Form 355 ES Instructions for Corporation Estimated 2024-2026

Understanding Form 355 ES for Corporations

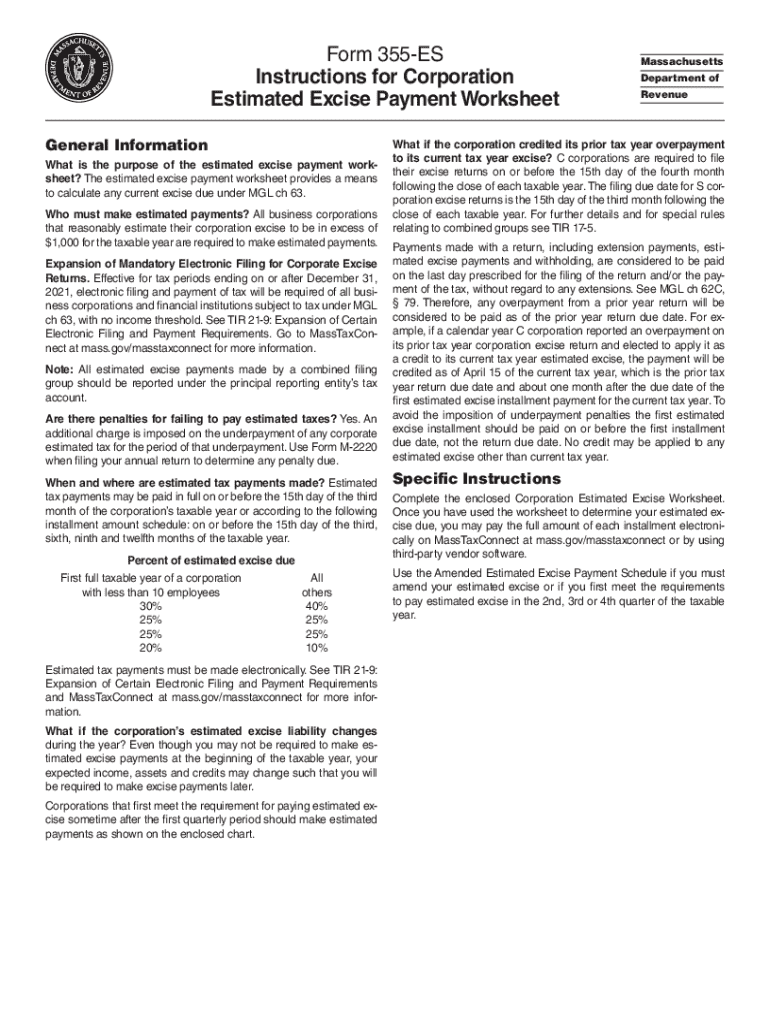

The Form 355 ES is an essential document for corporations in the United States that need to make estimated tax payments. This form is specifically designed for corporations to report and pay their estimated tax obligations to the state. It is crucial for maintaining compliance with state tax laws and avoiding penalties associated with underpayment. The form requires corporations to calculate their estimated tax based on expected income, deductions, and credits for the current tax year.

Steps to Complete Form 355 ES

Completing Form 355 ES involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records, including income statements and prior tax returns. Next, calculate your expected taxable income for the year. Use this figure to determine your estimated tax liability based on the applicable tax rates. Once you have calculated the amount due, fill out the form, ensuring all sections are completed accurately. Finally, submit the form and make your payment by the due date to avoid penalties.

Obtaining Form 355 ES

Corporations can obtain Form 355 ES through various channels. The form is available on the official state tax department website, where you can download it directly. Additionally, many tax preparation software programs include Form 355 ES as part of their offerings, making it easier to fill out and submit electronically. If you prefer a physical copy, you can request one by contacting your state tax office directly.

Legal Use of Form 355 ES

Form 355 ES is legally required for corporations that expect to owe a certain amount in state taxes. Filing this form ensures that corporations comply with state tax laws and fulfill their tax obligations on time. Failure to file or pay estimated taxes can result in penalties and interest charges. Therefore, understanding the legal implications of this form is vital for maintaining good standing with state tax authorities.

Filing Deadlines for Form 355 ES

Corporations must adhere to specific filing deadlines for Form 355 ES to avoid penalties. Typically, estimated tax payments are due on a quarterly basis, with deadlines falling on the 15th day of the fourth, sixth, ninth, and twelfth months of the tax year. It is important to check the specific deadlines for your state, as they may vary. Keeping track of these dates helps ensure timely submissions and compliance with tax regulations.

Key Elements of Form 355 ES

Form 355 ES includes several key elements that corporations must complete. These elements typically include the corporation's name, address, and federal employer identification number (EIN). Additionally, the form requires details about the estimated tax liability, including calculations based on projected income and applicable deductions. Accurate completion of these elements is crucial for processing the form correctly and avoiding issues with state tax authorities.

Quick guide on how to complete form 355 es instructions for corporation estimated

Execute Form 355 ES Instructions For Corporation Estimated effortlessly on any device

Online document management has become widely embraced by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely maintain it online. airSlate SignNow provides you with all the tools needed to create, amend, and electronically sign your documents rapidly without holdups. Manage Form 355 ES Instructions For Corporation Estimated on any platform with airSlate SignNow Android or iOS applications and streamline any document-focused process today.

How to amend and electronically sign Form 355 ES Instructions For Corporation Estimated with ease

- Locate Form 355 ES Instructions For Corporation Estimated and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or conceal confidential information with tools that airSlate SignNow specifically supplies for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies of documents. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 355 ES Instructions For Corporation Estimated and ensure exceptional communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 355 es instructions for corporation estimated

Create this form in 5 minutes!

How to create an eSignature for the form 355 es instructions for corporation estimated

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 355 es and how can airSlate SignNow help?

Form 355 es is a tax form used in certain jurisdictions for reporting income. airSlate SignNow simplifies the process of completing and submitting form 355 es by providing an intuitive platform for eSigning and document management, ensuring compliance and accuracy.

-

How much does airSlate SignNow cost for managing form 355 es?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Depending on your needs, you can choose a plan that allows you to efficiently manage form 355 es without breaking the bank, making it a cost-effective solution.

-

What features does airSlate SignNow offer for form 355 es?

airSlate SignNow provides a range of features for managing form 355 es, including customizable templates, secure eSigning, and real-time tracking. These features streamline the process, ensuring that your documents are completed accurately and efficiently.

-

Can I integrate airSlate SignNow with other software for form 355 es?

Yes, airSlate SignNow offers seamless integrations with various software applications, allowing you to enhance your workflow for form 355 es. This means you can connect with your existing tools to automate processes and improve efficiency.

-

Is airSlate SignNow secure for handling sensitive information on form 355 es?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that all data related to form 355 es is protected. With advanced encryption and secure storage, you can trust that your sensitive information is safe.

-

How does airSlate SignNow improve the efficiency of submitting form 355 es?

By using airSlate SignNow, you can signNowly reduce the time spent on submitting form 355 es. The platform allows for quick eSigning, document sharing, and automated reminders, which streamline the entire submission process.

-

What are the benefits of using airSlate SignNow for form 355 es?

The benefits of using airSlate SignNow for form 355 es include increased efficiency, reduced errors, and enhanced collaboration. With its user-friendly interface, you can easily manage your documents and ensure timely submissions.

Get more for Form 355 ES Instructions For Corporation Estimated

Find out other Form 355 ES Instructions For Corporation Estimated

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF