Ok 8 Es 2020

What is the OK-8ES?

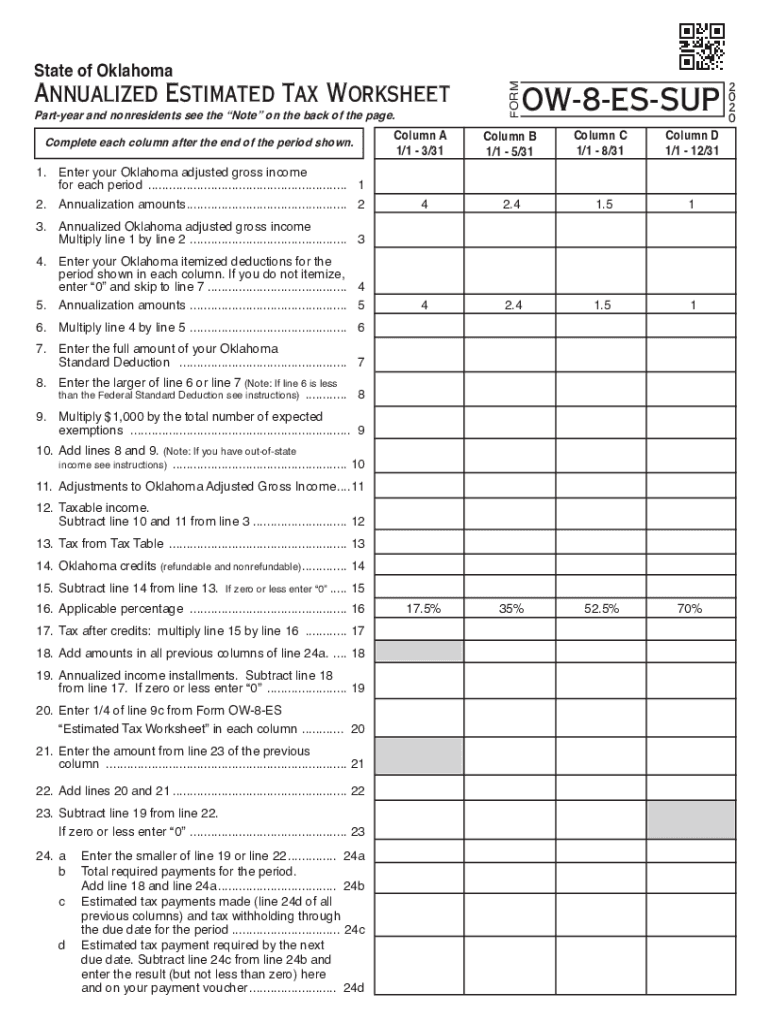

The OK-8ES form, also known as the Oklahoma Estimated Tax form, is a crucial document for individuals and businesses in Oklahoma who expect to owe tax of $1,000 or more when filing their annual tax return. This form allows taxpayers to calculate and pay their estimated tax liabilities throughout the year, ensuring compliance with state tax regulations. By submitting the OK-8ES, taxpayers can avoid penalties associated with underpayment of taxes.

How to Use the OK-8ES

Using the OK-8ES form involves a few key steps. First, gather your financial information, including income projections and deductions. Next, calculate your estimated tax liability based on your expected income for the year. This calculation will help you determine how much you should pay in estimated taxes. Finally, submit the completed form along with your payment to the Oklahoma Tax Commission by the specified deadlines.

Steps to Complete the OK-8ES

Completing the OK-8ES form requires careful attention to detail. Follow these steps:

- Gather necessary documentation, such as income statements and previous tax returns.

- Calculate your expected annual income and applicable deductions.

- Determine your estimated tax liability using the relevant tax rates.

- Fill out the OK-8ES form with your calculated figures.

- Submit the form and payment to the Oklahoma Tax Commission by the due date.

Legal Use of the OK-8ES

The OK-8ES form is legally binding when completed accurately and submitted on time. It is essential for taxpayers to comply with Oklahoma tax laws to avoid penalties. The form must be filed according to the state’s guidelines, ensuring that all calculations are correct and that payments are made as required. Understanding the legal implications of the OK-8ES helps taxpayers maintain compliance and avoid unnecessary fines.

Filing Deadlines / Important Dates

Timely filing of the OK-8ES is crucial to avoid penalties. Estimated tax payments are generally due on the 15th day of April, June, September, and January of the following year. Taxpayers should mark these dates on their calendars to ensure they meet their obligations. Additionally, if the due date falls on a weekend or holiday, the deadline may be adjusted, so it is important to verify the specific dates each year.

Required Documents

To accurately complete the OK-8ES form, taxpayers should have the following documents ready:

- Previous year’s tax return for reference.

- Income statements, such as W-2s or 1099s.

- Documentation of any deductions or credits you plan to claim.

- Any additional financial records that may impact your estimated tax calculations.

Penalties for Non-Compliance

Failing to file the OK-8ES form or underpaying estimated taxes can result in penalties from the Oklahoma Tax Commission. These penalties can accumulate quickly, leading to increased financial liability. Taxpayers should be aware of the potential consequences of non-compliance, including interest charges and fines, to ensure that they meet their tax obligations and avoid unnecessary costs.

Quick guide on how to complete ok 8 es

Easily prepare Ok 8 Es on any device

Managing documents online has gained popularity among organizations and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents promptly without any delays. Handle Ok 8 Es on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

Effortlessly edit and electronically sign Ok 8 Es

- Locate Ok 8 Es and click on Get Form to begin.

- Use the tools provided to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the identical legal validity as an ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that require new printed copies. airSlate SignNow meets all your document management requirements with just a few clicks from any device you prefer. Edit and electronically sign Ok 8 Es to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ok 8 es

Create this form in 5 minutes!

How to create an eSignature for the ok 8 es

How to create an electronic signature for your PDF in the online mode

How to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

The best way to create an eSignature for a PDF document on Android OS

People also ask

-

What is an ow estimated form and how does it work with airSlate SignNow?

An ow estimated form is a document outlining estimated costs or values that can be easily created and signed using airSlate SignNow. The platform allows users to customize these forms, ensuring that all parties can input necessary information quickly and securely. With airSlate SignNow, you can streamline the completion and signing process, making it more efficient for your business.

-

How can I create an ow estimated form using airSlate SignNow?

Creating an ow estimated form with airSlate SignNow is simple and user-friendly. You can start from a template or design your own form from scratch within the platform. Once your form is ready, you can send it for eSignature to colleagues or clients, ensuring quick turnaround times.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including a free trial to test its features. Plans include options for individual users to teams and enterprises, ensuring that you can find a cost-effective solution for managing your ow estimated forms. Visit our pricing page for detailed information on each plan.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow seamlessly integrates with various applications such as CRM systems, cloud storage services, and accounting software, helping you manage your ow estimated forms effectively. These integrations enhance workflow automation and improve collaboration between teams. You can check our integrations page for a full list of supported applications.

-

What are the benefits of using airSlate SignNow for ow estimated forms?

Using airSlate SignNow for ow estimated forms comes with numerous benefits, including reduced paperwork, faster turnaround times, and enhanced accuracy. The platform also provides secure storage for your documents, ensuring compliance and peace of mind. Additionally, eSigning features make it easy to get timely approvals.

-

Is airSlate SignNow secure for handling sensitive ow estimated forms?

Absolutely! airSlate SignNow prioritizes document security, employing industry-standard encryption and compliance measures to protect your ow estimated forms. With robust authentication options and audit trails, your data remains safe while being transmitted and stored within the platform.

-

Can I access my ow estimated forms on mobile devices?

Yes, airSlate SignNow is accessible on mobile devices, allowing you to manage and sign your ow estimated forms on-the-go. The mobile app offers full functionality, so you can easily create, send, and sign documents from anywhere and at any time, improving your workflow and productivity.

Get more for Ok 8 Es

Find out other Ok 8 Es

- How To Sign Massachusetts Codicil to Will

- How To Sign Arkansas Collateral Agreement

- Sign New York Codicil to Will Now

- Sign Oregon Codicil to Will Later

- How Do I Sign Oregon Bank Loan Proposal Template

- Help Me With Sign Oregon Bank Loan Proposal Template

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney

- Sign Michigan Mechanic's Lien Easy

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple