Hawaii Form

What is the Hawaii Form

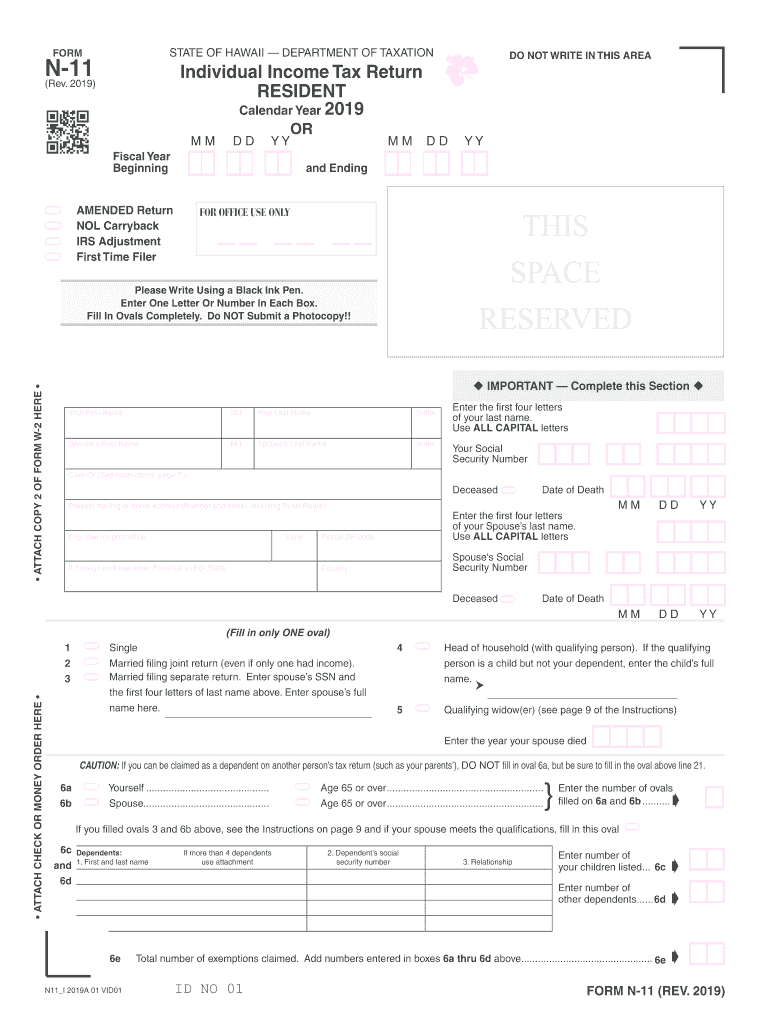

The 2019 n11 form, also known as the 2019 Hawaii Form N-11, is the standard individual income tax return for residents of Hawaii. This form is specifically designed for individuals who are full-time residents of Hawaii and need to report their income, claim deductions, and calculate their tax liability for the tax year 2019. It encompasses various income types, including wages, dividends, and interest, and allows taxpayers to take advantage of state-specific deductions and credits.

Steps to complete the Hawaii Form

Completing the 2019 n11 form involves several key steps to ensure accurate reporting and compliance with state tax laws. Begin by gathering all necessary documents, such as W-2 forms, 1099s, and any other income statements. Next, fill out the personal information section, including your name, address, and Social Security number. Proceed to report your total income, followed by any applicable deductions and credits. Finally, calculate your total tax due or refund expected. Make sure to review the completed form for accuracy before submission.

Legal use of the Hawaii Form

The 2019 n11 form is legally binding when completed correctly and submitted in accordance with Hawaii state tax laws. To ensure its legality, taxpayers must provide accurate information and sign the form. Electronic signatures are acceptable, provided they comply with the requirements set forth by the state. The form must be filed by the designated deadline to avoid penalties and ensure compliance with state regulations.

Filing Deadlines / Important Dates

For the 2019 tax year, the filing deadline for the Hawaii Form N-11 is typically April 20 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply, which can provide additional time to file the form without incurring penalties. It is crucial to keep track of these dates to avoid late fees and ensure timely processing of returns.

Required Documents

When preparing to file the 2019 n11 form, several documents are required to accurately report income and claim deductions. Essential documents include:

- W-2 forms from employers

- 1099 forms for other income sources

- Documentation for any deductions, such as mortgage interest statements or medical expenses

- Records of any tax credits being claimed

Having these documents on hand will facilitate a smoother filing process and help ensure that all income and deductions are reported accurately.

Form Submission Methods (Online / Mail / In-Person)

The 2019 n11 form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online filing through the Hawaii Department of Taxation's e-filing system

- Mailing a paper copy of the completed form to the appropriate state tax office

- In-person submission at designated tax offices, which may offer assistance in completing the form

Choosing the appropriate submission method can depend on personal preference and the availability of resources, such as internet access or proximity to tax offices.

Quick guide on how to complete publication 536 internal revenue service

Effortlessly prepare Hawaii Form on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers a sustainable alternative to conventional printed and signed forms, allowing you to easily locate the required document and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without any hold-ups. Manage Hawaii Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to edit and eSign Hawaii Form effortlessly

- Locate Hawaii Form and click Get Form to initiate.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to save your changes.

- Select how you wish to send your form: by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or disorganized documents, tedious form searches, or errors that require new document copies. airSlate SignNow streamlines all your document management needs in just a few clicks from your preferred device. Edit and eSign Hawaii Form to ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the publication 536 internal revenue service

How to make an eSignature for the Publication 536 Internal Revenue Service online

How to generate an electronic signature for the Publication 536 Internal Revenue Service in Google Chrome

How to create an electronic signature for putting it on the Publication 536 Internal Revenue Service in Gmail

How to generate an electronic signature for the Publication 536 Internal Revenue Service straight from your mobile device

How to make an eSignature for the Publication 536 Internal Revenue Service on iOS

How to make an electronic signature for the Publication 536 Internal Revenue Service on Android

People also ask

-

What is the 2019 Hawaii form used for?

The 2019 Hawaii form is primarily used for filing various tax-related documents in the state of Hawaii. It simplifies the reporting process for both businesses and individuals, ensuring compliance with state regulations. Utilizing airSlate SignNow can help you easily complete and eSign these forms for efficient submission.

-

How can airSlate SignNow help with the 2019 Hawaii form?

airSlate SignNow streamlines the process of completing the 2019 Hawaii form by allowing you to fill out necessary information digitally. With features like eSignature and document management, it ensures you can submit your forms accurately and on time. This reduces the hassle of paper forms and can save you time during tax season.

-

Is there a subscription fee for using airSlate SignNow to handle the 2019 Hawaii form?

Yes, airSlate SignNow offers various pricing plans depending on your needs. These plans are designed to be cost-effective, especially for businesses that frequently deal with documents like the 2019 Hawaii form. You can choose a plan that fits your budget and requirements, making it accessible for everyone.

-

What features does airSlate SignNow offer for managing the 2019 Hawaii form?

With airSlate SignNow, you have access to features such as customizable templates, eSignatures, and document tracking. These tools are especially useful for managing the 2019 Hawaii form, as they enhance accuracy and provide insight into the signing process. This ensures that your documents are handled efficiently from start to finish.

-

Are electronic signatures valid for the 2019 Hawaii form?

Yes, electronic signatures are legally valid for the 2019 Hawaii form when using a compliant eSignature solution like airSlate SignNow. This means you can sign and submit your forms without the need for printing, scanning, or mailing, saving you time and resources. Ensure you follow all requirements to maintain compliance.

-

Can I integrate airSlate SignNow with other applications for handling the 2019 Hawaii form?

Absolutely! airSlate SignNow offers a variety of integrations with popular applications, making it easier to manage the 2019 Hawaii form alongside your existing workflows. Whether it's accounting software or a CRM system, these integrations enhance your productivity and streamline the document handling process.

-

What are the benefits of using airSlate SignNow for the 2019 Hawaii form?

Using airSlate SignNow for the 2019 Hawaii form has numerous benefits, including increased efficiency and reduced paperwork. The platform allows for quick editing and easy sharing of documents, enhancing collaboration among stakeholders. Additionally, its secure features ensure your sensitive information remains protected throughout the process.

Get more for Hawaii Form

- Commercial film permit application city of san clemente form

- Home occupation permit application the city of bellflower bellflower form

- Tn beer permit application form

- Fee contract template form

- Federal proposal contract template form

- Fee for service contract template form

- Feed contract template form

- Fema provisions contract template form

Find out other Hawaii Form

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure