Form 355ES Instructions for Corporation Estimated 2023

What is the Form 355ES Instructions for Corporation Estimated

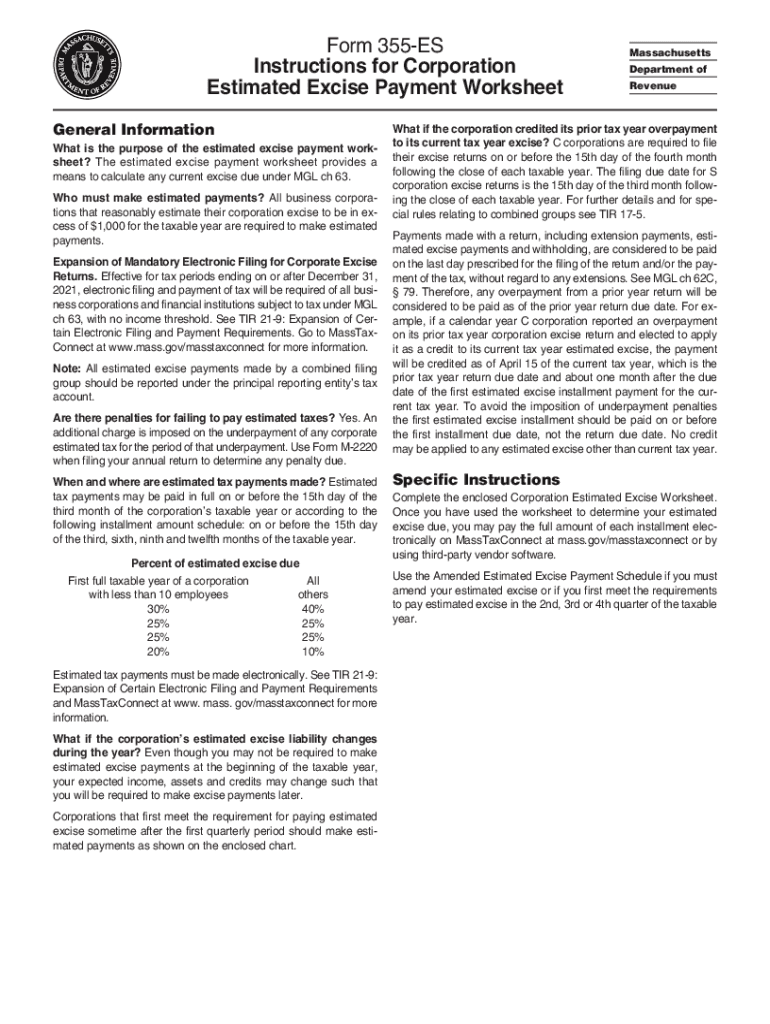

The Form 355ES is specifically designed for corporations in Massachusetts to report and pay estimated tax payments. This form is essential for businesses that expect to owe tax of five hundred dollars or more in the current tax year. The instructions for this form guide corporations through the process of calculating their estimated tax liability based on their anticipated income, deductions, and credits. Understanding these instructions is crucial for compliance with state tax obligations and to avoid penalties.

How to Use the Form 355ES Instructions for Corporation Estimated

Using the Form 355ES instructions involves several steps. First, corporations must determine their expected taxable income for the year. This includes all sources of income minus allowable deductions. Next, they should calculate their estimated tax liability using the current Massachusetts corporate tax rates. The instructions provide a detailed formula for this calculation. Once the estimated tax is determined, corporations can fill out the form, indicating the amount they plan to pay in installments throughout the year.

Steps to Complete the Form 355ES Instructions for Corporation Estimated

Completing the Form 355ES requires careful attention to detail. Start by gathering all relevant financial documents, including prior year tax returns and current income projections. Follow these steps:

- Calculate your estimated taxable income for the year.

- Determine your estimated tax liability using the Massachusetts corporate tax rate.

- Divide the total estimated tax by the number of required payments, typically four.

- Fill out the Form 355ES with the calculated amounts and any required identifying information.

- Submit the form along with your estimated tax payment by the due dates.

Filing Deadlines / Important Dates

Corporations must be aware of specific filing deadlines for the Form 355ES to ensure timely payments and avoid penalties. Generally, estimated tax payments are due on the fifteenth day of the fourth, sixth, ninth, and twelfth months of the tax year. For 2023, the deadlines are as follows:

- First payment: April 15, 2023

- Second payment: June 15, 2023

- Third payment: September 15, 2023

- Fourth payment: December 15, 2023

Key Elements of the Form 355ES Instructions for Corporation Estimated

The Form 355ES instructions include several key elements that are vital for accurate completion. These elements encompass:

- Eligibility criteria for filing the form.

- Detailed instructions on how to calculate estimated tax payments.

- Information on how to report changes in income or tax liability.

- Guidelines for submitting the form and payment methods.

Penalties for Non-Compliance

Failure to comply with the requirements of the Form 355ES can result in significant penalties. Corporations that do not make their estimated payments on time may face a penalty of one percent of the unpaid tax for each month or part of a month the tax remains unpaid. Additionally, underpayment of estimated taxes can incur interest charges, further increasing the total amount owed. It is essential for corporations to adhere to the guidelines provided in the instructions to avoid these financial repercussions.

Quick guide on how to complete form 355es instructions for corporation estimated

Effortlessly Prepare Form 355ES Instructions For Corporation Estimated on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without holdups. Manage Form 355ES Instructions For Corporation Estimated on any device through the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to Modify and eSign Form 355ES Instructions For Corporation Estimated with Ease

- Locate Form 355ES Instructions For Corporation Estimated and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select important sections of the documents or obscure sensitive information with the tools airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to finalize your updates.

- Choose your preferred method to send your form: via email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new copies of documents. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and eSign Form 355ES Instructions For Corporation Estimated and guarantee effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 355es instructions for corporation estimated

Create this form in 5 minutes!

How to create an eSignature for the form 355es instructions for corporation estimated

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow relevant to the 2023 Massachusetts estimated market?

In 2023, Massachusetts businesses can benefit from airSlate SignNow's comprehensive eSigning solutions, which offer features like document templates, real-time tracking, and collaboration tools. These features streamline the signing process, ensuring that all documents are completed efficiently and securely. Additionally, businesses can leverage custom workflows tailored to their specific needs for improved productivity.

-

How does airSlate SignNow help with compliance issues related to the 2023 Massachusetts estimated regulations?

airSlate SignNow ensures compliance with various regulatory standards including those relevant for the 2023 Massachusetts estimated environment. The platform provides secure document storage, audit trails, and compliant electronic signatures that meet legal requirements. This helps businesses stay compliant while managing their document signing processes smoothly.

-

What pricing plans does airSlate SignNow offer for businesses in Massachusetts in 2023?

For 2023, airSlate SignNow offers several competitive pricing plans tailored for Massachusetts businesses, ensuring flexibility and cost-effectiveness. Plans are designed to accommodate different business sizes and needs, ranging from basic to premium options. Users can choose monthly or annual subscriptions to optimize the costs as per their budget and usage requirements.

-

How does the integration of airSlate SignNow impact the workflow for 2023 Massachusetts estimated businesses?

By integrating airSlate SignNow into existing workflows, 2023 Massachusetts estimated businesses can automate repetitive tasks and improve efficiency signNowly. The platform offers seamless integrations with popular applications such as Google Workspace, Salesforce, and Microsoft 365. This connectivity enables businesses to manage documents effortlessly across all platforms, enhancing collaboration and productivity.

-

What are the benefits of using airSlate SignNow for document management in Massachusetts in 2023?

Using airSlate SignNow for document management in 2023 Massachusetts estimated businesses provides numerous benefits including enhanced security, reduced turnaround time, and improved customer experience. The platform safeguards sensitive information while allowing quick access for authorized users. As a result, businesses can create a smoother and more reliable document-signing process, ultimately saving time and resources.

-

How does airSlate SignNow support mobile document signing for businesses in 2023?

In 2023, airSlate SignNow offers robust mobile functionality that allows Massachusetts estimated businesses to send and sign documents from any device on the go. This mobile access ensures that documents can be completed anytime, anywhere, thus reducing delays and enhancing client satisfaction. The user-friendly mobile app ensures that all features are readily available at your fingertips.

-

Can airSlate SignNow help streamline contracts for businesses in the 2023 Massachusetts estimated market?

Absolutely! airSlate SignNow is designed to streamline contract management for businesses operating in the 2023 Massachusetts estimated market. Its electronic signature feature signNowly reduces the time required to finalize contracts, while templates and customization options enable faster drafting of standard agreements. This streamlining not only enhances efficiency but also allows businesses to focus on growth and development.

Get more for Form 355ES Instructions For Corporation Estimated

- Application for registration of rental housing city of detroit detroitmi form

- Ktc thompson form

- 504 teacher input form

- Public schools milwaukee services form

- Short term disability employee request teamsters145 form

- Dar form

- Grade progress report form

- Mary lou amp arthur f mahone fund ceo scholarship 2016 form

Find out other Form 355ES Instructions For Corporation Estimated

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself