New York State E File Signature Authorization for Tax Year for Forms it 201, it 201 X, it 203, it 203 X, it 214, and NYC 210

Understanding the New York State E File Signature Authorization

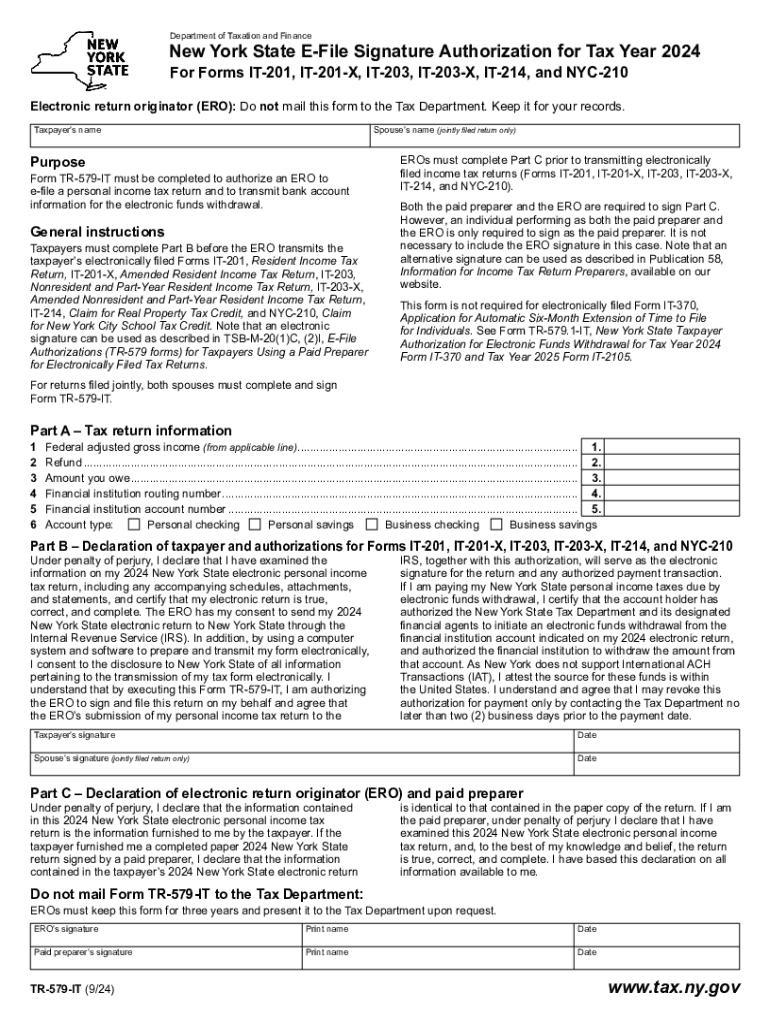

The New York State E File Signature Authorization is a crucial document for taxpayers filing electronically. This form is specifically designed for use with various tax forms, including IT-201, IT-201 X, IT-203, IT-203 X, IT-214, and NYC-210. By completing this authorization, taxpayers grant their tax preparers permission to file their returns electronically on their behalf. This process streamlines tax submissions and enhances efficiency, ensuring compliance with state regulations.

Steps to Complete the New York State E File Signature Authorization

Completing the New York State E File Signature Authorization involves several key steps:

- Obtain the appropriate form, typically referred to as Form TR-579 IT.

- Fill out the required fields, including taxpayer information and signature details.

- Ensure that all information is accurate and complete to avoid delays.

- Submit the form to your tax preparer, who will use it to file your taxes electronically.

Following these steps can help facilitate a smooth filing process.

Key Elements of the New York State E File Signature Authorization

Several important elements must be included in the New York State E File Signature Authorization:

- Taxpayer Information: This includes the name, address, and Social Security number of the taxpayer.

- Tax Preparer Information: The name and identification number of the tax preparer must be clearly stated.

- Signature: The taxpayer's signature is required to validate the authorization.

- Date: The date of signing is essential for record-keeping and compliance.

Legal Use of the New York State E File Signature Authorization

The New York State E File Signature Authorization is legally binding, allowing tax preparers to file returns on behalf of taxpayers. It is essential to understand that this authorization must be completed accurately to ensure compliance with state tax laws. Failure to properly authorize can result in delays or complications during the filing process.

Filing Deadlines and Important Dates

Filing deadlines for the New York State E File Signature Authorization coincide with the deadlines for the associated tax forms. Typically, individual tax returns are due by April 15. It is advisable to check for any updates or changes to these dates annually, as they may vary.

Required Documents for Submission

When submitting the New York State E File Signature Authorization, certain documents may be required:

- Completed Form TR-579 IT.

- Copy of the taxpayer’s identification, such as a driver's license or Social Security card.

- Any relevant tax documents that support the information provided on the form.

Gathering these documents in advance can help streamline the filing process.

Quick guide on how to complete new york state e file signature authorization for tax year for forms it 201 it 201 x it 203 it 203 x it 214 and nyc 210

Effortlessly Prepare New York State E File Signature Authorization For Tax Year For Forms IT 201, IT 201 X, IT 203, IT 203 X, IT 214, And NYC 210 on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to conventional printed and signed forms, as you can access the necessary template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without any holdups. Manage New York State E File Signature Authorization For Tax Year For Forms IT 201, IT 201 X, IT 203, IT 203 X, IT 214, And NYC 210 across any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Modify and eSign New York State E File Signature Authorization For Tax Year For Forms IT 201, IT 201 X, IT 203, IT 203 X, IT 214, And NYC 210 with Ease

- Find New York State E File Signature Authorization For Tax Year For Forms IT 201, IT 201 X, IT 203, IT 203 X, IT 214, And NYC 210 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select important sections of the documents or conceal sensitive information with tools designed specifically for that function by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes merely seconds and has the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to finalize your changes.

- Decide how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign New York State E File Signature Authorization For Tax Year For Forms IT 201, IT 201 X, IT 203, IT 203 X, IT 214, And NYC 210 while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the new york state e file signature authorization for tax year for forms it 201 it 201 x it 203 it 203 x it 214 and nyc 210

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the NYS e file authorization form?

The NYS e file authorization form is a document that allows taxpayers to authorize a tax professional to e-file their tax returns on their behalf. This form is essential for ensuring that your tax filings are submitted accurately and securely. Using airSlate SignNow, you can easily create and sign this form electronically, streamlining the process.

-

How can I obtain the NYS e file authorization form?

You can obtain the NYS e file authorization form directly from the New York State Department of Taxation and Finance website. Additionally, airSlate SignNow provides templates that allow you to generate this form quickly and efficiently. With our platform, you can customize and eSign the form in just a few clicks.

-

Is there a cost associated with using airSlate SignNow for the NYS e file authorization form?

airSlate SignNow offers a cost-effective solution for managing documents, including the NYS e file authorization form. Pricing plans vary based on features and usage, but we provide a free trial to help you explore our services. This ensures you can assess the value of our platform before committing to a subscription.

-

What features does airSlate SignNow offer for the NYS e file authorization form?

airSlate SignNow offers a range of features for the NYS e file authorization form, including customizable templates, secure eSigning, and document tracking. Our platform allows you to collaborate with tax professionals seamlessly, ensuring that your form is completed and submitted without any hassle. Additionally, you can store and manage all your documents in one place.

-

How does airSlate SignNow ensure the security of the NYS e file authorization form?

Security is a top priority at airSlate SignNow. We use advanced encryption protocols to protect your data and ensure that your NYS e file authorization form is safe from unauthorized access. Our platform complies with industry standards, providing you with peace of mind when handling sensitive tax documents.

-

Can I integrate airSlate SignNow with other software for the NYS e file authorization form?

Yes, airSlate SignNow offers integrations with various software applications, making it easy to manage your NYS e file authorization form alongside your other business tools. Whether you use accounting software or customer relationship management systems, our platform can connect seamlessly to enhance your workflow.

-

What are the benefits of using airSlate SignNow for the NYS e file authorization form?

Using airSlate SignNow for the NYS e file authorization form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced collaboration with tax professionals. Our user-friendly interface allows you to complete and sign documents quickly, saving you time and effort during tax season. Additionally, our platform helps you stay organized and compliant.

Get more for New York State E File Signature Authorization For Tax Year For Forms IT 201, IT 201 X, IT 203, IT 203 X, IT 214, And NYC 210

Find out other New York State E File Signature Authorization For Tax Year For Forms IT 201, IT 201 X, IT 203, IT 203 X, IT 214, And NYC 210

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement