Simply sign up for an account, and you will have access to this worksheet along with other essential document management tools.

-

Is there a cost associated with using the Annualized Estimated Tax Worksheet Oklahoma Digital Prairie?

Yes, there is a cost associated with using the Annualized Estimated Tax Worksheet Oklahoma Digital Prairie, but it is designed to be a cost-effective solution for businesses. Pricing plans vary based on the features you need, ensuring you only pay for what you use.

-

What features does the Annualized Estimated Tax Worksheet Oklahoma Digital Prairie offer?

The Annualized Estimated Tax Worksheet Oklahoma Digital Prairie offers features such as customizable templates, eSignature capabilities, and real-time collaboration. These features streamline the tax preparation process, making it easier for users to manage their tax obligations efficiently.

-

How does the Annualized Estimated Tax Worksheet Oklahoma Digital Prairie benefit businesses?

Using the Annualized Estimated Tax Worksheet Oklahoma Digital Prairie helps businesses stay organized and compliant with tax regulations. It reduces the risk of underpayment penalties and provides a clear overview of estimated tax liabilities, allowing for better financial planning.

-

Can I integrate the Annualized Estimated Tax Worksheet Oklahoma Digital Prairie with other software?

Yes, the Annualized Estimated Tax Worksheet Oklahoma Digital Prairie can be integrated with various accounting and financial software. This integration allows for seamless data transfer, enhancing your overall tax management process and improving efficiency.

-

Is the Annualized Estimated Tax Worksheet Oklahoma Digital Prairie user-friendly?

Absolutely! The Annualized Estimated Tax Worksheet Oklahoma Digital Prairie is designed with user experience in mind. Its intuitive interface makes it easy for users of all skill levels to navigate and utilize the worksheet effectively.

Get more for Annualized Estimated Tax Worksheet Oklahoma Digital Prairie

- Surface damage certificate oklahoma form

- Application for transient merchant license oklahoma form

- Transient merchant 90 day license oklahoma form

- Schedule of reimbursement oklahoma form

- Order directing transfer oklahoma form

- Affidavit of cancellation of lien oklahoma form

- Oklahoma visitation form

- Oklahoma notice judgment form

Find out other Annualized Estimated Tax Worksheet Oklahoma Digital Prairie

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online