Form STS20002 a Oklahoma Sales Tax Return Cloudfront Net

Understanding the Oklahoma Sales Tax Return Form STS20002 A

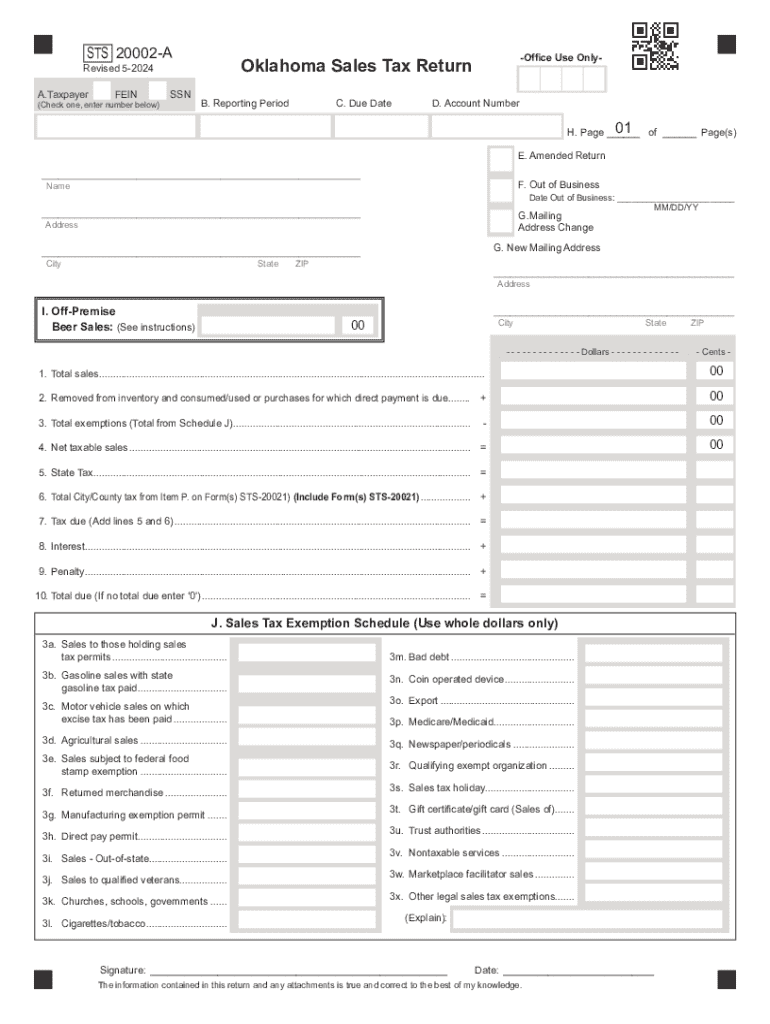

The Oklahoma Sales Tax Return Form STS20002 A is a crucial document for businesses operating within the state. This form is used to report sales tax collected from customers and remit it to the Oklahoma Tax Commission. It is essential for maintaining compliance with state tax regulations. The form captures various details, including total sales, taxable sales, and the amount of sales tax due.

Steps to Complete the Oklahoma Sales Tax Return Form STS20002 A

Completing the Oklahoma Sales Tax Return Form STS20002 A involves several key steps:

- Gather all sales records for the reporting period.

- Calculate the total sales and the amount of taxable sales.

- Determine the total sales tax collected based on the applicable rates.

- Fill out the form with the calculated figures, ensuring accuracy.

- Review the form for any errors before submission.

How to Obtain the Oklahoma Sales Tax Return Form STS20002 A

The Oklahoma Sales Tax Return Form STS20002 A can be obtained through the Oklahoma Tax Commission's official website. It is available for download in PDF format, which can be printed and filled out manually. Additionally, businesses may also request a physical copy through the mail by contacting the Oklahoma Tax Commission directly.

Filing Deadlines for the Oklahoma Sales Tax Return

Filing deadlines for the Oklahoma Sales Tax Return Form STS20002 A depend on the frequency of your sales tax reporting. Most businesses file monthly, with returns due on the 20th of the month following the reporting period. For businesses that file quarterly or annually, the deadlines differ accordingly. It is important to adhere to these deadlines to avoid penalties.

Penalties for Non-Compliance with Sales Tax Regulations

Failure to file the Oklahoma Sales Tax Return Form STS20002 A on time can result in significant penalties. Late filings may incur a percentage of the unpaid tax due, and continued non-compliance can lead to additional fines or legal action. Businesses should prioritize timely submissions to maintain good standing with the Oklahoma Tax Commission.

Legal Use of the Oklahoma Sales Tax Return Form STS20002 A

The Oklahoma Sales Tax Return Form STS20002 A serves as a legal document for reporting sales tax obligations. It provides a formal record of sales tax collected and remitted to the state. Accurate completion of this form is essential for legal compliance, and it may be subject to audit by the Oklahoma Tax Commission. Businesses should retain copies of submitted forms for their records.

Quick guide on how to complete form sts20002 a oklahoma sales tax return cloudfront net

Streamline Form STS20002 A Oklahoma Sales Tax Return Cloudfront net effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as a perfect environmentally-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without any hold-ups. Manage Form STS20002 A Oklahoma Sales Tax Return Cloudfront net on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and eSign Form STS20002 A Oklahoma Sales Tax Return Cloudfront net effortlessly

- Obtain Form STS20002 A Oklahoma Sales Tax Return Cloudfront net and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize signNow sections of the documents or black out sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow simplifies your document management needs in just a few clicks from any device you prefer. Modify and eSign Form STS20002 A Oklahoma Sales Tax Return Cloudfront net and ensure seamless communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form sts20002 a oklahoma sales tax return cloudfront net

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of Oklahoma sales tax for businesses using airSlate SignNow?

Oklahoma sales tax is crucial for businesses as it affects pricing and compliance. Using airSlate SignNow, businesses can streamline their document signing processes while ensuring they remain compliant with Oklahoma sales tax regulations. This helps avoid potential penalties and keeps operations running smoothly.

-

How can airSlate SignNow help with managing Oklahoma sales tax documentation?

airSlate SignNow provides an efficient way to manage all sales tax-related documents electronically. By using our eSignature solution, businesses can easily send, sign, and store documents related to Oklahoma sales tax, ensuring they are organized and accessible when needed. This reduces paperwork and enhances compliance.

-

What features does airSlate SignNow offer to assist with Oklahoma sales tax compliance?

airSlate SignNow offers features like customizable templates and automated workflows that can help businesses manage Oklahoma sales tax compliance effectively. These tools allow users to create and send tax-related documents quickly, ensuring that all necessary information is included and accurate. This minimizes errors and enhances efficiency.

-

Is airSlate SignNow cost-effective for small businesses dealing with Oklahoma sales tax?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses managing Oklahoma sales tax. Our pricing plans are flexible and affordable, allowing businesses to choose the option that best fits their needs. This ensures that even small enterprises can access essential tools for managing sales tax documentation.

-

Can airSlate SignNow integrate with accounting software for Oklahoma sales tax management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage Oklahoma sales tax. This integration allows businesses to synchronize their sales tax data and documentation, ensuring that all records are up-to-date and compliant with state regulations.

-

What are the benefits of using airSlate SignNow for Oklahoma sales tax-related documents?

Using airSlate SignNow for Oklahoma sales tax-related documents offers numerous benefits, including increased efficiency and reduced turnaround times. Our platform allows for quick document preparation and signing, which helps businesses stay on top of their sales tax obligations. Additionally, the secure storage of documents enhances compliance and peace of mind.

-

How does airSlate SignNow ensure the security of Oklahoma sales tax documents?

airSlate SignNow prioritizes the security of all documents, including those related to Oklahoma sales tax. We utilize advanced encryption and secure cloud storage to protect sensitive information. This ensures that your sales tax documents are safe from unauthorized access and comply with industry standards.

Get more for Form STS20002 A Oklahoma Sales Tax Return Cloudfront net

- Amendment to lease or rental agreement iowa form

- Warning notice due to complaint from neighbors iowa form

- Lease subordination agreement iowa form

- Apartment rules and regulations iowa form

- Agreed cancellation of lease iowa form

- Amendment of residential lease iowa form

- Agreement for payment of unpaid rent iowa form

- Commercial lease assignment from tenant to new tenant iowa form

Find out other Form STS20002 A Oklahoma Sales Tax Return Cloudfront net

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement