Massachusetts Department of Revenue Form 355 Es 2018

What is the Massachusetts Department Of Revenue Form 355 Es

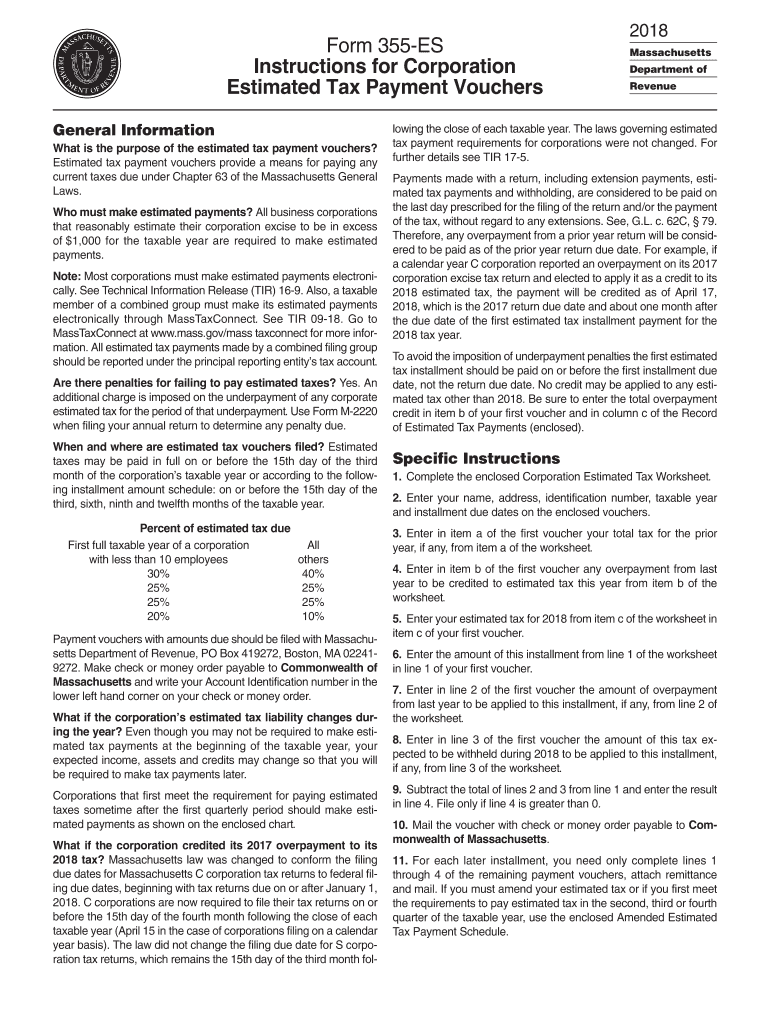

The Massachusetts Department of Revenue Form 355 Es is a tax form specifically designed for corporations operating within the state. This form is used to make estimated income tax payments for corporate excise taxes. It is essential for corporations to accurately report and pay their estimated taxes to avoid penalties and interest charges. The form must be filed by corporations that expect to owe more than a specified amount in taxes for the year. Understanding the purpose and requirements of Form 355 Es is crucial for compliance with Massachusetts tax laws.

Steps to complete the Massachusetts Department Of Revenue Form 355 Es

Completing the Massachusetts Department of Revenue Form 355 Es involves several key steps:

- Gather necessary information: Collect financial data, including previous tax returns and current income estimates.

- Calculate estimated tax liability: Use the appropriate tax rate to estimate the total tax owed for the year.

- Fill out the form: Enter the calculated amounts and any required information accurately on Form 355 Es.

- Review the form: Double-check all entries for accuracy to prevent errors that could lead to penalties.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person.

Legal use of the Massachusetts Department Of Revenue Form 355 Es

The legal use of the Massachusetts Department of Revenue Form 355 Es is governed by state tax laws. To ensure that the form is legally binding, it must be completed accurately and submitted by the specified deadlines. The form serves as a declaration of estimated tax payments and must be filed by corporations that meet the income thresholds set by the Massachusetts Department of Revenue. Compliance with the relevant tax regulations is essential to avoid any legal repercussions, including fines or audits.

Filing Deadlines / Important Dates

Corporations must be aware of the filing deadlines associated with the Massachusetts Department of Revenue Form 355 Es. Typically, estimated payments are due quarterly, with specific dates set by the state. These deadlines are crucial for maintaining compliance and avoiding penalties. It is advisable for corporations to mark these dates on their calendars and prepare their financial estimates in advance to ensure timely submission.

Form Submission Methods (Online / Mail / In-Person)

Corporations have several options for submitting the Massachusetts Department of Revenue Form 355 Es. The form can be submitted online through the Massachusetts Department of Revenue’s website, which offers a convenient and efficient method for filing. Alternatively, corporations may choose to mail the completed form to the appropriate address or deliver it in person at designated tax offices. Each submission method has its own advantages, and corporations should select the one that best fits their needs.

Required Documents

To complete the Massachusetts Department of Revenue Form 355 Es, corporations must gather various required documents. These may include:

- Prior year tax returns to establish a baseline for estimated payments.

- Financial statements that reflect current income and expenses.

- Any supporting documentation that may be necessary for specific deductions or credits.

Having these documents readily available will facilitate the accurate completion of the form and ensure compliance with tax obligations.

Quick guide on how to complete massachusetts department of revenue form 355 es 2018 2019

Easily Manage Massachusetts Department Of Revenue Form 355 Es on Any Device

Online document management has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, edit, and eSign your documents swiftly and without delays. Handle Massachusetts Department Of Revenue Form 355 Es on any platform with the airSlate SignNow apps available on Android or iOS and simplify any document-based tasks today.

How to Edit and eSign Massachusetts Department Of Revenue Form 355 Es Effortlessly

- Find Massachusetts Department Of Revenue Form 355 Es and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require reprinting new copies of documents. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Massachusetts Department Of Revenue Form 355 Es and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct massachusetts department of revenue form 355 es 2018 2019

Create this form in 5 minutes!

How to create an eSignature for the massachusetts department of revenue form 355 es 2018 2019

How to make an electronic signature for the Massachusetts Department Of Revenue Form 355 Es 2018 2019 in the online mode

How to create an eSignature for the Massachusetts Department Of Revenue Form 355 Es 2018 2019 in Chrome

How to create an electronic signature for signing the Massachusetts Department Of Revenue Form 355 Es 2018 2019 in Gmail

How to make an eSignature for the Massachusetts Department Of Revenue Form 355 Es 2018 2019 straight from your mobile device

How to make an electronic signature for the Massachusetts Department Of Revenue Form 355 Es 2018 2019 on iOS devices

How to create an eSignature for the Massachusetts Department Of Revenue Form 355 Es 2018 2019 on Android OS

People also ask

-

What is the Massachusetts Department Of Revenue Form 355 Es?

The Massachusetts Department Of Revenue Form 355 Es is a tax form used by businesses in Massachusetts to estimate their income tax liability. This form allows companies to submit estimated tax payments throughout the year, ensuring compliance with state tax regulations. Proper handling of this form can help avoid penalties and interest charges.

-

How can airSlate SignNow assist with the Massachusetts Department Of Revenue Form 355 Es?

airSlate SignNow simplifies the process of completing and submitting the Massachusetts Department Of Revenue Form 355 Es by allowing users to fill out the form electronically. With features like eSigning and document tracking, businesses can ensure their forms are submitted accurately and on time. This reduces the hassle of dealing with paperwork and enhances compliance.

-

What are the costs associated with using airSlate SignNow for the Massachusetts Department Of Revenue Form 355 Es?

airSlate SignNow offers a variety of pricing plans to accommodate different business needs, including options for single users and larger teams. The pricing is transparent, and there are no hidden fees involved when dealing with the Massachusetts Department Of Revenue Form 355 Es. This ensures that businesses can budget effectively while utilizing our document management solutions.

-

Are there any integrations available for managing the Massachusetts Department Of Revenue Form 355 Es?

Yes, airSlate SignNow integrates seamlessly with various applications to facilitate the management of the Massachusetts Department Of Revenue Form 355 Es. Whether you use accounting software or CRM tools, our platform can connect with your favorite apps, streamlining workflows and enhancing productivity. This means businesses can manage their tax forms alongside their other operations effortlessly.

-

What benefits does airSlate SignNow offer for businesses filing the Massachusetts Department Of Revenue Form 355 Es?

Using airSlate SignNow for the Massachusetts Department Of Revenue Form 355 Es offers numerous benefits, including time savings and increased accuracy. Our platform reduces the chances of errors that can occur with manual entry, helping ensure correct submissions. Additionally, the ability to track documents and receive reminders enhances accountability for tax compliance.

-

How does eSigning work for the Massachusetts Department Of Revenue Form 355 Es?

eSigning with airSlate SignNow for the Massachusetts Department Of Revenue Form 355 Es is a straightforward process. Users can sign the form electronically, which is legally recognized and compliant with state regulations. This method saves time and eliminates the need for printing and scanning, making the filing process much more efficient.

-

Can I access my previously submitted Massachusetts Department Of Revenue Form 355 Es using airSlate SignNow?

Absolutely! airSlate SignNow allows users to access their previously submitted Massachusetts Department Of Revenue Form 355 Es at any time. You can easily retrieve and download past submissions, enabling you to keep a comprehensive record of your tax documents. This feature is essential for maintaining organized financial records.

Get more for Massachusetts Department Of Revenue Form 355 Es

- Community services contract application form 3681 dads state tx

- Dads or hhsc form the texas department of aging and dads state tx

- Form h1830 r pdf

- Form h1200 ez

- Texas department of aging and disability services form 2382 august 2012 assisted living facilities checklist facility name

- Texas form 1028

- Cna registry form 5507

- Assisted living disclosure statement form 3647 dads state tx

Find out other Massachusetts Department Of Revenue Form 355 Es

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT