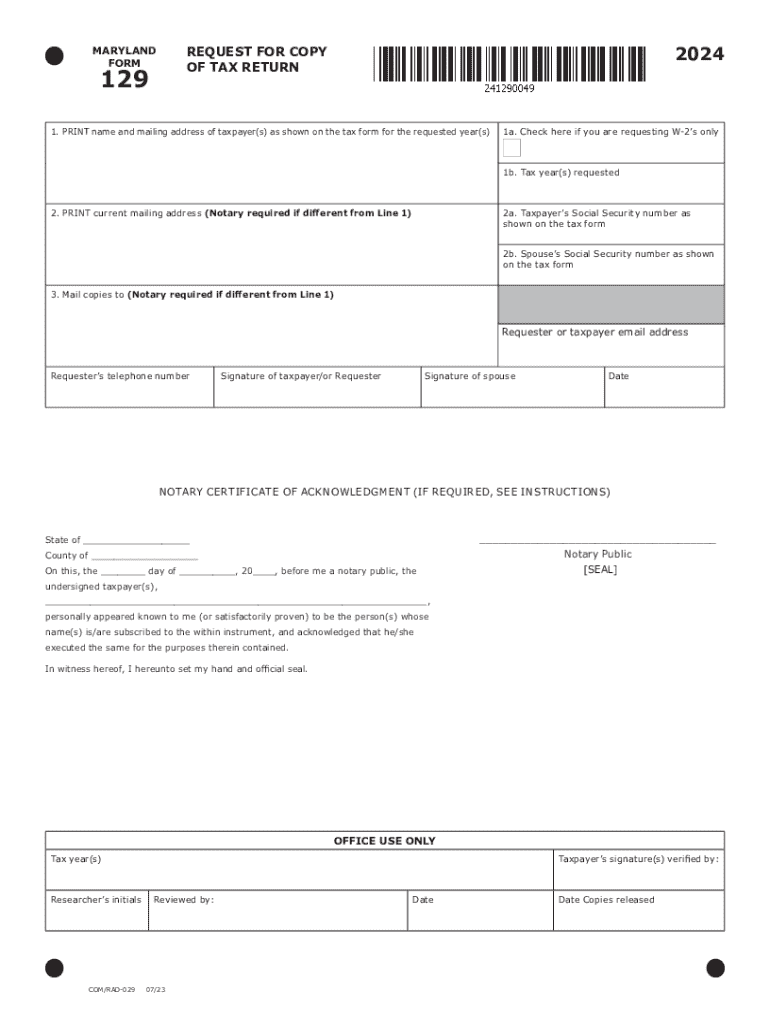

Form 129 Request for Copy of Tax Return

What is the Maryland 129 Form?

The Maryland 129 form, officially known as the Request for Copy of Tax Return, is a document used by individuals or businesses to request copies of their previously filed Maryland tax returns. This form is essential for those who may need to provide proof of income, verify past tax filings, or address discrepancies with the Maryland Comptroller's office. It allows taxpayers to obtain copies of their tax documents for various purposes, including loan applications, audits, or personal record-keeping.

How to Use the Maryland 129 Form

To utilize the Maryland 129 form effectively, taxpayers must complete it with accurate information. This includes providing personal details such as name, address, and Social Security number, as well as specifying the tax year for which copies are requested. Once completed, the form should be submitted to the Maryland Comptroller's office, either online, by mail, or in person, depending on the preferred submission method. Understanding the specific requirements and submission options is crucial for a smooth process.

Steps to Complete the Maryland 129 Form

Completing the Maryland 129 form involves several straightforward steps:

- Download the form from the Maryland Comptroller's website or obtain a physical copy.

- Fill in your personal information, including your full name, address, and Social Security number.

- Indicate the specific tax year(s) for which you are requesting copies.

- Sign and date the form to certify its accuracy.

- Submit the form via your chosen method: online, by mail to the designated address, or in person at a local office.

Legal Use of the Maryland 129 Form

The Maryland 129 form serves a legal purpose by allowing taxpayers to formally request copies of their tax returns. This is particularly important for legal matters such as audits or disputes with the tax authority. The form ensures that taxpayers have access to their historical tax information, which can be critical for compliance and verification processes. Proper use of this form helps maintain transparency and accuracy in tax reporting.

Required Documents for the Maryland 129 Form

When submitting the Maryland 129 form, taxpayers may need to provide certain documents to verify their identity and support their request. Commonly required documents include:

- A valid government-issued identification, such as a driver's license or passport.

- Proof of address, which can be a utility bill or bank statement.

- Any additional documentation that may support the request, depending on the specific circumstances.

Form Submission Methods

The Maryland 129 form can be submitted through various methods, ensuring convenience for taxpayers. The available submission options include:

- Online: If the Maryland Comptroller offers an online submission portal, this is often the quickest method.

- By Mail: Taxpayers can print the completed form and send it to the appropriate address specified by the Comptroller's office.

- In-Person: Individuals may also choose to deliver the form directly to a local Comptroller's office for immediate processing.

Quick guide on how to complete form 129 request for copy of tax return

Complete Form 129 Request For Copy Of Tax Return effortlessly on any device

Managing documents online has gained immense popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to obtain the right format and securely archive it online. airSlate SignNow equips you with all the necessary tools to design, alter, and eSign your documents promptly without hindrances. Handle Form 129 Request For Copy Of Tax Return on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to modify and eSign Form 129 Request For Copy Of Tax Return with ease

- Obtain Form 129 Request For Copy Of Tax Return and select Get Form to begin.

- Utilize the tools we offer to finish your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using specific tools provided by airSlate SignNow for this purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and press the Done button to save your changes.

- Select your preferred method of delivering your form, whether through email, SMS, an invitation link, or by downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Form 129 Request For Copy Of Tax Return to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 129 request for copy of tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maryland 129 form?

The Maryland 129 form is a document used for various tax-related purposes in the state of Maryland. It is essential for businesses and individuals to understand its requirements to ensure compliance with state regulations. Using airSlate SignNow, you can easily eSign and send the Maryland 129 form securely.

-

How can airSlate SignNow help with the Maryland 129 form?

airSlate SignNow provides a user-friendly platform to create, send, and eSign the Maryland 129 form efficiently. With its intuitive interface, you can streamline the signing process, reducing the time it takes to complete and submit the form. This ensures that you meet deadlines without hassle.

-

Is there a cost associated with using airSlate SignNow for the Maryland 129 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans provide access to features that simplify the process of managing the Maryland 129 form and other documents. You can choose a plan that fits your budget while benefiting from our comprehensive eSigning solutions.

-

What features does airSlate SignNow offer for the Maryland 129 form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for the Maryland 129 form. These tools enhance your workflow, making it easier to manage and complete your forms efficiently. Additionally, you can collaborate with team members in real-time.

-

Can I integrate airSlate SignNow with other applications for the Maryland 129 form?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to connect your workflow seamlessly. Whether you use CRM systems, cloud storage, or other document management tools, you can easily incorporate the Maryland 129 form into your existing processes.

-

What are the benefits of using airSlate SignNow for the Maryland 129 form?

Using airSlate SignNow for the Maryland 129 form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform ensures that your documents are signed and stored securely, minimizing the risk of errors. This allows you to focus on your core business activities.

-

How secure is the airSlate SignNow platform for handling the Maryland 129 form?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your documents, including the Maryland 129 form. Our platform is designed to safeguard sensitive information, ensuring that your data remains confidential and secure throughout the signing process.

Get more for Form 129 Request For Copy Of Tax Return

- Application for sublease tennessee form

- Inventory and condition of leased premises for pre lease and post lease tennessee form

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out tennessee form

- Property manager agreement tennessee form

- Agreement for delayed or partial rent payments tennessee form

- Tenants maintenance repair request form tennessee

- Guaranty attachment to lease for guarantor or cosigner tennessee form

- Amendment to lease or rental agreement tennessee form

Find out other Form 129 Request For Copy Of Tax Return

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT