Form OW 8 ES SUP Annualized Estimated Tax Worksheet 2022

What is the Form OW 8 ES SUP Annualized Estimated Tax Worksheet

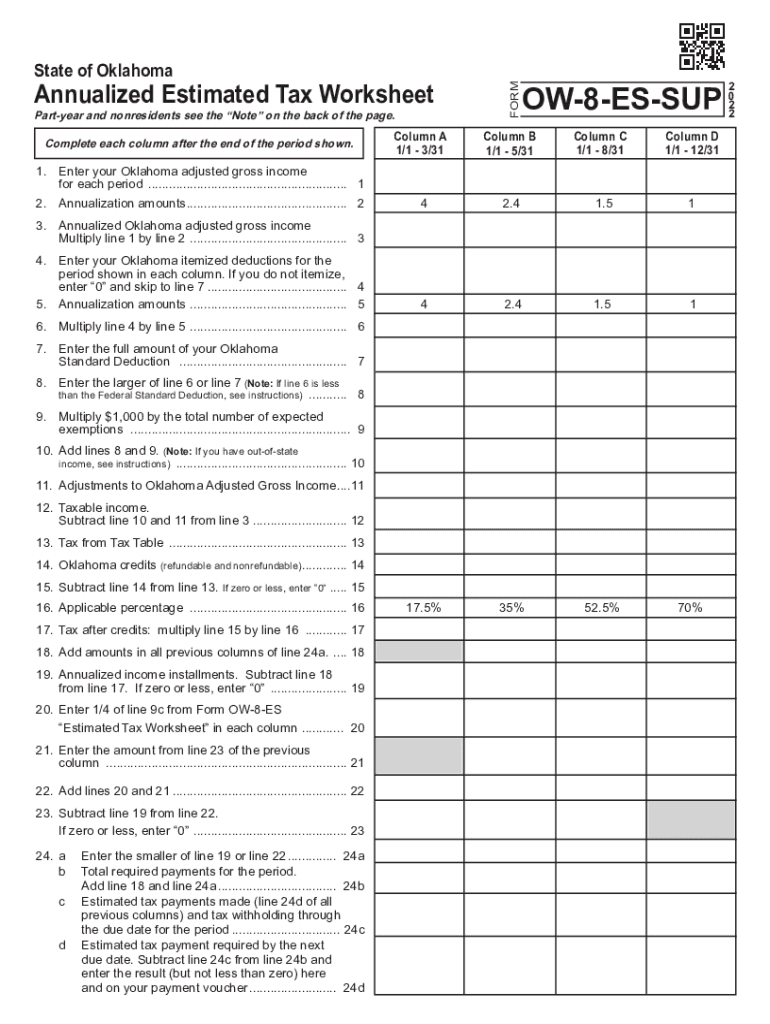

The Form OW 8 ES SUP Annualized Estimated Tax Worksheet is a document used by taxpayers in Oklahoma to calculate their estimated tax payments. This form is particularly relevant for individuals who may have fluctuating income throughout the year, such as self-employed individuals or those with seasonal income. By using this worksheet, taxpayers can determine their estimated tax liability based on their income for specific periods, allowing for a more accurate payment schedule.

How to use the Form OW 8 ES SUP Annualized Estimated Tax Worksheet

To effectively use the Form OW 8 ES SUP, taxpayers should first gather their income information for the year. This includes all sources of income, such as wages, business income, and any other earnings. Next, the taxpayer should follow the instructions on the form to calculate their estimated tax based on their income for each period. It is essential to ensure that all calculations are accurate to avoid underpayment penalties.

Steps to complete the Form OW 8 ES SUP Annualized Estimated Tax Worksheet

Completing the Form OW 8 ES SUP involves several key steps:

- Gather all relevant income documentation for the year.

- Fill in your personal information at the top of the form.

- Calculate your total income for each period as specified on the worksheet.

- Determine your estimated tax liability based on the income figures.

- Complete the payment schedule section, indicating when payments are due.

- Review the form for accuracy before submission.

Legal use of the Form OW 8 ES SUP Annualized Estimated Tax Worksheet

The Form OW 8 ES SUP is legally recognized by the state of Oklahoma for the purpose of estimating tax liabilities. To ensure compliance, taxpayers must adhere to the guidelines set forth by the Oklahoma Tax Commission. This includes timely submission of the form and making payments as outlined in the completed worksheet. Proper use of this form helps to avoid penalties associated with underpayment of taxes.

Filing Deadlines / Important Dates

Taxpayers should be aware of the filing deadlines associated with the Form OW 8 ES SUP. Typically, estimated tax payments are due quarterly, with specific dates set by the Oklahoma Tax Commission. It is crucial to mark these dates on your calendar to ensure timely payments and avoid penalties for late submissions.

Required Documents

When preparing to complete the Form OW 8 ES SUP, taxpayers should have the following documents on hand:

- Previous year’s tax return for reference.

- Income statements, such as W-2s or 1099s.

- Records of any other income sources.

- Documentation of deductions and credits that may apply.

Penalties for Non-Compliance

Failure to comply with the requirements of the Form OW 8 ES SUP can result in penalties. Taxpayers who underpay their estimated taxes may face interest charges and additional penalties from the Oklahoma Tax Commission. It is important to accurately complete the form and make timely payments to avoid these consequences.

Quick guide on how to complete 2022 form ow 8 es sup annualized estimated tax worksheet

Prepare Form OW 8 ES SUP Annualized Estimated Tax Worksheet effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary format and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without any delays. Handle Form OW 8 ES SUP Annualized Estimated Tax Worksheet on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest method to modify and eSign Form OW 8 ES SUP Annualized Estimated Tax Worksheet with ease

- Find Form OW 8 ES SUP Annualized Estimated Tax Worksheet and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of the documents or redact confidential information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Form OW 8 ES SUP Annualized Estimated Tax Worksheet and guarantee excellent communication at any phase of the form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form ow 8 es sup annualized estimated tax worksheet

Create this form in 5 minutes!

How to create an eSignature for the 2022 form ow 8 es sup annualized estimated tax worksheet

How to make an electronic signature for your PDF in the online mode

How to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to create an e-signature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

How to create an e-signature for a PDF on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to 'ok es estimated'?

airSlate SignNow is an eSignature solution that allows businesses to send and sign documents electronically. When considering 'ok es estimated' for your business needs, airSlate SignNow offers an intuitive interface and competitive pricing to help you manage your document workflows efficiently.

-

How does pricing work for airSlate SignNow and what does 'ok es estimated' imply?

The pricing for airSlate SignNow is designed to be cost-effective, with several plans to accommodate different business sizes. When you see 'ok es estimated,' it provides potential users with a clear expectation of what they can anticipate in terms of costs related to document management.

-

What are the key features of airSlate SignNow relevant to 'ok es estimated'?

Key features of airSlate SignNow include customizable templates, document tracking, and seamless eSigning capabilities. These aspects are particularly important when 'ok es estimated' refers to streamlining processes and ensuring timely execution of documents.

-

How can airSlate SignNow benefit my business in relation to 'ok es estimated'?

AirSlate SignNow can signNowly enhance your business efficiency by reducing the time and resources spent on managing paperwork. With an 'ok es estimated' approach, you can expect to save money and foster a quicker turnaround in document handling.

-

Is airSlate SignNow easy to integrate with other tools and platforms considering 'ok es estimated'?

Yes, airSlate SignNow is designed to easily integrate with various third-party applications, which streamlines workflow management. This ensures that 'ok es estimated' remains relevant as businesses look to connect their existing tools while benefiting from our eSignature solution.

-

What compliance standards does airSlate SignNow meet, relating to 'ok es estimated'?

airSlate SignNow complies with major eSignature laws, such as ESIGN and UETA, providing assurance that your documents are legally binding. With 'ok es estimated', it's important to know that the solution meets compliance standards, ensuring security and trustworthiness.

-

Can I use airSlate SignNow for international agreements based on 'ok es estimated'?

Absolutely! airSlate SignNow supports international eSignatures, making it suitable for global businesses. The 'ok es estimated' aspect indicates that you can efficiently handle documents across borders without compromising legal integrity.

Get more for Form OW 8 ES SUP Annualized Estimated Tax Worksheet

- Nj easement form

- New jersey deed 497319416 form

- Assumption agreement of mortgage and release of original mortgagors new jersey form

- Foreign judgment enforcement form

- New jersey estate form

- Nj landlord tenant eviction forms

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house new 497319421 form

- Nj annual report form

Find out other Form OW 8 ES SUP Annualized Estimated Tax Worksheet

- eSign Wisconsin Cohabitation Agreement Free

- How To eSign Colorado Living Will

- eSign Maine Living Will Now

- eSign Utah Living Will Now

- eSign Iowa Affidavit of Domicile Now

- eSign Wisconsin Codicil to Will Online

- eSign Hawaii Guaranty Agreement Mobile

- eSign Hawaii Guaranty Agreement Now

- How Can I eSign Kentucky Collateral Agreement

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer