Georgia Tax Center 2020

What is the Georgia Tax Center

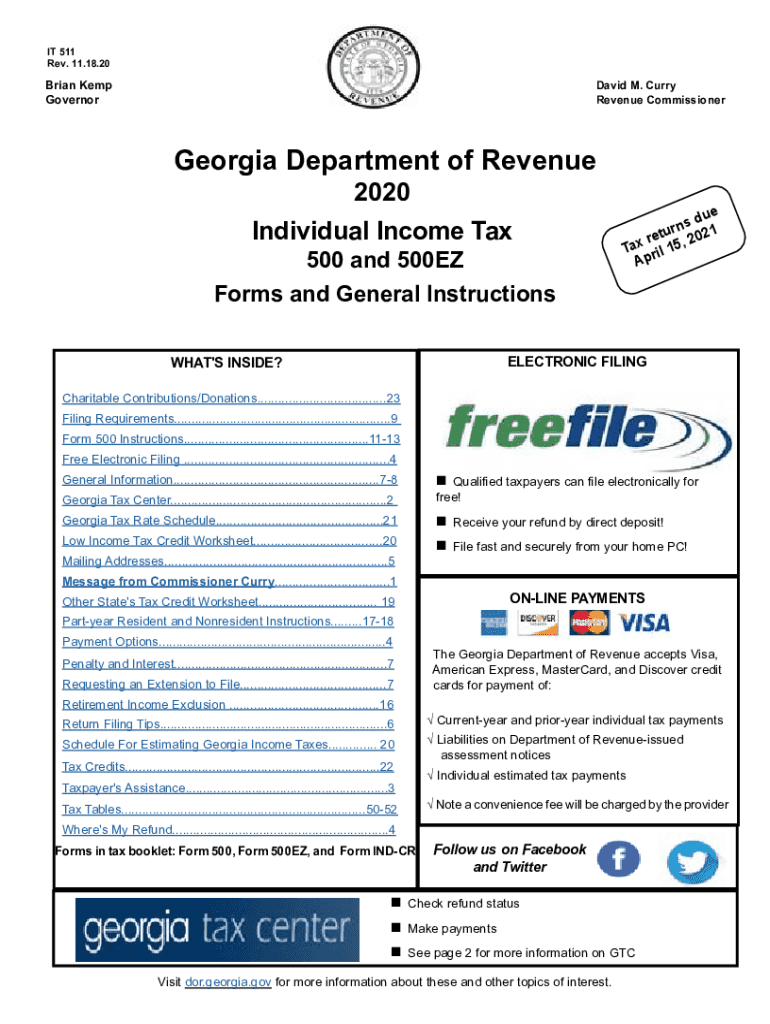

The Georgia Tax Center is an online portal designed for individuals and businesses to manage their state tax obligations efficiently. It serves as a central hub for accessing various tax forms, including the 2019 Georgia income tax forms, and provides essential information regarding tax filing and payments. Users can navigate the platform to find specific forms, check the status of their filings, and obtain guidance on tax-related inquiries.

How to use the Georgia Tax Center

Using the Georgia Tax Center is straightforward. Users can create an account or log in to access personalized services. Once logged in, individuals can easily find the necessary forms, including the 2019 Georgia income tax forms, by navigating through the categories provided. The site also offers resources such as FAQs and instructional guides to assist users in completing their tax filings accurately and efficiently.

Filing Deadlines / Important Dates

Understanding filing deadlines is crucial for compliance with state tax regulations. For the 2019 tax year, the deadline for filing Georgia income tax returns typically aligns with the federal deadline, which is usually April 15. However, it is essential to verify specific dates each year, as they may vary due to weekends or holidays. Staying informed about these deadlines helps taxpayers avoid penalties and interest on late filings.

Required Documents

To complete the 2019 Georgia income tax forms, taxpayers need to gather several key documents. These typically include:

- W-2 forms from employers

- 1099 forms for additional income

- Records of any deductions or credits

- Previous year’s tax return for reference

Having these documents ready ensures a smoother filing process and helps in accurately reporting income and deductions.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have multiple options for submitting their 2019 Georgia income tax forms. The preferred method is online submission through the Georgia Tax Center, which provides a secure and efficient way to file. Alternatively, individuals can mail their completed forms to the appropriate state address or submit them in person at designated tax offices. Each method has its own processing times and requirements, so it is advisable to choose the one that best fits individual needs.

Penalties for Non-Compliance

Failing to comply with Georgia tax filing requirements can result in various penalties. Common consequences include:

- Late filing penalties, which can accumulate over time

- Interest on unpaid taxes

- Potential legal actions for severe non-compliance

It is important for taxpayers to understand these penalties to ensure timely and accurate submissions, thereby avoiding unnecessary financial burdens.

Eligibility Criteria

Eligibility for filing Georgia income tax forms, including the 2019 Georgia income tax forms, generally depends on factors such as residency status, income level, and filing status. Residents of Georgia must file if their income exceeds certain thresholds, while non-residents may have different requirements based on income sourced from Georgia. Understanding these criteria helps taxpayers determine their obligations accurately.

Quick guide on how to complete georgia tax center

Complete Georgia Tax Center seamlessly across any device

Digital document management has surged in popularity among businesses and individuals. It offers a superb eco-friendly substitute for traditional printed and signed documents, enabling you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Manage Georgia Tax Center on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

How to adjust and electronically sign Georgia Tax Center with ease

- Locate Georgia Tax Center and click Get Form to begin.

- Employ the tools we offer to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select how you wish to send your form, either via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Adjust and electronically sign Georgia Tax Center and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct georgia tax center

Create this form in 5 minutes!

How to create an eSignature for the georgia tax center

The best way to create an electronic signature for a PDF document online

The best way to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

How to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

How to generate an eSignature for a PDF file on Android OS

People also ask

-

What are the 2019 Georgia income tax forms that I need to file?

The primary 2019 Georgia income tax forms include the Form 500 for individual income tax and Form 501 for part-year residents. It's important to check if additional forms are required based on your specific tax situation. Using airSlate SignNow can help you streamline the eSignature process for these forms.

-

How can I obtain the 2019 Georgia income tax forms?

You can download the 2019 Georgia income tax forms directly from the Georgia Department of Revenue's website. Additionally, with airSlate SignNow, you can easily send these forms for eSigning, making your filing process more efficient. Ensure you have the most updated versions before filing.

-

Are there any fees associated with filing the 2019 Georgia income tax forms online?

Filing the 2019 Georgia income tax forms online usually incurs a fee if you choose a paid tax platform, but it may be free through the Georgia Department of Revenue website. AirSlate SignNow offers competitive pricing for document eSigning, which can make your overall process cost-effective. Always check for any additional fees associated with your chosen method of filing.

-

What features does airSlate SignNow offer for handling 2019 Georgia income tax forms?

AirSlate SignNow provides features such as easy eSignature collection, document templates, and seamless integrations with accounting software. These features simplify the management of your 2019 Georgia income tax forms and ensure compliance. Plus, you can track the signing progress in real-time.

-

Can I use airSlate SignNow to sign 2019 Georgia income tax forms on my mobile device?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to sign your 2019 Georgia income tax forms anytime and anywhere. This flexibility ensures that you can manage your tax documents without being tied to a desktop. The mobile app is user-friendly and convenient for on-the-go signing.

-

What are the benefits of using airSlate SignNow for my 2019 Georgia income tax forms?

Using airSlate SignNow for your 2019 Georgia income tax forms offers the benefits of faster processing, increased security, and a reduced chance of errors. You can sign documents electronically without printing them, saving time and resources. This streamlined process helps you comply with tax deadlines efficiently.

-

Are there integrations available for airSlate SignNow to manage my 2019 Georgia income tax forms?

AirSlate SignNow integrates seamlessly with a variety of accounting and tax software, such as QuickBooks and Xero. This integration helps you keep all your paperwork organized and enables you to manage your 2019 Georgia income tax forms more effectively. By connecting your tools, you enhance efficiency and reduce manual entry tasks.

Get more for Georgia Tax Center

- Vt landlord 497428811 form

- Letter from tenant to landlord for 30 day notice to landlord that tenant will vacate premises on or prior to expiration of 497428812 form

- Letter from tenant to landlord about insufficient notice to terminate rental agreement vermont form

- Letter from tenant to landlord about insufficient notice of change in rental agreement for other than rent increase vermont form

- Letter from landlord to tenant as notice to remove unauthorized inhabitants vermont form

- Letter from tenant to landlord utility shut off notice to landlord due to tenant vacating premises vermont form

- Letter from tenant to landlord about inadequacy of heating resources insufficient heat vermont form

- Petition to open trust estate vermont form

Find out other Georgia Tax Center

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement