* Religious or Charitable Institution 2020

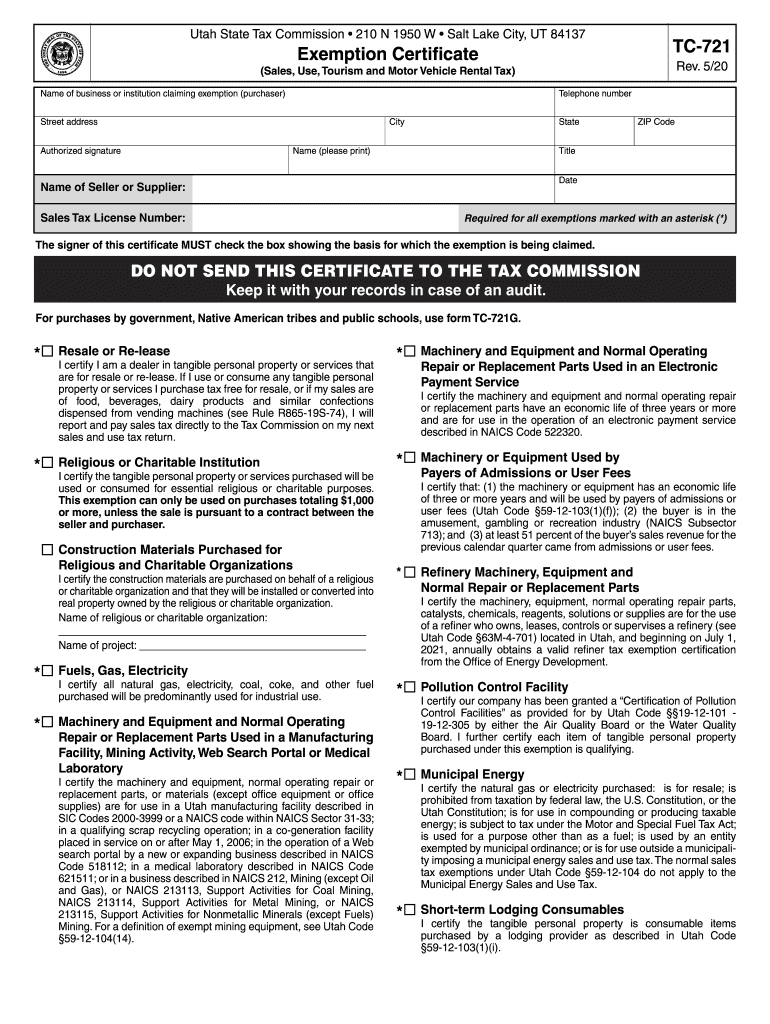

What is the Utah tax exempt form TC 721?

The Utah tax exempt form TC 721 is a document used by organizations to claim exemption from sales tax. This form is specifically designed for religious or charitable institutions that meet certain criteria established by the state of Utah. By submitting this form, eligible entities can purchase goods and services without incurring sales tax, thereby supporting their mission and activities.

Key elements of the Utah tax exempt form TC 721

The TC 721 includes several key elements that must be accurately completed for the form to be valid. These elements typically include:

- Organization Information: Name, address, and type of organization.

- Tax Identification Number: The organization's federal employer identification number (EIN).

- Signature: An authorized representative must sign the form to validate it.

- Purpose of Exemption: A clear statement of the reasons for seeking tax-exempt status.

Steps to complete the Utah tax exempt form TC 721

Completing the TC 721 form involves several important steps to ensure compliance and accuracy:

- Gather necessary documentation, including the organization’s EIN and proof of its charitable or religious status.

- Fill out the form with accurate information, ensuring all required fields are completed.

- Have the form signed by an authorized representative of the organization.

- Submit the completed form to the appropriate state agency, either online or via mail.

Legal use of the Utah tax exempt form TC 721

The legal use of the TC 721 form is governed by state regulations that outline the eligibility criteria for tax exemption. Organizations must comply with these regulations to maintain their exempt status. This includes ensuring that purchases made under the exemption are used solely for exempt purposes and not for personal use or resale.

Filing deadlines / Important dates for the Utah tax exempt form TC 721

While the TC 721 form does not have a specific filing deadline, it is important for organizations to submit the form before making tax-exempt purchases. Keeping track of any updates or changes in state regulations regarding tax exemption is also crucial for compliance.

Who issues the Utah tax exempt form TC 721?

The TC 721 form is issued by the Utah State Tax Commission. This agency is responsible for overseeing tax compliance and administering tax laws in the state. Organizations seeking tax-exempt status must submit their completed form to this agency for approval.

Quick guide on how to complete religious or charitable institution

Effortlessly Prepare * Religious Or Charitable Institution on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Handle * Religious Or Charitable Institution on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

Edit and eSign * Religious Or Charitable Institution with Ease

- Obtain * Religious Or Charitable Institution and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and possesses the same legal standing as a conventional ink signature.

- Review the information and click on the Done button to save your updates.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign * Religious Or Charitable Institution and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct religious or charitable institution

Create this form in 5 minutes!

How to create an eSignature for the religious or charitable institution

How to make an electronic signature for your PDF file online

How to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

How to create an eSignature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

How to create an eSignature for a PDF on Android devices

People also ask

-

What is tc 721 in the context of airSlate SignNow?

tc 721 refers to a specific compliance standard that airSlate SignNow adheres to, ensuring that our eSignature solutions meet regulatory requirements. By following the tc 721 guidelines, businesses can trust that their document signing processes are secure and legitimate.

-

How does airSlate SignNow support tc 721 compliance?

airSlate SignNow supports tc 721 compliance by implementing robust security measures and providing features like audit trails and authentication options. This ensures that all signatures are verifiable and that your documents maintain legal standing.

-

What are the pricing options for airSlate SignNow related to tc 721 features?

airSlate SignNow offers several pricing plans that include features geared towards tc 721 compliance. These plans ensure that businesses of all sizes can access necessary tools without overspending, while still receiving the security they need.

-

Can I integrate airSlate SignNow with my existing software for tc 721 compliance?

Yes, airSlate SignNow provides seamless integrations with various software solutions to help maintain tc 721 compliance. You can easily connect it with CRMs, document management systems, and other productivity tools to streamline your workflow.

-

What benefits does airSlate SignNow offer for businesses needing tc 721 compliance?

airSlate SignNow offers numerous benefits for businesses focusing on tc 721 compliance, including enhanced security, reduced paper usage, and faster turnaround times for document approvals. This empowers organizations to improve efficiency while ensuring legal adherence.

-

Is training available for using airSlate SignNow with tc 721 standards?

Absolutely! airSlate SignNow provides comprehensive training resources to help you and your team understand how to use the platform while maintaining tc 721 standards. These resources include tutorials, webinars, and customer support to address any questions.

-

What types of documents can be signed under tc 721 using airSlate SignNow?

Under tc 721, airSlate SignNow enables you to sign a variety of documents, including contracts, agreements, and forms. Each document signed through our platform adheres to the necessary compliance measures to ensure validity and security.

Get more for * Religious Or Charitable Institution

- Insurance agreement 497337104 form

- Medical transcriptionist agreement self employed independent contractor form

- Actor actress employment agreement self employed independent contractor form

- General home repair services contract long form self employed

- Outside contractor form

- Moving services contract self employed form

- Removal services contract form

- Water softening and purification services contract self employed form

Find out other * Religious Or Charitable Institution

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template