Consumer Use Return Introduced Graduated Penalty and Interest Rates 2022-2026

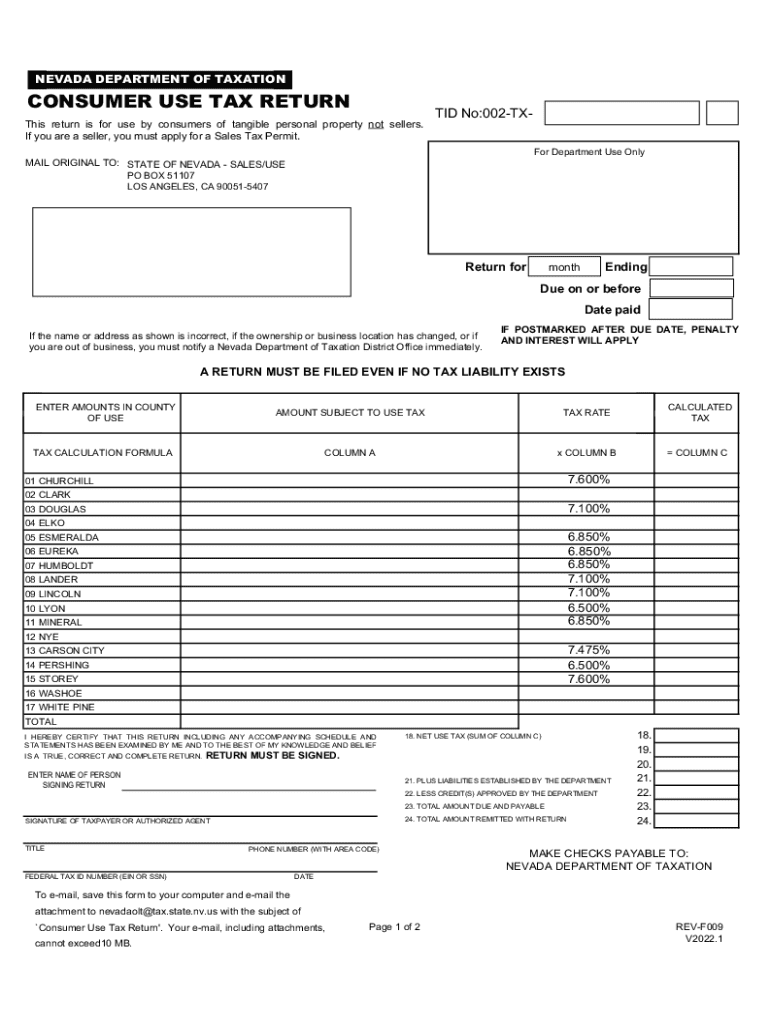

What is the Nevada Consumer Use Tax Form?

The Nevada Consumer Use Tax Form is a document used by individuals and businesses to report and pay use tax on items purchased for use in Nevada. This form is essential for those who have acquired goods from out-of-state vendors that did not charge Nevada sales tax. The purpose of the consumer use tax is to ensure that all individuals and businesses contribute fairly to the state's revenue, regardless of where the purchase was made.

Steps to Complete the Nevada Consumer Use Tax Form

Completing the Nevada Consumer Use Tax Form involves several key steps:

- Gather Information: Collect all necessary details regarding your purchases, including dates, descriptions, and amounts spent.

- Calculate Use Tax: Determine the applicable use tax rate based on the total value of the items purchased.

- Fill Out the Form: Enter the required information accurately on the form, ensuring all calculations are correct.

- Review and Submit: Double-check the completed form for accuracy before submitting it online or via mail.

Filing Deadlines for the Nevada Consumer Use Tax Form

It is crucial to be aware of the filing deadlines for the Nevada Consumer Use Tax Form. Typically, the form must be submitted by the last day of the month following the end of each quarter. For example, the due date for the first quarter (January to March) is April 30. Staying on top of these deadlines helps avoid penalties and interest on late payments.

Penalties for Non-Compliance

Failure to file the Nevada Consumer Use Tax Form on time can result in penalties and interest charges. The penalties may vary based on the amount of tax owed and the length of the delay. It is advisable to file the form even if you cannot pay the full amount owed to minimize potential penalties.

Form Submission Methods

The Nevada Consumer Use Tax Form can be submitted through various methods:

- Online: Use the Nevada Department of Taxation's online portal for electronic filing.

- Mail: Send a completed paper form to the appropriate state tax office.

- In-Person: Visit a local tax office to submit the form directly.

Required Documents for Filing

When filing the Nevada Consumer Use Tax Form, you may need to provide supporting documents, such as:

- Receipts or invoices for purchases made.

- Records of any sales tax paid to other states.

- Documentation of any exemptions claimed.

Quick guide on how to complete consumer use return introduced graduated penalty and interest rates

Finalize Consumer Use Return Introduced Graduated Penalty And Interest Rates effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed paperwork, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without delays. Handle Consumer Use Return Introduced Graduated Penalty And Interest Rates on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to alter and eSign Consumer Use Return Introduced Graduated Penalty And Interest Rates seamlessly

- Locate Consumer Use Return Introduced Graduated Penalty And Interest Rates and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and bears the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your needs in document management within a few clicks from any device you prefer. Edit and eSign Consumer Use Return Introduced Graduated Penalty And Interest Rates and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct consumer use return introduced graduated penalty and interest rates

Create this form in 5 minutes!

How to create an eSignature for the consumer use return introduced graduated penalty and interest rates

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nv consumer use tax form?

The nv consumer use tax form is a document used by Nevada residents to report and pay taxes on items purchased outside the state for use in Nevada. This form ensures compliance with state tax laws and helps residents avoid penalties. Understanding how to fill out this form correctly is crucial for accurate tax reporting.

-

How can airSlate SignNow help with the nv consumer use tax form?

airSlate SignNow provides an efficient platform for electronically signing and sending the nv consumer use tax form. With its user-friendly interface, you can easily complete and submit your tax form without the hassle of printing and mailing. This streamlines the process, saving you time and ensuring your documents are securely handled.

-

Is there a cost associated with using airSlate SignNow for the nv consumer use tax form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. The cost is competitive and provides access to features that simplify the completion of the nv consumer use tax form. Investing in this solution can lead to signNow time savings and improved efficiency in managing your tax documents.

-

What features does airSlate SignNow offer for managing the nv consumer use tax form?

airSlate SignNow includes features such as customizable templates, secure eSignature capabilities, and document tracking. These tools make it easy to manage the nv consumer use tax form from start to finish. Additionally, you can collaborate with team members and ensure that all necessary information is included before submission.

-

Can I integrate airSlate SignNow with other software for the nv consumer use tax form?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow for the nv consumer use tax form. Whether you use accounting software or document management systems, these integrations help streamline the process and keep your data organized.

-

What are the benefits of using airSlate SignNow for the nv consumer use tax form?

Using airSlate SignNow for the nv consumer use tax form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick edits and real-time collaboration, ensuring that your tax form is accurate and submitted on time. This can lead to a smoother tax filing experience overall.

-

Is airSlate SignNow secure for submitting the nv consumer use tax form?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for submitting the nv consumer use tax form. The platform employs advanced encryption and security protocols to protect your sensitive information. You can confidently eSign and send your tax documents without worrying about data bsignNowes.

Get more for Consumer Use Return Introduced Graduated Penalty And Interest Rates

- Letter from tenant to landlord about inadequacy of heating resources insufficient heat minnesota form

- Mn 20 1 form

- Change name m online form

- Assignment of mortgage by business entity ucbc form 2032 minnesota

- Mn satisfaction form

- Satisfaction of mortgage by business entity with change of name or identity minn stat 507411 ucbc form 2053 minnesota

- Partial release mortgage form 497312087

- Partial release of mortgage by business entity with change of name or identity minn stat 507411 ucbc form 2063 minnesota

Find out other Consumer Use Return Introduced Graduated Penalty And Interest Rates

- Can I Electronic signature Michigan Trademark License Agreement

- Electronic signature Indiana Letter Bankruptcy Inquiry Now

- eSignature Oklahoma Payroll Deduction Authorization Easy

- How To eSignature Texas Payroll Deduction Authorization

- Can I Electronic signature Connecticut Retainer for Attorney

- How Do I Electronic signature Idaho Assignment of License

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage