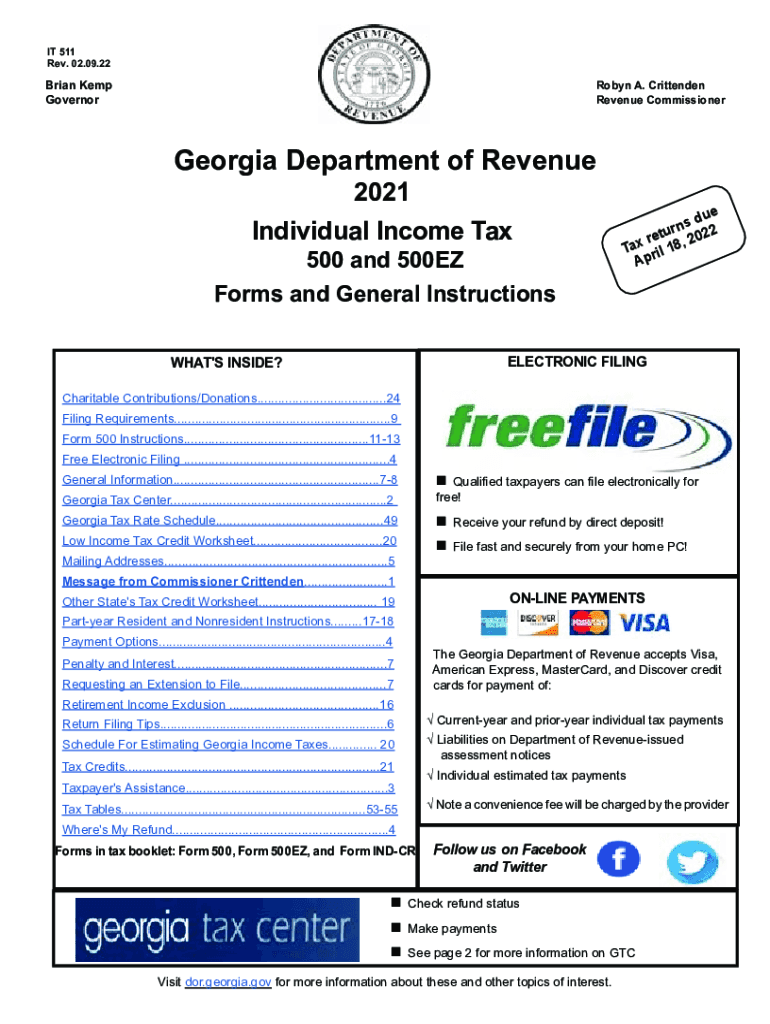

it 511 Individual Income Tax 500 and 500EZ Forms and General 2022

What is the Georgia Form 500?

The Georgia Form 500 is the state income tax return form used by residents of Georgia to report their annual income to the Georgia Department of Revenue. This form is essential for individuals and couples filing their state taxes, as it allows them to calculate their tax liability based on their income, deductions, and credits. The form is designed to accommodate various income sources, including wages, self-employment income, and investment earnings.

Steps to Complete the Georgia Form 500

Completing the Georgia Form 500 involves several key steps to ensure accuracy and compliance with state tax laws. Here is a simplified process:

- Gather necessary documents, including W-2s, 1099s, and records of other income.

- Determine your filing status, which can affect your tax rate and eligibility for certain deductions.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income, including wages, interest, dividends, and any other sources.

- Claim any deductions or credits you qualify for, such as the standard deduction or specific itemized deductions.

- Calculate your total tax liability and any payments already made.

- Sign and date the form before submission.

Filing Deadlines for the Georgia Form 500

It is crucial to be aware of the filing deadlines for the Georgia Form 500 to avoid penalties. Typically, the deadline for filing your state income tax return is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers can also request an extension, but it is important to pay any estimated taxes owed by the original deadline to avoid interest and penalties.

Required Documents for Filing the Georgia Form 500

To accurately complete the Georgia Form 500, certain documents are necessary. These include:

- W-2 forms from employers, detailing annual wages and withheld taxes.

- 1099 forms for other income sources, such as freelance work or interest income.

- Records of deductible expenses, including medical costs, mortgage interest, and property taxes.

- Any documentation for tax credits you intend to claim.

Form Submission Methods

The Georgia Form 500 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online filing through the Georgia Department of Revenue's e-file system, which is convenient and secure.

- Mailing a paper copy of the completed form to the appropriate address specified by the Georgia Department of Revenue.

- In-person submission at local tax offices, which may offer assistance with the filing process.

Legal Use of the Georgia Form 500

Filing the Georgia Form 500 is a legal requirement for residents earning income in the state. Failure to file can result in penalties, including fines and interest on unpaid taxes. It is essential to ensure that all information provided is accurate and complete to maintain compliance with state tax laws. Utilizing reliable electronic solutions for filing can enhance the security and legality of the submission process.

Quick guide on how to complete it 511 individual income tax 500 and 500ez forms and general

Complete IT 511 Individual Income Tax 500 And 500EZ Forms And General effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle IT 511 Individual Income Tax 500 And 500EZ Forms And General on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign IT 511 Individual Income Tax 500 And 500EZ Forms And General seamlessly

- Find IT 511 Individual Income Tax 500 And 500EZ Forms And General and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your amendments.

- Choose how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate worries about misplaced or lost documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Modify and electronically sign IT 511 Individual Income Tax 500 And 500EZ Forms And General and guarantee exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct it 511 individual income tax 500 and 500ez forms and general

Create this form in 5 minutes!

People also ask

-

What are Georgia 500 instructions for using airSlate SignNow?

The Georgia 500 instructions provide a streamlined process for completing essential documents electronically. With airSlate SignNow, users can easily follow these instructions to eSign and submit their documents, ensuring compliance with state regulations.

-

How does airSlate SignNow help with Georgia 500 instructions?

airSlate SignNow simplifies the completion of Georgia 500 instructions by allowing users to fill out and sign documents online. This not only expedites the process but also enhances accuracy, as digital signatures reduce the chances of errors compared to traditional methods.

-

Is there a cost associated with following Georgia 500 instructions on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. These plans provide access to features that facilitate following Georgia 500 instructions effectively, including templates and secure storage.

-

What features does airSlate SignNow provide for Georgia 500 instructions?

airSlate SignNow includes features such as document templates, real-time tracking, and secure eSignatures that simplify the workflow for Georgia 500 instructions. These tools ensure that users can efficiently manage their documents from start to finish.

-

Can airSlate SignNow integrate with other software for processing Georgia 500 instructions?

Yes, airSlate SignNow offers integrations with various software applications that enhance the management of Georgia 500 instructions. This allows for seamless workflow across platforms, making it easier to manage documents in a cohesive manner.

-

What are the benefits of using airSlate SignNow for Georgia 500 instructions?

Using airSlate SignNow for Georgia 500 instructions provides several benefits, including reduced turnaround time and enhanced security for document transactions. The platform's user-friendly interface ensures that both individuals and businesses can navigate the eSignature process with ease.

-

How secure is the airSlate SignNow platform for Georgia 500 instructions?

The airSlate SignNow platform employs top-level security measures to protect documents related to Georgia 500 instructions. This includes encryption and secure access, ensuring that sensitive information is handled with the utmost care.

Get more for IT 511 Individual Income Tax 500 And 500EZ Forms And General

- Agreed cancellation of lease north dakota form

- Amendment of residential lease north dakota form

- Agreement for payment of unpaid rent north dakota form

- Commercial lease assignment from tenant to new tenant north dakota form

- Tenant consent to background and reference check north dakota form

- Residential lease or rental agreement for month to month north dakota form

- Residential rental lease agreement north dakota form

- Tenant welcome letter north dakota form

Find out other IT 511 Individual Income Tax 500 And 500EZ Forms And General

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors