Arts Pb 501 C 3 2013

What is the Arts Pb 501 C 3

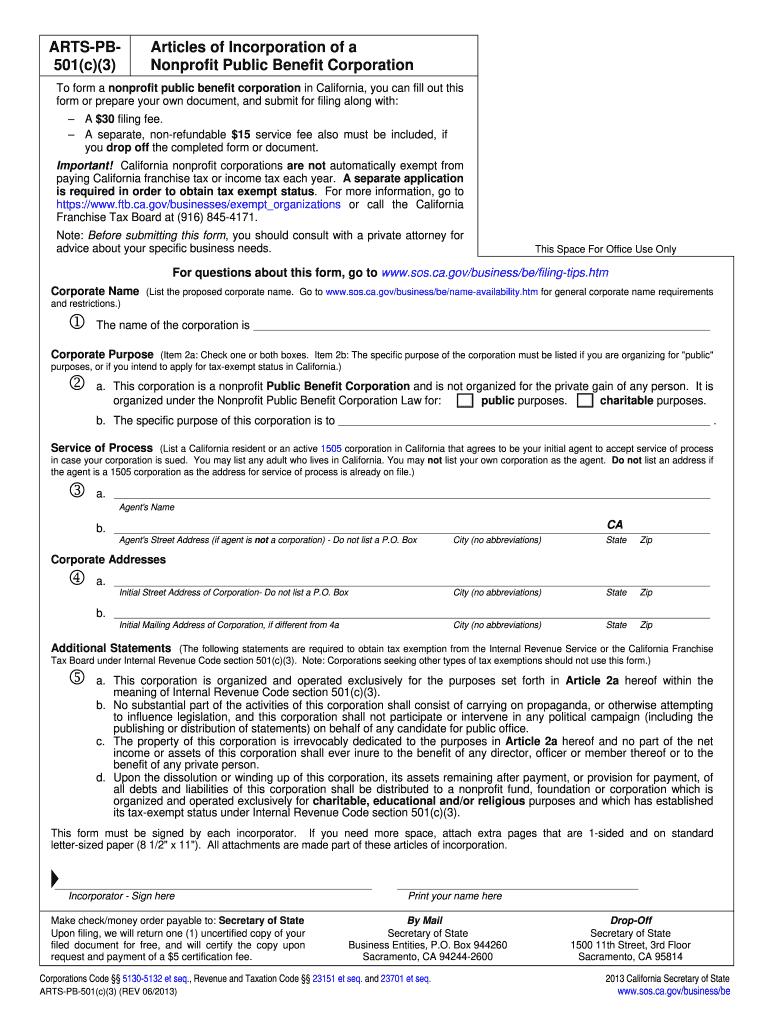

The Arts Pb 501 C 3 form is a crucial document for organizations seeking tax-exempt status under the Internal Revenue Code in the United States. This form is specifically designed for nonprofit entities that operate for charitable, educational, or artistic purposes. By filing the Arts Pb 501 C 3, organizations can gain significant tax benefits, including exemption from federal income tax and eligibility to receive tax-deductible contributions from donors. Understanding the purpose and implications of this form is essential for any nonprofit aiming to operate within the legal framework set by the IRS.

How to obtain the Arts Pb 501 C 3

To obtain the Arts Pb 501 C 3 form, organizations must first ensure they meet the eligibility criteria set by the IRS. This involves confirming that the organization operates exclusively for exempt purposes, such as charitable, educational, or artistic endeavors. Once eligibility is established, the form can be downloaded from the IRS website or obtained through the office of the Secretary of State in California. It is important to gather all necessary documentation, including articles of incorporation and bylaws, before beginning the application process to ensure a smooth submission.

Steps to complete the Arts Pb 501 C 3

Completing the Arts Pb 501 C 3 form involves several key steps:

- Gather required documentation, including your organization’s mission statement, articles of incorporation, and financial statements.

- Fill out the form accurately, providing detailed information about your organization’s structure, activities, and finances.

- Review the completed form for accuracy and completeness to avoid delays in processing.

- Submit the form to the IRS along with any required fees and supporting documents.

Following these steps carefully can help ensure that the application is processed efficiently.

Legal use of the Arts Pb 501 C 3

The legal use of the Arts Pb 501 C 3 form is governed by the Internal Revenue Code, which outlines the requirements for maintaining tax-exempt status. Organizations must operate in compliance with applicable laws and regulations, ensuring that their activities align with the exempt purposes stated in the application. Additionally, maintaining proper records and adhering to disclosure requirements is essential for compliance. Failure to do so may result in penalties or revocation of tax-exempt status.

Eligibility Criteria

To qualify for the Arts Pb 501 C 3 designation, organizations must meet specific eligibility criteria set forth by the IRS. These criteria include:

- Operating exclusively for charitable, educational, or artistic purposes.

- Ensuring that no part of the organization’s net earnings benefits any private individual or shareholder.

- Meeting the public support test, which requires a certain percentage of funding to come from the general public or government sources.

Understanding these criteria is vital for organizations seeking to establish themselves as tax-exempt entities.

IRS Guidelines

The IRS provides comprehensive guidelines for completing and submitting the Arts Pb 501 C 3 form. These guidelines outline the necessary documentation, filing procedures, and compliance requirements that organizations must adhere to. It is important for applicants to familiarize themselves with these guidelines to ensure that their application is complete and meets all legal standards. Additionally, organizations should stay updated on any changes to IRS regulations that may affect their tax-exempt status.

Quick guide on how to complete arts pb 501 c 3

Prepare Arts Pb 501 C 3 effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It presents an excellent eco-friendly substitute to traditional printed and signed documents, as you can locate the appropriate form and securely save it online. airSlate SignNow provides you with all the resources you require to create, modify, and eSign your documents quickly without delays. Manage Arts Pb 501 C 3 on any platform with airSlate SignNow Android or iOS applications and simplify any document-based process today.

How to alter and eSign Arts Pb 501 C 3 effortlessly

- Find Arts Pb 501 C 3 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your preference. Modify and eSign Arts Pb 501 C 3 and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct arts pb 501 c 3

Create this form in 5 minutes!

How to create an eSignature for the arts pb 501 c 3

How to create an electronic signature for your PDF document in the online mode

How to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature right from your mobile device

How to create an electronic signature for a PDF document on iOS devices

The way to create an electronic signature for a PDF on Android devices

People also ask

-

What is the 'form arts pb 501 c' and how can it be used with airSlate SignNow?

The 'form arts pb 501 c' is a specific document that can be utilized by nonprofit organizations to apply for 501(c)(3) tax-exempt status. With airSlate SignNow, you can easily prepare, send, and eSign the 'form arts pb 501 c' digitally, streamlining your application process and saving time.

-

How does airSlate SignNow handle pricing for using 'form arts pb 501 c' documents?

airSlate SignNow offers flexible pricing plans that allow organizations to use forms like the 'form arts pb 501 c' at an affordable cost. You can choose a monthly or annual plan based on your organization’s needs, ensuring you have access to the features required to manage and eSign your important documents.

-

What features does airSlate SignNow provide for managing 'form arts pb 501 c'?

airSlate SignNow includes a variety of features for managing the 'form arts pb 501 c', including customizable templates, automated workflows, and secure storage. These features not only simplify the preparation of the form but also enhance the legality of your eSignatures, ensuring compliance with regulations.

-

How can 'form arts pb 501 c' help my nonprofit organization?

The 'form arts pb 501 c' is crucial for establishing tax-exempt status for nonprofit organizations. By leveraging airSlate SignNow, you can efficiently complete and submit your form, enabling your organization to benefit from tax exemptions and enhance funding opportunities for your operations.

-

Are there any integrations available for 'form arts pb 501 c' with airSlate SignNow?

Yes, airSlate SignNow offers integrations with various apps that can enhance your experience with the 'form arts pb 501 c'. You can connect with CRM systems, cloud storage solutions, and productivity tools to streamline your document management and ensure seamless communication.

-

What security measures does airSlate SignNow implement for 'form arts pb 501 c' documents?

AirSlate SignNow ensures the highest level of security for all documents, including the 'form arts pb 501 c'. Our platform employs encryption, secure access controls, and compliance with industry standards to protect your sensitive information and ensure your documents' integrity.

-

Can I track the status of 'form arts pb 501 c' sent through airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your submitted 'form arts pb 501 c'. You will receive real-time notifications when the form is viewed, signed, or completed, giving you complete visibility throughout the process.

Get more for Arts Pb 501 C 3

Find out other Arts Pb 501 C 3

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors