Do You Reimburse Expenses When People Paid Cash and 2023-2026

Understanding the Check Request Form Template

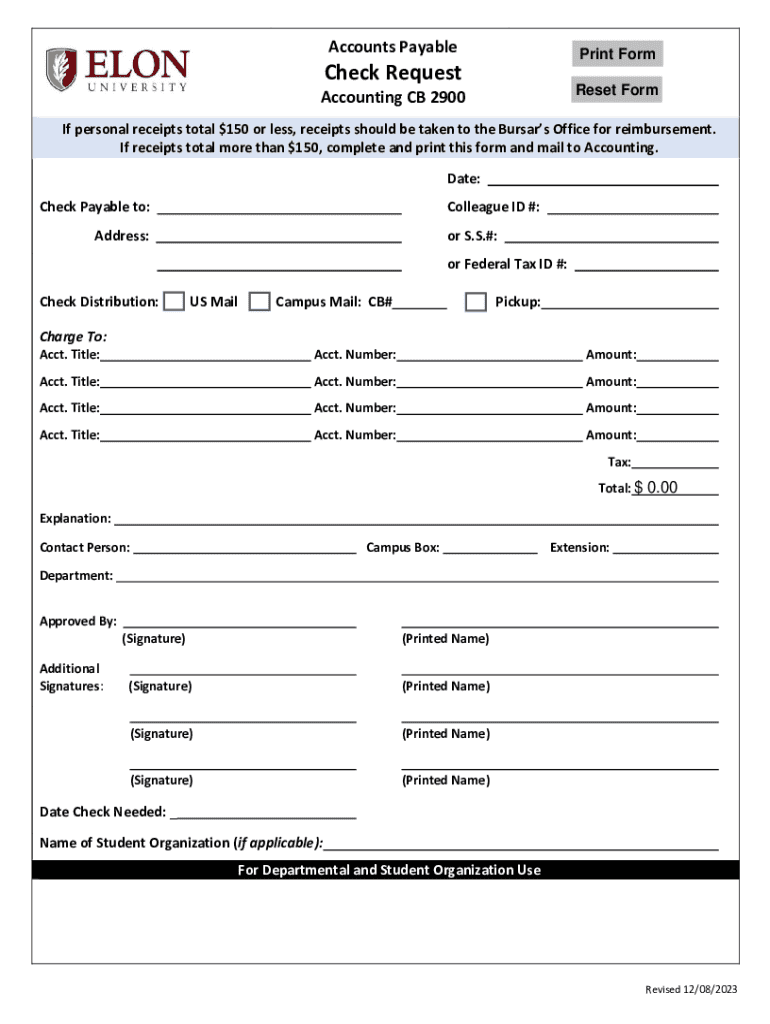

A check request form template is a crucial document used by businesses to request payment for goods or services rendered. This form serves as a formal request for funds from the accounts payable department and is essential for maintaining accurate financial records. The template typically includes fields for the requestor's name, department, purpose of the request, and the amount needed. By utilizing a standardized template, companies can streamline their payment processes and ensure compliance with internal controls.

Key Elements of a Check Request Form

When creating a check request form template, several key elements should be included to ensure clarity and completeness:

- Requestor Information: Name, department, and contact details of the person requesting the check.

- Payee Details: Name and address of the individual or business receiving the payment.

- Purpose of Payment: A brief description of what the payment is for, which helps in the approval process.

- Amount Requested: The total amount being requested for payment.

- Supporting Documentation: A section to attach any necessary invoices or receipts that justify the request.

- Approval Signatures: Spaces for required signatures from supervisors or finance personnel to authorize the payment.

Steps to Complete a Check Request Form

Filling out a check request form template involves several straightforward steps:

- Gather all necessary information, including the payee's details and the purpose of the payment.

- Fill in the requestor's information accurately to ensure proper processing.

- Clearly state the amount requested and attach any supporting documents, such as invoices.

- Review the form for completeness and accuracy before submission.

- Obtain required approvals from supervisors or finance personnel.

- Submit the completed form to the accounts payable department for processing.

Examples of Using a Check Request Form Template

Check request forms can be used in various scenarios, including:

- Reimbursement for employee expenses, such as travel or supplies purchased out of pocket.

- Payments to vendors for services rendered, such as consulting fees or maintenance services.

- Purchasing office supplies or equipment that require immediate payment.

Each example illustrates the versatility of the check request form template in managing financial transactions within an organization.

Legal Use of the Check Request Form

Using a check request form template is not only a best practice but also a legal requirement in many businesses. It helps maintain transparency and accountability in financial transactions. Proper documentation through a check request form can protect businesses during audits and ensure compliance with financial regulations. Keeping accurate records of all requests and payments made can also help in resolving disputes and tracking expenses effectively.

Digital vs. Paper Version of Check Request Forms

Organizations can choose between digital and paper versions of check request forms, each with its advantages. Digital forms allow for easier storage, faster processing, and the ability to track submissions in real-time. They can also be integrated with accounting software, enhancing efficiency. On the other hand, paper forms may be preferred in environments where digital access is limited. Regardless of the format chosen, ensuring that the form is standardized and easily accessible is essential for smooth operations.

Create this form in 5 minutes or less

Find and fill out the correct do you reimburse expenses when people paid cash and

Create this form in 5 minutes!

How to create an eSignature for the do you reimburse expenses when people paid cash and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a check request form template?

A check request form template is a standardized document used to request payment for services or expenses. It simplifies the process of obtaining approvals and ensures that all necessary information is captured. Using a check request form template can streamline your financial operations and improve accuracy.

-

How can I create a check request form template with airSlate SignNow?

Creating a check request form template with airSlate SignNow is straightforward. You can start by selecting a pre-designed template or create one from scratch using our intuitive drag-and-drop editor. This allows you to customize the form to meet your specific needs and branding.

-

What are the benefits of using a check request form template?

Using a check request form template offers numerous benefits, including increased efficiency and reduced errors in the payment process. It ensures that all necessary information is collected upfront, which speeds up approvals and payments. Additionally, it enhances accountability and tracking of expenses.

-

Is there a cost associated with using the check request form template?

airSlate SignNow offers various pricing plans that include access to the check request form template. Depending on your business needs, you can choose a plan that fits your budget while providing the features you require. We also offer a free trial to help you evaluate our services.

-

Can I integrate the check request form template with other software?

Yes, airSlate SignNow allows you to integrate the check request form template with various third-party applications. This includes popular accounting and project management tools, which can help streamline your workflow and enhance productivity. Our integration capabilities ensure that your data flows seamlessly between platforms.

-

How secure is the check request form template on airSlate SignNow?

Security is a top priority at airSlate SignNow. Our check request form template is protected with advanced encryption and complies with industry standards to ensure your data is safe. You can confidently manage sensitive information knowing that we take security seriously.

-

Can I customize the check request form template to fit my business needs?

Absolutely! The check request form template in airSlate SignNow is fully customizable. You can add your company logo, modify fields, and adjust the layout to align with your branding and specific requirements, ensuring that the template meets your unique business needs.

Get more for Do You Reimburse Expenses When People Paid Cash And

Find out other Do You Reimburse Expenses When People Paid Cash And

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure