Application for Extension of Time to File Inheritance Tax Return Application for Extension of Time to File Inheritance Tax Retur Form

Understanding the Application for Extension of Time to File Inheritance Tax Return

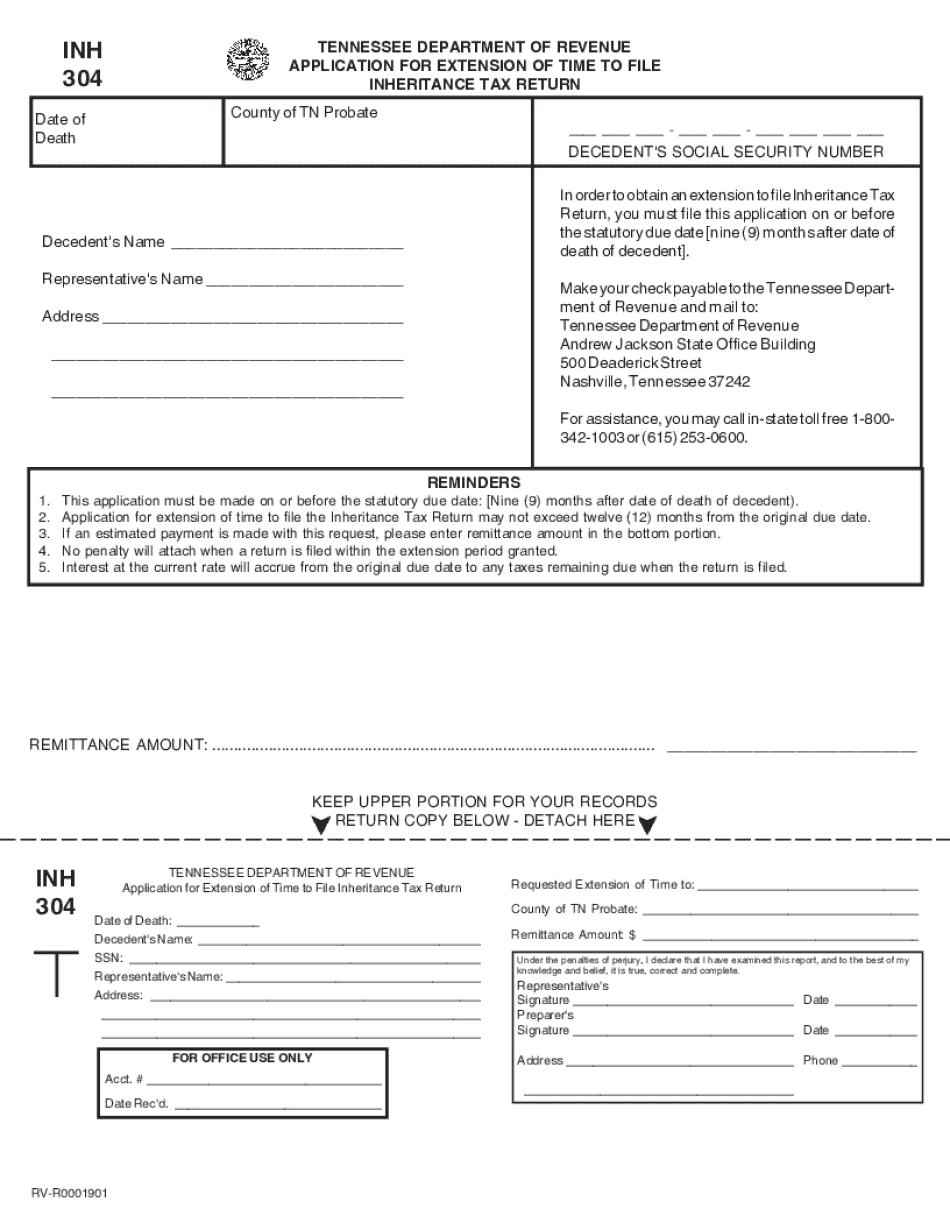

The Application for Extension of Time to File Inheritance Tax Return is a crucial document for individuals managing estates. This application allows executors or administrators additional time to file the necessary inheritance tax returns. Understanding its purpose is essential for compliance with state regulations and ensuring that all tax obligations are met.

Steps to Complete the Application for Extension of Time

Completing the Application for Extension of Time involves several key steps:

- Gather all relevant information about the estate, including assets and liabilities.

- Fill out the application form accurately, ensuring all required fields are completed.

- Review the application for any errors or omissions before submission.

- Submit the application by the specified deadline to avoid penalties.

Eligibility Criteria for the Application

To qualify for the Application for Extension of Time to File Inheritance Tax Return, the applicant must meet specific criteria. Generally, the applicant must be the executor or administrator of the estate. Additionally, the estate must have a valid reason for requesting an extension, such as needing more time to gather financial information or resolve disputes among beneficiaries.

Required Documents for Submission

When submitting the Application for Extension of Time, certain documents may be required. These typically include:

- The completed application form.

- Documentation supporting the need for an extension, such as a letter explaining the circumstances.

- Any preliminary financial statements or tax documents related to the estate.

Filing Deadlines for the Application

It is vital to be aware of the filing deadlines associated with the Application for Extension of Time. Generally, the application must be submitted before the original due date of the inheritance tax return. Missing this deadline can result in penalties or interest on unpaid taxes.

Legal Use of the Application

The Application for Extension of Time to File Inheritance Tax Return serves a legal purpose, allowing estates to comply with tax laws while ensuring proper management of estate assets. Utilizing this application correctly can help prevent legal complications and ensure that the estate is settled in accordance with state laws.

Quick guide on how to complete application for extension of time to file inheritance tax return application for extension of time to file inheritance tax

Prepare Application For Extension Of Time To File Inheritance Tax Return Application For Extension Of Time To File Inheritance Tax Retur effortlessly on anydevice

Digital document management has become increasingly popular among organizations and individuals. It offers a perfect environmentally friendly substitute for traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Handle Application For Extension Of Time To File Inheritance Tax Return Application For Extension Of Time To File Inheritance Tax Retur on any platform with airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to modify and eSign Application For Extension Of Time To File Inheritance Tax Return Application For Extension Of Time To File Inheritance Tax Retur smoothly

- Find Application For Extension Of Time To File Inheritance Tax Return Application For Extension Of Time To File Inheritance Tax Retur and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important parts of your documents or obscure sensitive information with tools airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal authority as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to submit your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your requirements in document management in a few clicks from any device you prefer. Modify and eSign Application For Extension Of Time To File Inheritance Tax Return Application For Extension Of Time To File Inheritance Tax Retur and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application for extension of time to file inheritance tax return application for extension of time to file inheritance tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a due application inheritance sample?

A due application inheritance sample is a template that outlines the necessary steps and documentation required for inheriting assets. It serves as a guide for individuals navigating the complexities of inheritance, ensuring all legal requirements are met.

-

How can airSlate SignNow help with due application inheritance samples?

airSlate SignNow provides an efficient platform for creating, sending, and eSigning due application inheritance samples. With our user-friendly interface, you can easily customize templates to fit your specific needs, streamlining the inheritance process.

-

What features does airSlate SignNow offer for managing due application inheritance samples?

Our platform offers features such as customizable templates, secure eSigning, and document tracking, all essential for managing due application inheritance samples. These tools help ensure that your documents are processed quickly and securely.

-

Is there a cost associated with using airSlate SignNow for due application inheritance samples?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions ensure that you can manage due application inheritance samples without breaking the bank, providing excellent value for your investment.

-

Can I integrate airSlate SignNow with other applications for due application inheritance samples?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enhancing your workflow for due application inheritance samples. This allows you to connect with tools you already use, making document management even more efficient.

-

What are the benefits of using airSlate SignNow for due application inheritance samples?

Using airSlate SignNow for due application inheritance samples offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the signing process, allowing you to focus on what matters most.

-

How secure is airSlate SignNow when handling due application inheritance samples?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and compliance measures to protect your due application inheritance samples, ensuring that your sensitive information remains confidential and secure.

Get more for Application For Extension Of Time To File Inheritance Tax Return Application For Extension Of Time To File Inheritance Tax Retur

Find out other Application For Extension Of Time To File Inheritance Tax Return Application For Extension Of Time To File Inheritance Tax Retur

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors