Employer's Guide to Unemployment Insurance Tax in OhioNolo 2019

Understanding the California Form 3840

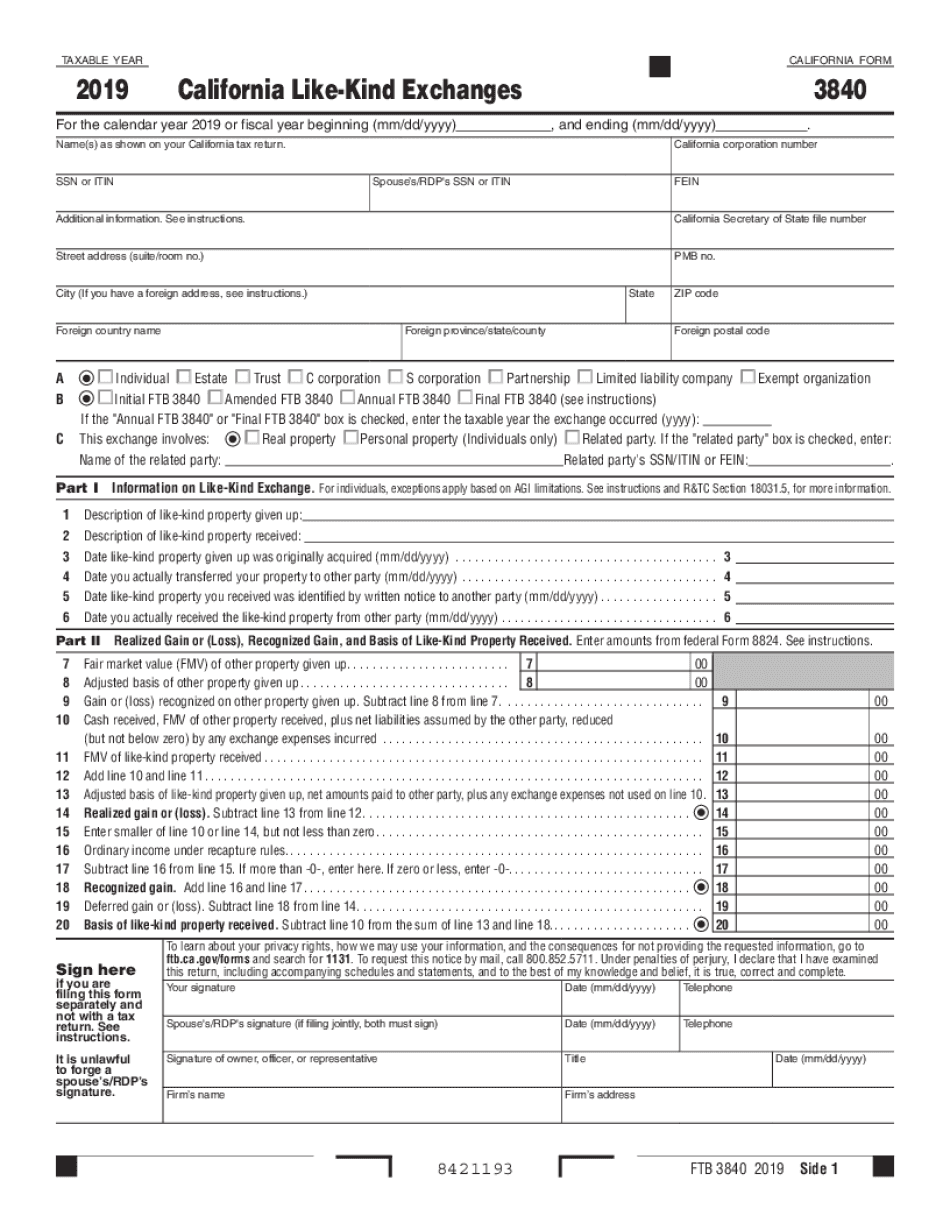

The California Form 3840, also known as the California Like-Kind Exchange, is a crucial document for taxpayers looking to defer capital gains taxes on the exchange of similar properties. This form is particularly relevant for real estate transactions and other asset exchanges that qualify under California tax law. By properly completing this form, taxpayers can ensure compliance with state regulations while maximizing their tax benefits.

Steps to Complete the California Form 3840

Completing the California Form 3840 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation related to the properties being exchanged. This includes purchase agreements, closing statements, and any prior tax filings relevant to the properties. Next, fill out the form with detailed information about both the relinquished and acquired properties, ensuring that all descriptions align with the requirements set forth by the California Franchise Tax Board. After completing the form, review it thoroughly for any errors before submission.

Filing Deadlines for Form 3840

It is important to be aware of the filing deadlines associated with the California Form 3840. Generally, the form must be submitted along with your California tax return for the year in which the exchange took place. For most taxpayers, this means filing by April fifteenth. However, if you are operating on a fiscal year, the deadline may differ. Ensure you check the specific dates applicable to your tax situation to avoid penalties.

Required Documents for Form Submission

When submitting the California Form 3840, certain documents are required to support your claim. These typically include:

- Purchase agreements for both the relinquished and acquired properties.

- Closing statements that detail the financial aspects of the transactions.

- Any prior tax returns that may be relevant to the properties involved.

- Documentation proving the like-kind nature of the exchanged properties.

Having these documents ready will facilitate a smoother filing process and help substantiate your claim if questioned by tax authorities.

Penalties for Non-Compliance with Form 3840

Failure to comply with the requirements of the California Form 3840 can result in significant penalties. These may include fines for late filing or incorrect information provided on the form. Additionally, if the form is not submitted properly, taxpayers may lose the opportunity to defer capital gains taxes, which can lead to a substantial financial burden. It is essential to ensure that all information is accurate and submitted on time to avoid these consequences.

Digital vs. Paper Version of Form 3840

Taxpayers have the option to complete the California Form 3840 either digitally or on paper. The digital version offers several advantages, including ease of use and the ability to quickly correct errors. Electronic submissions are typically processed faster, which can lead to quicker resolutions. However, some taxpayers may prefer the paper version for its tangible nature. Regardless of the method chosen, it is crucial to ensure that all information is accurately filled out to comply with state regulations.

Quick guide on how to complete employers guide to unemployment insurance tax in ohionolo

Prepare Employer's Guide To Unemployment Insurance Tax In OhioNolo effortlessly on any gadget

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Employer's Guide To Unemployment Insurance Tax In OhioNolo on any gadget with airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to modify and eSign Employer's Guide To Unemployment Insurance Tax In OhioNolo with ease

- Locate Employer's Guide To Unemployment Insurance Tax In OhioNolo and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign Employer's Guide To Unemployment Insurance Tax In OhioNolo and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct employers guide to unemployment insurance tax in ohionolo

Create this form in 5 minutes!

How to create an eSignature for the employers guide to unemployment insurance tax in ohionolo

How to make an electronic signature for your PDF document in the online mode

How to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to create an eSignature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

How to create an eSignature for a PDF file on Android devices

People also ask

-

What is the ca 3840 plan offered by airSlate SignNow?

The ca 3840 plan from airSlate SignNow provides businesses with robust eSigning capabilities. It is designed to streamline document management by enabling efficient signing processes while remaining cost-effective. This plan is ideal for organizations looking to enhance their workflow efficiency with an affordable solution.

-

How can the ca 3840 solution improve my business's productivity?

Implementing the ca 3840 solution allows businesses to reduce the time spent on document handling. With fast electronic signatures and automated workflows, you can enhance operational efficiency signNowly. This means less time on administrative tasks and more focus on core business activities.

-

What are the key features of the ca 3840 plan?

The ca 3840 plan includes features like customizable templates, secure document storage, and mobile access. Users can send documents for eSignature with just a few clicks, ensuring a seamless user experience. Additionally, it integrates with various applications to enhance functionality.

-

Is the ca 3840 plan suitable for small businesses?

Absolutely! The ca 3840 plan is tailored to meet the needs of small businesses by offering cost-effective solutions without compromising on features. It equips small organizations with the essential tools needed to manage their document signing processes efficiently.

-

What integrations are available with the ca 3840 plan?

The ca 3840 plan supports integration with multiple platforms, including Google Drive, Microsoft Office, and Salesforce. These integrations allow for seamless document management and enhance overall productivity. Users can easily connect their existing workflows to the airSlate SignNow platform.

-

How secure is the ca 3840 eSignature process?

Security is a top priority with the ca 3840 plan. AirSlate SignNow employs industry-standard encryption and compliance measures to protect your documents. This ensures that all sensitive information remains secure throughout the entire signing process.

-

Can I try the ca 3840 plan before committing?

Yes, airSlate SignNow offers a free trial for the ca 3840 plan, allowing you to explore its features and benefits without any commitment. This gives prospective users the opportunity to evaluate how it fits into their business needs. Experience the efficiency of eSigning firsthand with the trial.

Get more for Employer's Guide To Unemployment Insurance Tax In OhioNolo

- Self employed tour guide services contract 497337266 form

- Aluminum form

- Court employment form

- Service contract pest control form

- Self employed air conditioning services contract 497337270 form

- Self employed awning services contract form

- Self employed bathroom remodeling services contract form

- Self employed ceiling installation contract form

Find out other Employer's Guide To Unemployment Insurance Tax In OhioNolo

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe