NEVADA DEPARTMENT of TAXATIONAFFIDAVIT of PURCHASE Form

What is the NEVADA DEPARTMENT OF TAXATION AFFIDAVIT OF PURCHASE

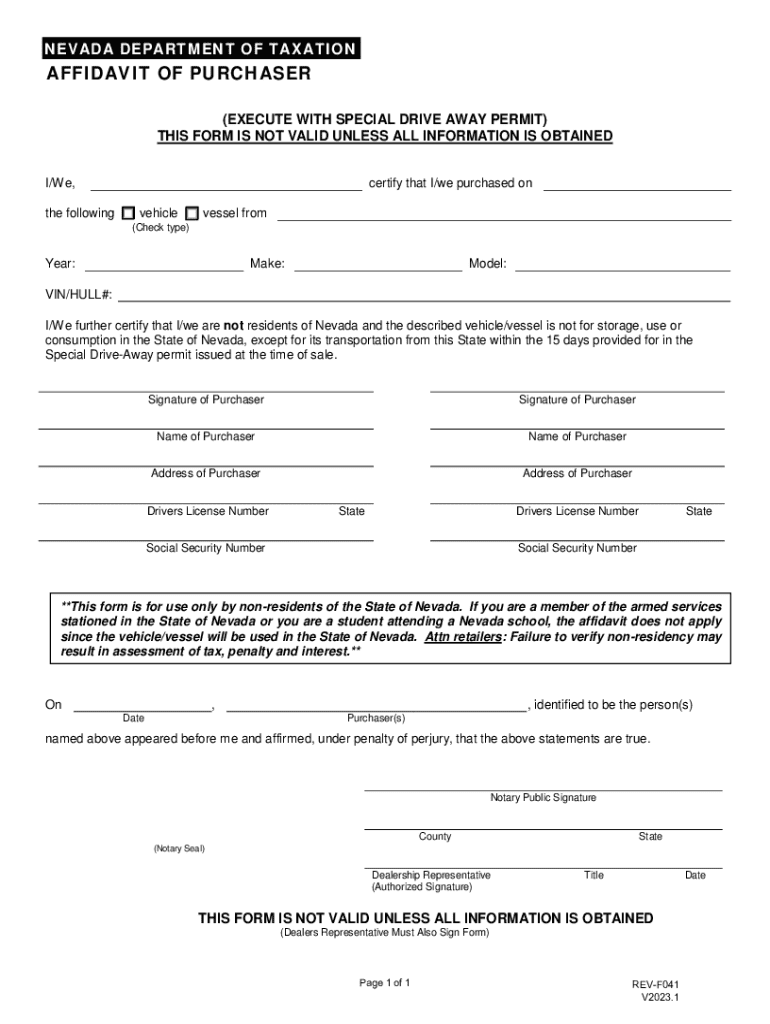

The NEVADA DEPARTMENT OF TAXATION AFFIDAVIT OF PURCHASE is a legal document used in Nevada to certify the purchase of certain items, typically related to property or sales tax exemptions. This affidavit serves as a formal declaration by the buyer, affirming that the purchase meets specific criteria outlined by the state tax authority. It is essential for ensuring compliance with Nevada tax laws and may be required for various transactions, including real estate purchases and vehicle acquisitions.

How to Obtain the NEVADA DEPARTMENT OF TAXATION AFFIDAVIT OF PURCHASE

To obtain the NEVADA DEPARTMENT OF TAXATION AFFIDAVIT OF PURCHASE, individuals can visit the official website of the Nevada Department of Taxation. The form is usually available for download in a PDF format, allowing users to print and fill it out. Additionally, individuals may contact their local county tax office for assistance in acquiring the affidavit or for any specific requirements related to their purchase.

Steps to Complete the NEVADA DEPARTMENT OF TAXATION AFFIDAVIT OF PURCHASE

Completing the NEVADA DEPARTMENT OF TAXATION AFFIDAVIT OF PURCHASE involves several key steps:

- Download the affidavit form from the Nevada Department of Taxation website or obtain it from your local tax office.

- Fill in the required information, including details about the buyer, seller, and the purchased item.

- Provide any necessary documentation that supports the claim for tax exemption, such as receipts or contracts.

- Sign the affidavit to affirm the accuracy of the information provided.

- Submit the completed affidavit to the appropriate tax authority, either in person or by mail.

Legal Use of the NEVADA DEPARTMENT OF TAXATION AFFIDAVIT OF PURCHASE

The NEVADA DEPARTMENT OF TAXATION AFFIDAVIT OF PURCHASE is legally binding and must be used in accordance with Nevada tax laws. It is crucial for buyers to ensure that the information provided is accurate and truthful, as any discrepancies may lead to penalties or legal consequences. This affidavit is particularly important for claiming tax exemptions and ensuring that the correct tax rate is applied to the purchase.

Key Elements of the NEVADA DEPARTMENT OF TAXATION AFFIDAVIT OF PURCHASE

Key elements of the NEVADA DEPARTMENT OF TAXATION AFFIDAVIT OF PURCHASE include:

- The names and addresses of both the buyer and seller.

- A detailed description of the item purchased, including any relevant identification numbers.

- The date of purchase and the purchase price.

- Statements affirming the buyer's eligibility for tax exemptions.

- Signature of the buyer, certifying the accuracy of the information.

State-Specific Rules for the NEVADA DEPARTMENT OF TAXATION AFFIDAVIT OF PURCHASE

Nevada has specific regulations governing the use of the AFFIDAVIT OF PURCHASE. Buyers should be aware of the following state-specific rules:

- Eligibility criteria for tax exemptions may vary based on the type of purchase.

- Certain items may be exempt from sales tax under specific conditions, which must be clearly stated in the affidavit.

- Failure to comply with state regulations may result in fines or additional tax liabilities.

Quick guide on how to complete nevada department of taxationaffidavit of purchase

Easily Create NEVADA DEPARTMENT OF TAXATIONAFFIDAVIT OF PURCHASE on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without delays. Manage NEVADA DEPARTMENT OF TAXATIONAFFIDAVIT OF PURCHASE on any device using the airSlate SignNow apps for Android or iOS and streamline your document-related tasks today.

The Simplest Method to Modify and Electronically Sign NEVADA DEPARTMENT OF TAXATIONAFFIDAVIT OF PURCHASE Effortlessly

- Find NEVADA DEPARTMENT OF TAXATIONAFFIDAVIT OF PURCHASE and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact confidential information with the tools available from airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and has the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes requiring new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign NEVADA DEPARTMENT OF TAXATIONAFFIDAVIT OF PURCHASE to guarantee effective communication at any point during your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nevada department of taxationaffidavit of purchase

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the NEVADA DEPARTMENT OF TAXATION AFFIDAVIT OF PURCHASE?

The NEVADA DEPARTMENT OF TAXATION AFFIDAVIT OF PURCHASE is a legal document required for certain transactions in Nevada. It serves to verify the purchase of property and ensures compliance with state tax regulations. Using airSlate SignNow, you can easily create and eSign this affidavit, streamlining the process.

-

How can airSlate SignNow help with the NEVADA DEPARTMENT OF TAXATION AFFIDAVIT OF PURCHASE?

airSlate SignNow provides a user-friendly platform to create, send, and eSign the NEVADA DEPARTMENT OF TAXATION AFFIDAVIT OF PURCHASE. Our solution simplifies document management, allowing you to complete transactions quickly and securely. With our templates, you can ensure that all necessary information is included.

-

What are the pricing options for using airSlate SignNow for the NEVADA DEPARTMENT OF TAXATION AFFIDAVIT OF PURCHASE?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Whether you are a small business or a large enterprise, our cost-effective solutions ensure you can manage the NEVADA DEPARTMENT OF TAXATION AFFIDAVIT OF PURCHASE without breaking the bank. Visit our pricing page for detailed information.

-

Are there any integrations available for the NEVADA DEPARTMENT OF TAXATION AFFIDAVIT OF PURCHASE?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance your workflow. You can connect with CRM systems, cloud storage services, and more to manage the NEVADA DEPARTMENT OF TAXATION AFFIDAVIT OF PURCHASE efficiently. This integration capability helps streamline your document processes.

-

What features does airSlate SignNow offer for the NEVADA DEPARTMENT OF TAXATION AFFIDAVIT OF PURCHASE?

airSlate SignNow offers a range of features including customizable templates, secure eSigning, and real-time tracking for the NEVADA DEPARTMENT OF TAXATION AFFIDAVIT OF PURCHASE. These features ensure that your documents are handled efficiently and securely, providing peace of mind during the signing process.

-

Is airSlate SignNow secure for handling the NEVADA DEPARTMENT OF TAXATION AFFIDAVIT OF PURCHASE?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your NEVADA DEPARTMENT OF TAXATION AFFIDAVIT OF PURCHASE is protected. We utilize advanced encryption and authentication measures to safeguard your documents and personal information.

-

Can I access the NEVADA DEPARTMENT OF TAXATION AFFIDAVIT OF PURCHASE on mobile devices?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to manage the NEVADA DEPARTMENT OF TAXATION AFFIDAVIT OF PURCHASE on the go. Our mobile app provides the same features as the desktop version, ensuring you can eSign and send documents anytime, anywhere.

Get more for NEVADA DEPARTMENT OF TAXATIONAFFIDAVIT OF PURCHASE

Find out other NEVADA DEPARTMENT OF TAXATIONAFFIDAVIT OF PURCHASE

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile