Form OW 8 ES SUP Annualized Estimated Tax Worksheet 2025-2026

What is the Form OW-8 ES SUP Annualized Estimated Tax Worksheet

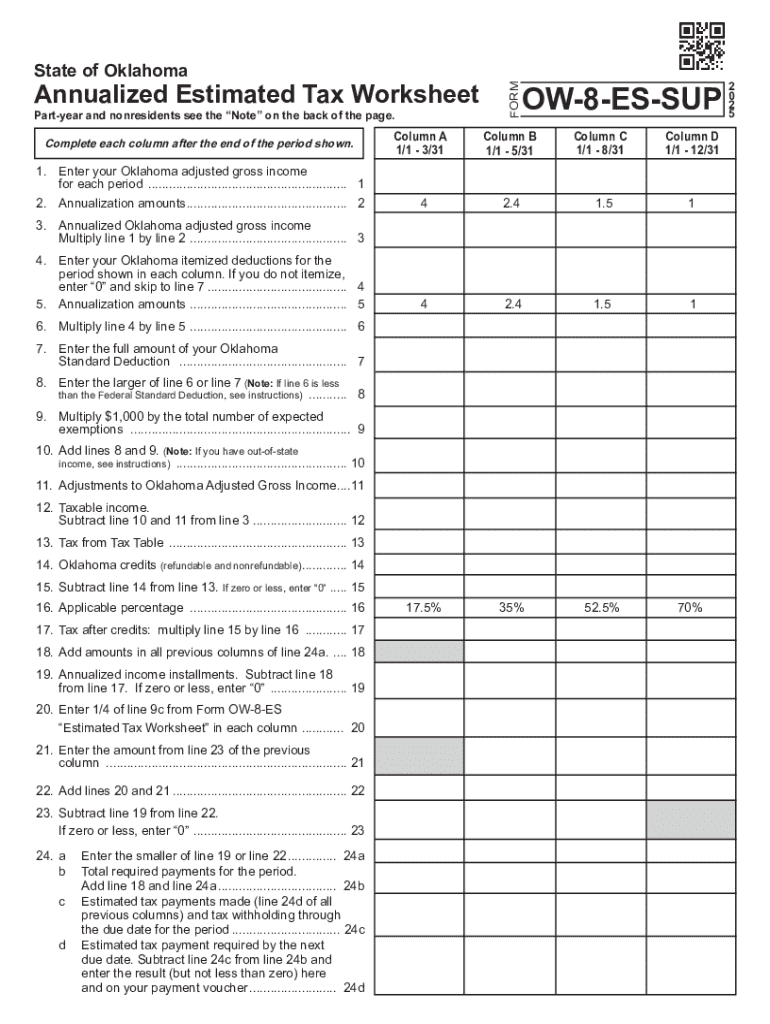

The Form OW-8 ES SUP Annualized Estimated Tax Worksheet is a tax form used by individuals and businesses in the United States to calculate their estimated tax payments on an annualized basis. This worksheet helps taxpayers determine their tax liability based on income received during specific periods of the year, rather than on a traditional annual basis. It is particularly useful for those whose income fluctuates significantly throughout the year, such as self-employed individuals or seasonal workers. By using this form, taxpayers can avoid underpayment penalties and ensure they are making accurate estimated tax payments.

How to use the Form OW-8 ES SUP Annualized Estimated Tax Worksheet

To effectively use the Form OW-8 ES SUP Annualized Estimated Tax Worksheet, taxpayers should follow a systematic approach. First, gather all necessary financial documents, including income statements and expense records. Next, fill out the worksheet by entering income figures for each period as specified. The form includes sections for various income types, allowing for a comprehensive calculation of estimated taxes owed. After completing the worksheet, review the calculations to ensure accuracy. This completed form can then be used to guide estimated tax payments throughout the year.

Steps to complete the Form OW-8 ES SUP Annualized Estimated Tax Worksheet

Completing the Form OW-8 ES SUP Annualized Estimated Tax Worksheet involves several key steps:

- Gather Documentation: Collect all relevant income and expense records for the year.

- Fill in Income Details: Enter the total income received during each applicable period on the worksheet.

- Calculate Deductions: Deduct any eligible expenses to determine the taxable income for each period.

- Determine Tax Liability: Use the tax tables or rates provided to calculate the estimated tax owed based on the taxable income.

- Review and Adjust: Double-check all entries and calculations for accuracy before finalizing.

Key elements of the Form OW-8 ES SUP Annualized Estimated Tax Worksheet

Several key elements are essential to understand when using the Form OW-8 ES SUP Annualized Estimated Tax Worksheet:

- Income Sections: The form includes distinct sections for different types of income, such as wages, interest, and self-employment income.

- Deductions: Taxpayers can list deductions that apply to their situation, which helps in accurately calculating taxable income.

- Tax Rates: The worksheet provides guidance on applicable tax rates, which are crucial for determining total tax liability.

- Payment Schedule: Instructions on how to schedule estimated tax payments are included, ensuring timely compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Form OW-8 ES SUP Annualized Estimated Tax Worksheet are critical for taxpayers to avoid penalties. Generally, estimated tax payments are due quarterly, with specific dates set by the IRS. Taxpayers should be aware of these deadlines to ensure timely submission of their payments. Additionally, the worksheet may need to be updated if there are significant changes in income or expenses throughout the year, which could affect the estimated tax calculations.

Eligibility Criteria

To use the Form OW-8 ES SUP Annualized Estimated Tax Worksheet, taxpayers must meet certain eligibility criteria. This form is primarily designed for individuals and businesses with fluctuating income levels, such as freelancers, contractors, or those with seasonal employment. Taxpayers should also have a reasonable expectation of owing tax of one thousand dollars or more for the year. Understanding these criteria helps ensure that the worksheet is used appropriately and effectively for estimating tax obligations.

Create this form in 5 minutes or less

Find and fill out the correct form ow 8 es sup annualized estimated tax worksheet

Create this form in 5 minutes!

How to create an eSignature for the form ow 8 es sup annualized estimated tax worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form OW 8 ES SUP Annualized Estimated Tax Worksheet?

The Form OW 8 ES SUP Annualized Estimated Tax Worksheet is a tax document used to calculate estimated tax payments for individuals and businesses. It helps taxpayers determine their tax liability based on their income throughout the year, allowing for more accurate payment planning.

-

How can airSlate SignNow assist with the Form OW 8 ES SUP Annualized Estimated Tax Worksheet?

airSlate SignNow provides a user-friendly platform to create, send, and eSign the Form OW 8 ES SUP Annualized Estimated Tax Worksheet. Our solution simplifies the process, ensuring that you can complete and submit your tax documents efficiently and securely.

-

Is there a cost associated with using airSlate SignNow for the Form OW 8 ES SUP Annualized Estimated Tax Worksheet?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Each plan provides access to features that facilitate the completion and management of the Form OW 8 ES SUP Annualized Estimated Tax Worksheet, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for managing the Form OW 8 ES SUP Annualized Estimated Tax Worksheet?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage, all designed to streamline the management of the Form OW 8 ES SUP Annualized Estimated Tax Worksheet. These tools enhance productivity and ensure compliance with tax regulations.

-

Can I integrate airSlate SignNow with other software for the Form OW 8 ES SUP Annualized Estimated Tax Worksheet?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage the Form OW 8 ES SUP Annualized Estimated Tax Worksheet alongside your existing tools. This integration capability enhances workflow efficiency and data accuracy.

-

What are the benefits of using airSlate SignNow for the Form OW 8 ES SUP Annualized Estimated Tax Worksheet?

Using airSlate SignNow for the Form OW 8 ES SUP Annualized Estimated Tax Worksheet provides numerous benefits, including time savings, reduced paperwork, and enhanced security. Our platform ensures that your tax documents are handled efficiently and securely, giving you peace of mind.

-

Is airSlate SignNow suitable for both individuals and businesses needing the Form OW 8 ES SUP Annualized Estimated Tax Worksheet?

Yes, airSlate SignNow is designed to cater to both individuals and businesses requiring the Form OW 8 ES SUP Annualized Estimated Tax Worksheet. Our flexible solution adapts to various user needs, making it an ideal choice for anyone looking to manage their tax documents effectively.

Get more for Form OW 8 ES SUP Annualized Estimated Tax Worksheet

- Referral by department of corrections to sentencing court section 3021139g geriatric terminal wisconsin form

- Sentence modification form

- Wisconsin sentence adjustment form

- Wisconsin district attorney form

- Wisconsin sentence adjustment 497430803 form

- Time served 497430804 form

- Wi release form 497430805

- Department of corrections approval to file petition for determination of eligibility for the earned release program section form

Find out other Form OW 8 ES SUP Annualized Estimated Tax Worksheet

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online