Checkoff GeorgiaDonations 2024-2026

Understanding the Checkoff Georgia Donations

The Checkoff Georgia Donations is a program that allows taxpayers to contribute a portion of their tax refund to specific charitable organizations directly on their Georgia income tax forms. This initiative supports various causes, including education, health, and the environment, enabling taxpayers to make a positive impact while filing their taxes.

How to Utilize the Checkoff Georgia Donations

To take advantage of the Checkoff Georgia Donations, taxpayers should locate the designated section on their 2024 Georgia income tax forms. By filling out this section, individuals can specify the amount they wish to donate from their refund. It's essential to ensure that the selected organizations are eligible under the program guidelines to ensure the contributions are processed correctly.

Steps to Complete the Checkoff Georgia Donations

Completing the Checkoff Georgia Donations involves several straightforward steps:

- Obtain the 2024 Georgia income tax forms.

- Locate the Checkoff Georgia Donations section on the form.

- Choose the charitable organization(s) you wish to support.

- Enter the amount of your donation.

- Review your entries for accuracy before submission.

Filing Deadlines and Important Dates

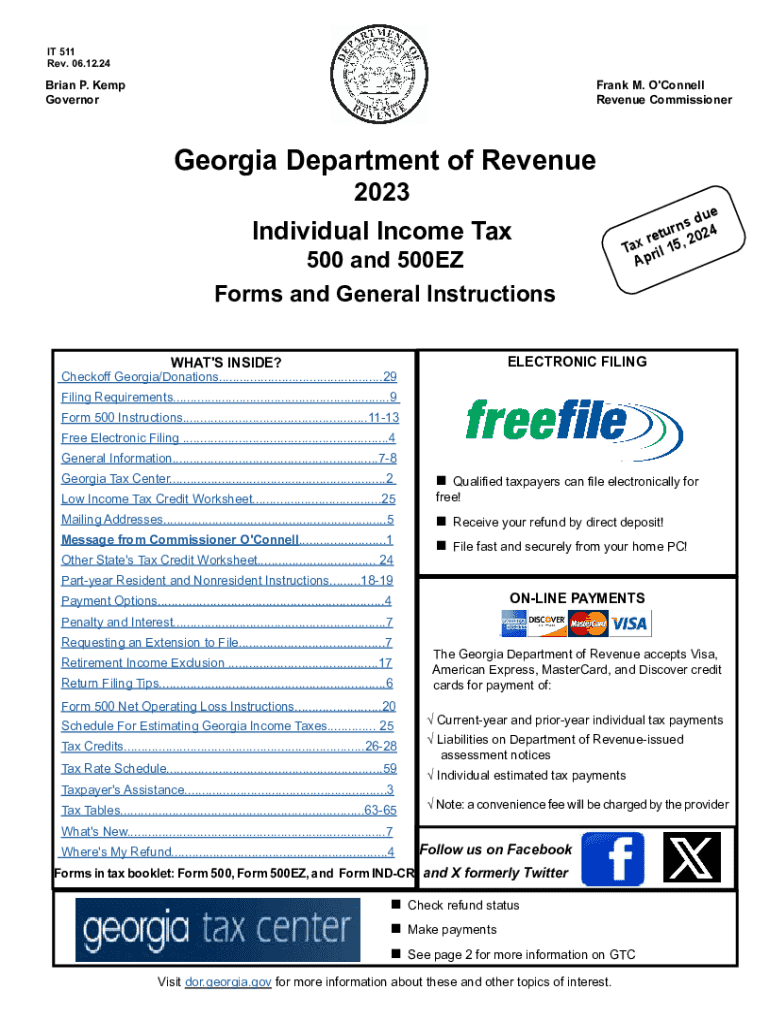

It is crucial for taxpayers to be aware of the filing deadlines for the 2024 Georgia income tax forms. Typically, the deadline for filing is April 15, unless it falls on a weekend or holiday. Taxpayers should ensure their forms, including the Checkoff Georgia Donations, are submitted by this date to avoid penalties.

Eligibility Criteria for the Checkoff Georgia Donations

To participate in the Checkoff Georgia Donations, taxpayers must be filing their Georgia income tax returns. Additionally, the charitable organizations selected must be recognized by the state as eligible recipients of donations through this program. Taxpayers should verify the status of these organizations to ensure compliance with the program's requirements.

Form Submission Methods

Taxpayers can submit their 2024 Georgia income tax forms, including the Checkoff Georgia Donations, through various methods:

- Online filing through approved tax software.

- Mailing a paper copy of the completed form to the appropriate state address.

- In-person submission at designated state tax offices.

Key Elements of the Checkoff Georgia Donations

Important elements to consider when participating in the Checkoff Georgia Donations include:

- The specific organizations available for donation.

- The minimum and maximum donation amounts allowed.

- The impact of donations on overall tax refunds.

Create this form in 5 minutes or less

Find and fill out the correct checkoff georgiadonations

Create this form in 5 minutes!

How to create an eSignature for the checkoff georgiadonations

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the 2024 Georgia income tax forms I need to file?

The 2024 Georgia income tax forms include the Form 500 for individual income tax, along with any necessary schedules and attachments. It's essential to ensure you have the correct forms to avoid delays in processing your tax return. You can find these forms on the Georgia Department of Revenue website or through tax preparation software.

-

How can airSlate SignNow help with 2024 Georgia income tax forms?

airSlate SignNow provides a seamless way to eSign and send your 2024 Georgia income tax forms securely. With our user-friendly platform, you can easily upload your tax documents, add signatures, and share them with your accountant or tax preparer. This streamlines the filing process and ensures your forms are submitted on time.

-

Are there any costs associated with using airSlate SignNow for 2024 Georgia income tax forms?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, starting with a free trial. Depending on the features you require for managing your 2024 Georgia income tax forms, you can choose a plan that fits your budget. Our cost-effective solution ensures you get the best value for your eSigning needs.

-

What features does airSlate SignNow offer for managing 2024 Georgia income tax forms?

airSlate SignNow offers features such as document templates, real-time tracking, and secure cloud storage for your 2024 Georgia income tax forms. You can also customize workflows to ensure that all necessary signatures are collected efficiently. These features enhance productivity and simplify the tax filing process.

-

Can I integrate airSlate SignNow with other software for my 2024 Georgia income tax forms?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software, making it easy to manage your 2024 Georgia income tax forms. This integration allows you to import and export documents effortlessly, ensuring a smooth workflow between platforms.

-

Is airSlate SignNow secure for handling sensitive 2024 Georgia income tax forms?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your 2024 Georgia income tax forms are protected. We use advanced encryption and secure servers to safeguard your data. You can trust that your sensitive information is handled with the utmost care and confidentiality.

-

How do I get started with airSlate SignNow for my 2024 Georgia income tax forms?

Getting started with airSlate SignNow is easy! Simply sign up for an account, and you can begin uploading your 2024 Georgia income tax forms right away. Our intuitive interface guides you through the process of eSigning and sharing documents, making tax season less stressful.

Get more for Checkoff GeorgiaDonations

Find out other Checkoff GeorgiaDonations

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast