Form ARTS PB 2024-2026

What is the Form ARTS PB

The Form ARTS PB is a specific document utilized for reporting and compliance purposes within the United States. It is often required for various regulatory and legal processes, ensuring that businesses and individuals adhere to state and federal guidelines. This form plays a crucial role in maintaining transparency and accountability in transactions and operations.

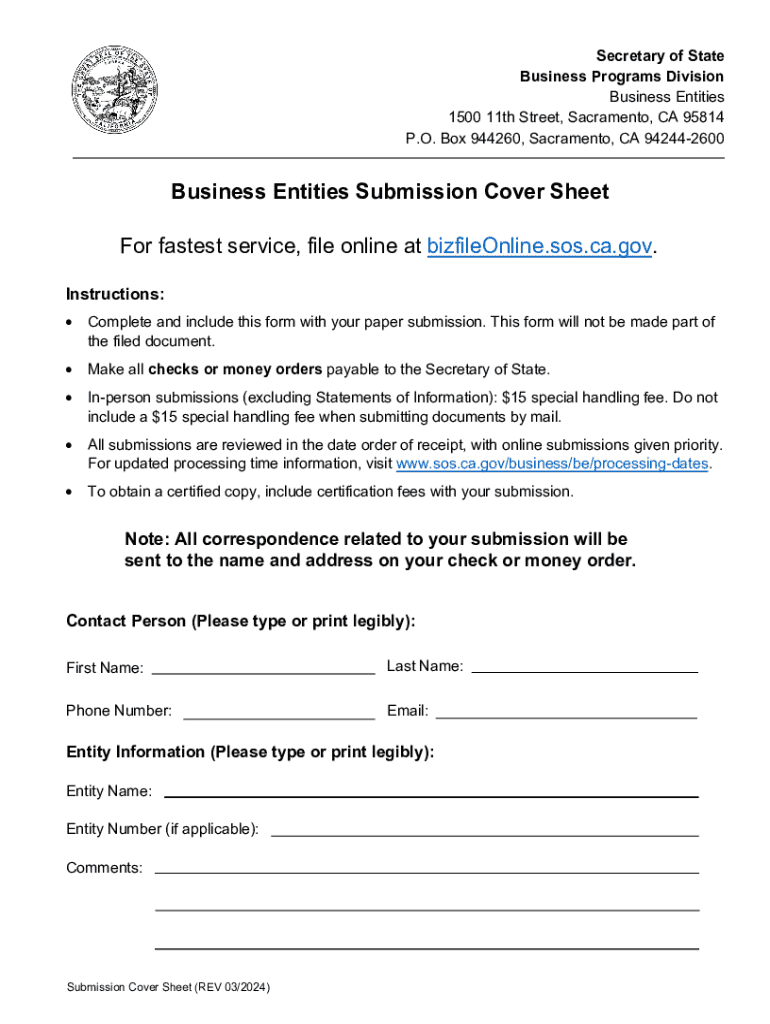

How to use the Form ARTS PB

Using the Form ARTS PB involves several steps to ensure accurate completion and submission. First, gather all necessary information and documentation required for the form. Next, fill out the form carefully, ensuring that all fields are completed accurately. Once the form is filled out, review it for any errors or omissions before submitting it according to the specified guidelines.

Steps to complete the Form ARTS PB

Completing the Form ARTS PB requires careful attention to detail. Start by reading the instructions provided with the form. Follow these steps:

- Gather required documents, such as identification and financial records.

- Fill in your personal or business information as requested.

- Provide any additional information relevant to the form’s purpose.

- Review the completed form for accuracy.

- Submit the form through the designated method, whether online, by mail, or in person.

Legal use of the Form ARTS PB

The Form ARTS PB has specific legal implications and must be used in accordance with applicable laws and regulations. Failure to properly complete and submit this form can result in penalties or legal issues. It is important to understand the legal context in which the form is used, including any state-specific requirements that may apply.

Required Documents

When completing the Form ARTS PB, certain documents may be required to support the information provided. Commonly required documents include:

- Identification documents, such as a driver's license or passport.

- Financial statements or tax returns.

- Business registration documents if applicable.

- Any other relevant records that substantiate the claims made on the form.

Form Submission Methods

The Form ARTS PB can be submitted through various methods, depending on the specific requirements set forth by the issuing authority. Common submission methods include:

- Online submission through a designated portal.

- Mailing the completed form to the appropriate office.

- In-person submission at designated locations.

Eligibility Criteria

Eligibility to use the Form ARTS PB may vary based on the specific purpose of the form. Generally, individuals or businesses must meet certain criteria, such as:

- Being a resident or registered entity within the state.

- Meeting any financial or operational thresholds set by regulatory bodies.

- Providing accurate and truthful information as required by law.

Quick guide on how to complete form arts pb

Effortlessly Prepare Form ARTS PB on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without any delays. Manage Form ARTS PB on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Edit and eSign Form ARTS PB with Ease

- Locate Form ARTS PB and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of your documents or obscure sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced files, the hassle of searching for forms, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Form ARTS PB and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form arts pb

Create this form in 5 minutes!

How to create an eSignature for the form arts pb

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form ARTS PB and how does it work?

Form ARTS PB is a digital document solution that allows users to create, send, and eSign forms efficiently. With airSlate SignNow, businesses can streamline their document workflows, ensuring that Form ARTS PB is completed quickly and securely. This tool is designed to enhance productivity and reduce the time spent on paperwork.

-

What are the key features of Form ARTS PB?

Form ARTS PB offers a variety of features including customizable templates, real-time tracking, and secure eSignature capabilities. Users can easily integrate Form ARTS PB into their existing workflows, making it a versatile tool for document management. Additionally, it supports multiple file formats, ensuring compatibility with various business needs.

-

How much does it cost to use Form ARTS PB?

The pricing for Form ARTS PB is competitive and designed to fit the budgets of businesses of all sizes. airSlate SignNow offers flexible subscription plans that cater to different needs, ensuring that you only pay for what you use. For detailed pricing information, it's best to visit the airSlate SignNow website or contact their sales team.

-

What are the benefits of using Form ARTS PB for my business?

Using Form ARTS PB can signNowly enhance your business's efficiency by reducing the time spent on manual document handling. It allows for faster turnaround times on contracts and agreements, improving overall productivity. Additionally, the secure eSigning feature ensures that your documents are legally binding and protected.

-

Can Form ARTS PB integrate with other software?

Yes, Form ARTS PB seamlessly integrates with various software applications, including CRM systems, cloud storage services, and productivity tools. This integration capability allows businesses to incorporate Form ARTS PB into their existing workflows without disruption. By connecting with other tools, you can enhance your document management processes.

-

Is Form ARTS PB secure for sensitive documents?

Absolutely, Form ARTS PB prioritizes security and compliance, ensuring that all documents are protected with advanced encryption methods. airSlate SignNow adheres to industry standards for data protection, making it a reliable choice for handling sensitive information. You can trust that your documents are safe when using Form ARTS PB.

-

How can I get started with Form ARTS PB?

Getting started with Form ARTS PB is simple. You can sign up for a free trial on the airSlate SignNow website, allowing you to explore its features without any commitment. Once registered, you can begin creating and sending documents using Form ARTS PB right away.

Get more for Form ARTS PB

- Revocation of living trust south dakota form

- Letter to lienholder to notify of trust south dakota form

- South dakota timber sale contract south dakota form

- South dakota forest products timber sale contract south dakota form

- South dakota easement form

- Assumption agreement of mortgage and release of original mortgagors south dakota form

- Small estate heirship affidavit for estates under 50000 south dakota form

- South dakota eviction form

Find out other Form ARTS PB

- Sign Oregon Banking Limited Power Of Attorney Easy

- Sign South Dakota Banking Limited Power Of Attorney Mobile

- How Do I Sign Texas Banking Memorandum Of Understanding

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now