Form 592 Resident and Nonresident Withholding Statement , Form 592, Resident and Nonresident Withholding Statement 2020

Understanding the Form 592 Resident and Nonresident Withholding Statement

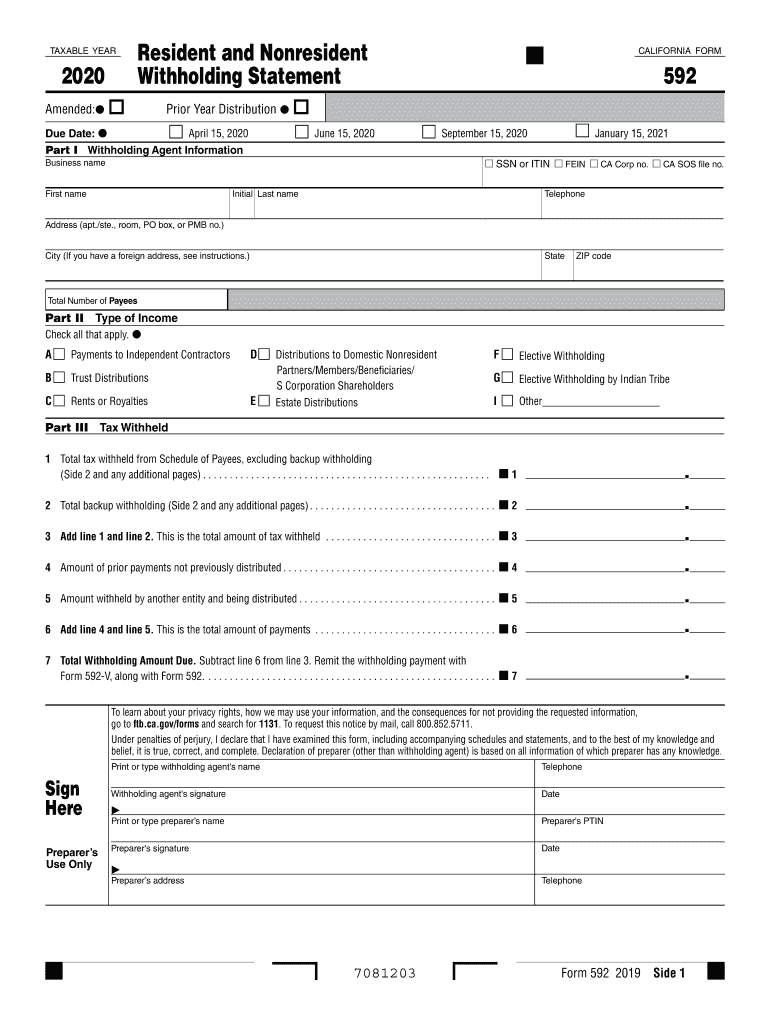

The Form 592 is essential for reporting withholding tax on payments made to nonresidents and residents in California. This form is used by entities that make payments subject to withholding, such as partnerships, LLCs, and corporations. It ensures that the appropriate amount of tax is withheld and reported to the California Franchise Tax Board (FTB). The form includes details about the payee, the amount paid, and the tax withheld, which helps maintain compliance with California tax laws.

Steps to Complete the Form 592

Completing the Form 592 involves several key steps to ensure accuracy and compliance:

- Gather Required Information: Collect details about the payee, including their name, address, and taxpayer identification number (TIN).

- Report Payment Amounts: Enter the total payments made to the payee during the tax year.

- Calculate Withholding Amount: Determine the amount of tax to withhold based on the applicable rates and the nature of the payments.

- Complete the Form: Fill out all sections of the form, ensuring that all entries are accurate and complete.

- Review and Sign: Double-check the form for errors and sign it to certify that the information provided is true and correct.

Legal Use of the Form 592

The Form 592 is legally binding and must be used in accordance with California tax regulations. It serves as a record of withholding tax obligations and must be submitted to the FTB when payments are made to nonresidents. Proper use of this form helps prevent penalties and ensures compliance with state tax laws. Additionally, it is crucial for entities to retain copies of the form for their records, as it may be required for future audits or inquiries.

Filing Deadlines and Important Dates

Timely filing of the Form 592 is critical to avoid penalties. The form must be submitted to the California Franchise Tax Board by the due date, which is typically the 15th day of the month following the end of the quarter in which the payments were made. For annual filers, the deadline aligns with the tax return due date. Keeping track of these deadlines is essential for maintaining compliance and avoiding unnecessary fees.

Obtaining the Form 592

The Form 592 can be easily obtained from the California Franchise Tax Board's official website. It is available in a downloadable format, allowing users to print and complete it manually. Additionally, many tax preparation software programs include the Form 592, making it convenient for users to fill it out digitally. Ensuring that you have the most current version of the form is important, as tax regulations may change from year to year.

Examples of Using the Form 592

The Form 592 is commonly used in various scenarios, including:

- Payments to Nonresident Contractors: Businesses making payments to nonresident contractors for services rendered in California must use this form to report and withhold the appropriate taxes.

- Distributions to Partners: Partnerships distributing income to nonresident partners must report these payments using the Form 592.

- Sales of California Real Estate: When nonresidents sell California real estate, the withholding tax must be reported on this form.

Quick guide on how to complete 2020 form 592 resident and nonresident withholding statement 2020 form 592 resident and nonresident withholding statement

Easily prepare Form 592 Resident And Nonresident Withholding Statement , Form 592, Resident And Nonresident Withholding Statement on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without any holdups. Handle Form 592 Resident And Nonresident Withholding Statement , Form 592, Resident And Nonresident Withholding Statement on any platform with the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

Effortlessly modify and eSign Form 592 Resident And Nonresident Withholding Statement , Form 592, Resident And Nonresident Withholding Statement

- Locate Form 592 Resident And Nonresident Withholding Statement , Form 592, Resident And Nonresident Withholding Statement and click on Get Form to begin.

- Utilize the tools we provide to submit your document.

- Emphasize relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign function, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and eSign Form 592 Resident And Nonresident Withholding Statement , Form 592, Resident And Nonresident Withholding Statement and ensure outstanding communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 592 resident and nonresident withholding statement 2020 form 592 resident and nonresident withholding statement

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 592 resident and nonresident withholding statement 2020 form 592 resident and nonresident withholding statement

How to make an eSignature for a PDF online

How to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

How to create an eSignature straight from your smartphone

The best way to make an eSignature for a PDF on iOS

How to create an eSignature for a PDF document on Android

People also ask

-

What are the 2019 form 592 instructions?

The 2019 form 592 instructions provide detailed guidance on how to complete and file the California Nonresident Composite Income Tax Return. Understanding these instructions is crucial for ensuring accurate tax reporting and compliance. Familiarizing yourself with the requirements outlined in the 2019 form 592 instructions will help you avoid potential penalties.

-

How can airSlate SignNow help with 2019 form 592 instructions?

airSlate SignNow allows you to easily send and eSign documents, including tax forms like the 2019 form 592 instructions. You can streamline your document management process by using our user-friendly platform to gather signatures and ensure all documents are completed accurately and promptly. This way, you can focus on your tax readiness without stress.

-

Are there any costs associated with using airSlate SignNow for 2019 form 592 instructions?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. We provide a cost-effective solution for managing document workflows, including the eSigning of documents such as the 2019 form 592 instructions. Check out our pricing page to find the plan that fits your budget.

-

What features does airSlate SignNow offer for handling tax forms like the 2019 form 592 instructions?

airSlate SignNow includes features like template creation, real-time tracking of document status, and secure eSigning capabilities. These tools make it easier to manage paperwork and ensure that your 2019 form 592 instructions are processed smoothly. Enhancing your workflow with these features can save time and improve efficiency.

-

Can I integrate airSlate SignNow with other systems for the 2019 form 592 instructions?

Absolutely! airSlate SignNow offers integrations with various popular applications, allowing you to streamline processes related to the 2019 form 592 instructions. Whether you need to connect with CRM systems or cloud storage services, our integrations enhance your workflow and improve data management.

-

How does eSigning improve the process of handling 2019 form 592 instructions?

eSigning through airSlate SignNow simplifies the process of handling the 2019 form 592 instructions by eliminating the need for printing, signing, and scanning paperwork. This not only accelerates document turnaround times but also reduces the risk of errors associated with manual processes. ESigning helps ensure a hassle-free experience.

-

What benefits can I expect from using airSlate SignNow for my 2019 form 592 instructions?

Using airSlate SignNow can yield several benefits, including increased efficiency, reduced turnaround times, and enhanced security for your sensitive documents like the 2019 form 592 instructions. Our platform is designed to optimize your document workflows and ensure that all necessary steps are completed accurately.

Get more for Form 592 Resident And Nonresident Withholding Statement , Form 592, Resident And Nonresident Withholding Statement

Find out other Form 592 Resident And Nonresident Withholding Statement , Form 592, Resident And Nonresident Withholding Statement

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now

- eSign Georgia Rental lease agreement template Simple

- Can I eSign Wyoming Rental lease agreement forms

- eSign New Hampshire Rental lease agreement template Online

- eSign Utah Rental lease contract Free

- eSign Tennessee Rental lease agreement template Online

- eSign Tennessee Rental lease agreement template Myself

- eSign West Virginia Rental lease agreement template Safe