355 ES Instr with Coupon 2020

What is the 355 ES Instr With Coupon

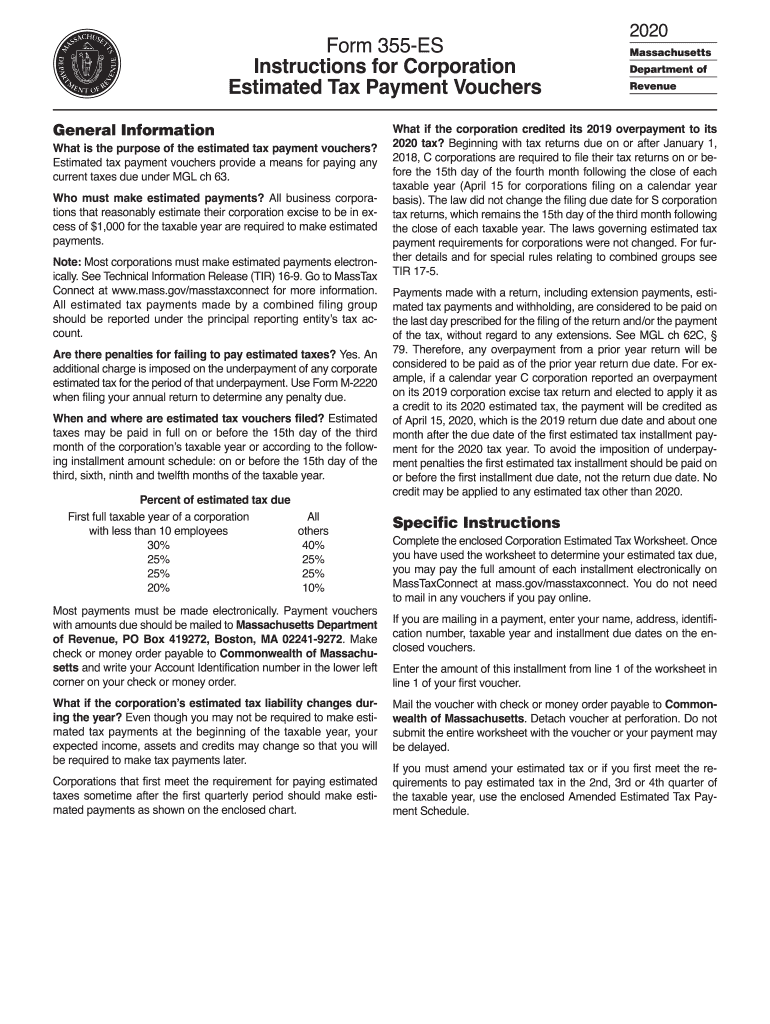

The 355 ES Instr With Coupon is a form used by corporations in Massachusetts to report estimated tax payments. This form is essential for businesses that expect to owe a certain amount of tax for the year. It allows them to make quarterly payments, ensuring they stay compliant with state tax laws. The form includes specific instructions and a coupon that must be submitted with each payment to ensure proper crediting to the taxpayer’s account.

Steps to complete the 355 ES Instr With Coupon

Completing the 355 ES Instr With Coupon involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Calculate the estimated tax liability for the current year based on expected income.

- Fill out the form accurately, ensuring all required fields are completed.

- Attach the payment coupon to the form, indicating the payment amount and due date.

- Submit the form and payment by the specified deadlines to avoid penalties.

Legal use of the 355 ES Instr With Coupon

To ensure the legal validity of the 355 ES Instr With Coupon, it must be completed and submitted according to Massachusetts tax regulations. The use of electronic signatures is permissible, provided that the signer complies with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). This ensures that the form is legally binding and recognized by the state.

Filing Deadlines / Important Dates

Timely filing of the 355 ES Instr With Coupon is crucial to avoid penalties. The estimated tax payments are typically due on the fifteenth day of the month following the end of each quarter. For example, payments for the first quarter are due by April 15, the second quarter by June 15, the third quarter by September 15, and the fourth quarter by January 15 of the following year. Keeping track of these deadlines helps ensure compliance with state tax obligations.

Required Documents

When completing the 355 ES Instr With Coupon, businesses should have the following documents ready:

- Previous year’s tax returns for reference.

- Financial statements that reflect expected income and expenses.

- Any relevant documentation that supports the estimated tax calculations.

Form Submission Methods (Online / Mail / In-Person)

The 355 ES Instr With Coupon can be submitted through various methods. Businesses may choose to file online via the Massachusetts Department of Revenue's website, which offers a streamlined process for electronic submissions. Alternatively, forms can be mailed to the appropriate address provided by the state or submitted in person at designated tax offices. Each method has its own processing times, so it is important to choose the one that best fits the business's needs.

Quick guide on how to complete 355 es instr with coupon

Complete 355 ES Instr With Coupon with ease on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and safely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle 355 ES Instr With Coupon on any platform with airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

The easiest way to modify and electronically sign 355 ES Instr With Coupon effortlessly

- Locate 355 ES Instr With Coupon and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of your documents or conceal sensitive details with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form—via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign 355 ES Instr With Coupon and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 355 es instr with coupon

Create this form in 5 minutes!

How to create an eSignature for the 355 es instr with coupon

The way to create an eSignature for a PDF document in the online mode

The way to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

How to make an electronic signature straight from your mobile device

The best way to generate an eSignature for a PDF document on iOS devices

How to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the 355es pricing model for airSlate SignNow?

The 355es pricing model offers flexible plans to suit businesses of all sizes. You can choose from monthly or annual subscriptions, allowing for cost-effective solutions based on your document signing needs. With transparent pricing, you can easily budget for your eSigning requirements without hidden fees.

-

What are the key features of the 355es solution?

The 355es solution includes essential features such as document templates, automated workflows, and advanced security settings. You can seamlessly send, track, and manage your documents, ensuring a smooth eSigning experience. These features are designed to enhance productivity and streamline your document handling processes.

-

How does the 355es solution benefit my business?

The 355es solution benefits your business by providing a quick and efficient way to manage documents electronically. By reducing the reliance on paper documents, you can save time and resources while improving collaboration among team members and clients. This efficient process ultimately leads to faster closing times and increased customer satisfaction.

-

Can I integrate the 355es solution with other software tools?

Yes, the 355es solution can be easily integrated with various software tools such as CRM systems, project management applications, and cloud storage services. These integrations facilitate a seamless workflow, allowing you to synchronize your data and improve overall efficiency. With the right integrations, you can enhance your document management processes.

-

Is there a mobile app for the 355es solution?

Yes, the 355es solution offers a mobile app that allows you to manage and sign documents on the go. This feature ensures that you can access important documents anytime, anywhere, enhancing flexibility for users. The mobile app is designed to be user-friendly and secure, making it easy to eSign documents from your smartphone or tablet.

-

What security measures are in place for the 355es solution?

The 355es solution prioritizes security with features like encryption, two-factor authentication, and audit trails for all document activities. These security measures ensure that your sensitive data remains protected throughout the eSigning process. You can have peace of mind knowing that your documents are safe and secure.

-

How does the 355es solution improve team collaboration?

The 355es solution improves team collaboration by allowing multiple users to access and work on documents simultaneously. With features such as commenting and version history, your team can easily communicate and stay updated on document changes. This collaborative environment fosters better decision-making and speeds up the signing process.

Get more for 355 ES Instr With Coupon

Find out other 355 ES Instr With Coupon

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template