STATE of ARKANSAS Composite Estimated Tax Form

What is the STATE OF ARKANSAS Composite Estimated Tax

The STATE OF ARKANSAS Composite Estimated Tax is a tax mechanism designed for certain pass-through entities, such as partnerships and S-corporations. This tax allows these entities to pay state income tax on behalf of their owners, simplifying the tax process for individuals who receive income from these entities. By utilizing this tax, the owners can avoid the necessity of filing individual state income tax returns for the income derived from the pass-through entity.

How to use the STATE OF ARKANSAS Composite Estimated Tax

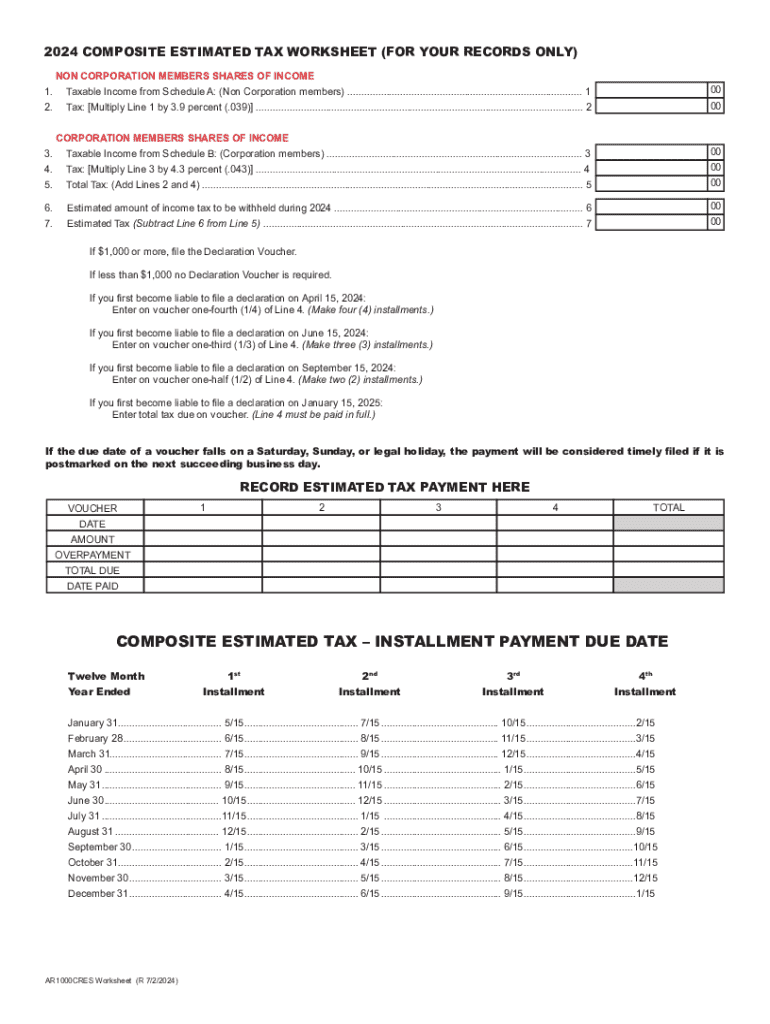

To effectively use the STATE OF ARKANSAS Composite Estimated Tax, pass-through entities must first determine their estimated tax liability based on the projected income for the year. This involves calculating the expected revenue and applying the appropriate state tax rates. Once the estimated tax amount is determined, the entity can remit the payment to the Arkansas Department of Finance and Administration. It is essential to keep accurate records of income and expenses to ensure compliance and facilitate future tax filings.

Steps to complete the STATE OF ARKANSAS Composite Estimated Tax

Completing the STATE OF ARKANSAS Composite Estimated Tax involves several key steps:

- Gather financial records, including income statements and expense reports.

- Calculate the estimated tax liability based on projected income.

- Complete the appropriate tax forms, ensuring all information is accurate.

- Submit the completed forms along with the estimated tax payment to the Arkansas Department of Finance and Administration.

- Maintain copies of all submitted documents for your records.

Filing Deadlines / Important Dates

Filing deadlines for the STATE OF ARKANSAS Composite Estimated Tax typically align with the state’s tax calendar. Estimated tax payments are generally due quarterly, with specific dates falling on the fifteenth day of April, June, September, and January of the following year. It is crucial for entities to adhere to these deadlines to avoid penalties and interest on late payments.

Who Issues the Form

The STATE OF ARKANSAS Composite Estimated Tax form is issued by the Arkansas Department of Finance and Administration. This state agency oversees tax collection and compliance, ensuring that all tax-related processes are conducted in accordance with state laws. Entities seeking to file this form should refer to the official guidelines provided by the department for the most accurate and up-to-date information.

Penalties for Non-Compliance

Failure to comply with the requirements of the STATE OF ARKANSAS Composite Estimated Tax can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential legal action for persistent non-compliance. It is important for entities to stay informed about their tax obligations and to make timely payments to avoid these consequences.

Quick guide on how to complete state of arkansas composite estimated tax

Complete STATE OF ARKANSAS Composite Estimated Tax easily on any device

Online document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Manage STATE OF ARKANSAS Composite Estimated Tax on any platform with airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and eSign STATE OF ARKANSAS Composite Estimated Tax effortlessly

- Locate STATE OF ARKANSAS Composite Estimated Tax and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize essential sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Decide how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Put aside worries about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your needs in document management with just a few clicks from any device you prefer. Alter and eSign STATE OF ARKANSAS Composite Estimated Tax and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the state of arkansas composite estimated tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the STATE OF ARKANSAS Composite Estimated Tax?

The STATE OF ARKANSAS Composite Estimated Tax is a tax payment made by certain businesses and individuals to estimate their tax liability for the year. This tax helps ensure that taxpayers meet their obligations and avoid penalties. Understanding this tax is crucial for effective financial planning.

-

How can airSlate SignNow help with STATE OF ARKANSAS Composite Estimated Tax forms?

airSlate SignNow simplifies the process of preparing and submitting STATE OF ARKANSAS Composite Estimated Tax forms. Our platform allows users to easily fill out, sign, and send documents electronically, ensuring compliance and timely submissions. This streamlines your tax preparation process signNowly.

-

What are the pricing options for using airSlate SignNow for STATE OF ARKANSAS Composite Estimated Tax?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including those focused on STATE OF ARKANSAS Composite Estimated Tax. Our plans are designed to be cost-effective, ensuring that you get the best value for your investment in document management and e-signature solutions.

-

What features does airSlate SignNow provide for managing STATE OF ARKANSAS Composite Estimated Tax documents?

airSlate SignNow provides features such as customizable templates, secure e-signatures, and document tracking specifically for STATE OF ARKANSAS Composite Estimated Tax documents. These features enhance efficiency and ensure that all necessary documentation is handled securely and professionally.

-

Are there any benefits to using airSlate SignNow for STATE OF ARKANSAS Composite Estimated Tax submissions?

Using airSlate SignNow for STATE OF ARKANSAS Composite Estimated Tax submissions offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and submitted quickly, helping you stay compliant with tax regulations.

-

Can airSlate SignNow integrate with other software for STATE OF ARKANSAS Composite Estimated Tax management?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage your STATE OF ARKANSAS Composite Estimated Tax documents. This integration allows for a smoother workflow, ensuring that all your financial data is synchronized and accessible.

-

Is airSlate SignNow secure for handling STATE OF ARKANSAS Composite Estimated Tax documents?

Absolutely! airSlate SignNow employs advanced security measures to protect your STATE OF ARKANSAS Composite Estimated Tax documents. Our platform uses encryption and secure storage to ensure that your sensitive information remains confidential and safe from unauthorized access.

Get more for STATE OF ARKANSAS Composite Estimated Tax

Find out other STATE OF ARKANSAS Composite Estimated Tax

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word