Form ST 101 7 Report of Clothing and Footwear Sales 2024

What is the Form ST 101 7 Report Of Clothing And Footwear Sales

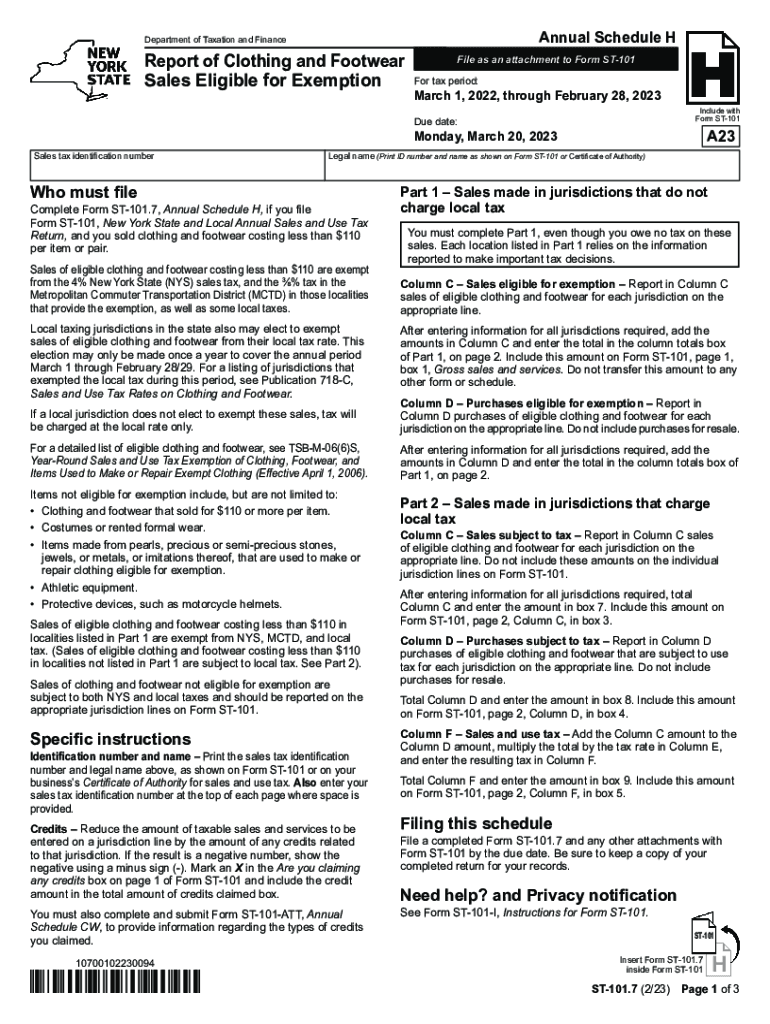

The Form ST 101 7 Report Of Clothing And Footwear Sales is a specific document used by businesses in the United States to report sales of clothing and footwear. This form is essential for compliance with state tax regulations, particularly in states that impose sales tax on clothing and footwear items. The information collected on this form helps state authorities track sales and ensure proper tax collection. It is important for businesses to understand the requirements and implications of this form to avoid potential penalties.

How to use the Form ST 101 7 Report Of Clothing And Footwear Sales

Using the Form ST 101 7 involves several steps to ensure accurate reporting. First, businesses should gather all relevant sales data for clothing and footwear. This includes total sales amounts, any exemptions, and applicable tax rates. Next, the form must be filled out with precise details, ensuring that all sections are completed according to state guidelines. Once completed, the form should be submitted to the appropriate state tax authority, either electronically or via mail, depending on the state's submission requirements.

Steps to complete the Form ST 101 7 Report Of Clothing And Footwear Sales

Completing the Form ST 101 7 requires careful attention to detail. The following steps outline the process:

- Gather all sales records for clothing and footwear during the reporting period.

- Determine the total sales amount and any applicable exemptions or deductions.

- Fill out each section of the form, ensuring accuracy in reporting sales figures.

- Review the completed form for any errors or omissions.

- Submit the form to the designated state tax authority by the required deadline.

Legal use of the Form ST 101 7 Report Of Clothing And Footwear Sales

The legal use of the Form ST 101 7 is governed by state tax laws. Businesses are required to use this form to report sales accurately and comply with tax obligations. Failing to submit this form or providing incorrect information can lead to legal repercussions, including fines or audits. It is crucial for businesses to stay informed about their legal responsibilities regarding this form to maintain compliance and avoid potential issues with state authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Form ST 101 7 can vary by state and are typically aligned with the state's sales tax reporting schedule. Businesses should be aware of these deadlines to ensure timely submission. Missing a deadline can result in penalties or interest charges. It is advisable to check with the state tax authority for specific dates and any changes to the filing schedule.

Form Submission Methods (Online / Mail / In-Person)

The Form ST 101 7 can usually be submitted through various methods, including online submission, mail, or in-person delivery to the state tax office. The preferred method may depend on the state’s regulations and the business's capabilities. Online submission is often encouraged for its efficiency and quicker processing times. Businesses should confirm the available submission options with their state tax authority to ensure compliance.

Quick guide on how to complete form st 101 7 report of clothing and footwear sales

Complete Form ST 101 7 Report Of Clothing And Footwear Sales effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Form ST 101 7 Report Of Clothing And Footwear Sales on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

The easiest method to modify and eSign Form ST 101 7 Report Of Clothing And Footwear Sales without hassle

- Find Form ST 101 7 Report Of Clothing And Footwear Sales and then click Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your updates.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tiring form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Modify and eSign Form ST 101 7 Report Of Clothing And Footwear Sales and guarantee exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form st 101 7 report of clothing and footwear sales

Create this form in 5 minutes!

How to create an eSignature for the form st 101 7 report of clothing and footwear sales

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form ST 101 7 Report Of Clothing And Footwear Sales?

The Form ST 101 7 Report Of Clothing And Footwear Sales is a document required for reporting sales of clothing and footwear in certain jurisdictions. This form helps businesses comply with tax regulations and ensures accurate reporting of sales tax exemptions. Understanding this form is crucial for retailers in the clothing and footwear industry.

-

How can airSlate SignNow help with the Form ST 101 7 Report Of Clothing And Footwear Sales?

airSlate SignNow streamlines the process of completing and submitting the Form ST 101 7 Report Of Clothing And Footwear Sales. With our easy-to-use platform, you can fill out, eSign, and send the form electronically, saving time and reducing errors. This efficiency is essential for businesses looking to stay compliant.

-

Is there a cost associated with using airSlate SignNow for the Form ST 101 7 Report Of Clothing And Footwear Sales?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions ensure that you can manage the Form ST 101 7 Report Of Clothing And Footwear Sales without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the Form ST 101 7 Report Of Clothing And Footwear Sales?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for the Form ST 101 7 Report Of Clothing And Footwear Sales. These features enhance the user experience and ensure that your documents are handled efficiently and securely.

-

Can I integrate airSlate SignNow with other software for the Form ST 101 7 Report Of Clothing And Footwear Sales?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage the Form ST 101 7 Report Of Clothing And Footwear Sales alongside your existing tools. This integration capability enhances workflow efficiency and data management.

-

What are the benefits of using airSlate SignNow for the Form ST 101 7 Report Of Clothing And Footwear Sales?

Using airSlate SignNow for the Form ST 101 7 Report Of Clothing And Footwear Sales provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. Our platform simplifies the eSigning process, making it easier for businesses to manage their sales reporting accurately.

-

Is airSlate SignNow secure for handling the Form ST 101 7 Report Of Clothing And Footwear Sales?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Form ST 101 7 Report Of Clothing And Footwear Sales is handled with the utmost care. Our platform employs advanced encryption and security measures to protect your sensitive information throughout the signing process.

Get more for Form ST 101 7 Report Of Clothing And Footwear Sales

Find out other Form ST 101 7 Report Of Clothing And Footwear Sales

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract