M4np, Unrelated Business Income Tax Return Form

What is the M4np, Unrelated Business Income Tax Return

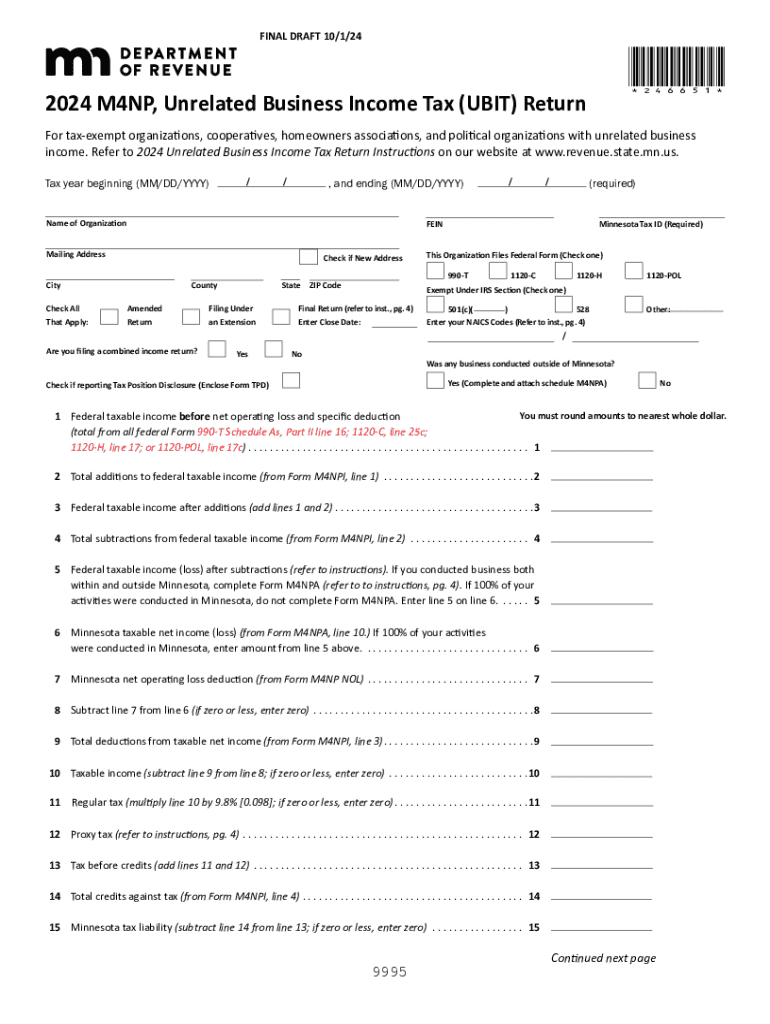

The M4np form, officially known as the Unrelated Business Income Tax Return, is a tax document used by organizations to report income generated from activities that are not substantially related to their exempt purpose. This form is particularly relevant for non-profit entities that engage in business activities that may generate taxable income. Understanding the M4np form is crucial for compliance with IRS regulations and to avoid potential penalties.

Steps to complete the M4np, Unrelated Business Income Tax Return

Completing the M4np form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents related to unrelated business income. This includes income statements, expense reports, and any relevant receipts. Next, fill out the form by providing detailed information about the organization, the nature of the unrelated business activities, and the income generated. It is important to accurately report all income and related expenses to calculate the correct tax liability. Finally, review the completed form for errors before submission.

Filing Deadlines / Important Dates

The M4np form must be filed by the fifteenth day of the fifth month after the end of the organization's fiscal year. For organizations operating on a calendar year basis, this means the deadline is typically May 15. It is essential to adhere to this deadline to avoid late filing penalties. Additionally, organizations should be aware of any changes in tax law that may affect filing dates or requirements.

Who Issues the Form

The M4np form is issued by the Internal Revenue Service (IRS). Organizations must ensure they are using the most current version of the form, as updates may occur annually. The IRS provides guidelines and instructions for completing the form, which can be accessed through their official publications. Staying informed about any changes to the form or filing requirements is important for compliance.

Legal use of the M4np, Unrelated Business Income Tax Return

The M4np form serves a legal purpose by ensuring that organizations report any unrelated business income accurately. This is crucial for maintaining tax-exempt status under IRS regulations. Failure to file the M4np form when required can result in penalties, including the loss of tax-exempt status. Organizations must understand the legal implications of their unrelated business activities and ensure compliance with all relevant tax laws.

Key elements of the M4np, Unrelated Business Income Tax Return

Key elements of the M4np form include sections for reporting income, expenses, and the calculation of unrelated business taxable income. Organizations must provide detailed descriptions of the business activities, the amount of income generated, and any associated costs. Additionally, the form requires information about the organization itself, including its tax identification number and exempt status. Accurate reporting of these elements is essential for proper tax assessment.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the m4np unrelated business income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the m4np form and how does it work?

The m4np form is a digital document designed for efficient electronic signing and management. With airSlate SignNow, users can easily create, send, and eSign the m4np form, streamlining the process of document handling. This ensures that all parties can access and sign the form from anywhere, enhancing productivity.

-

How much does it cost to use the m4np form with airSlate SignNow?

airSlate SignNow offers competitive pricing plans that include the ability to use the m4np form. Pricing varies based on the features and number of users, making it a cost-effective solution for businesses of all sizes. You can choose a plan that best fits your needs and budget.

-

What features are included with the m4np form in airSlate SignNow?

The m4np form in airSlate SignNow comes with a variety of features, including customizable templates, secure eSigning, and real-time tracking. These features help ensure that your documents are processed quickly and securely. Additionally, users can integrate the m4np form with other applications for enhanced functionality.

-

What are the benefits of using the m4np form for my business?

Using the m4np form can signNowly reduce the time and resources spent on document management. It allows for faster turnaround times and improved accuracy, as all signatures and edits are captured electronically. This not only enhances efficiency but also contributes to a more environmentally friendly approach by reducing paper usage.

-

Can I integrate the m4np form with other software?

Yes, airSlate SignNow allows for seamless integration of the m4np form with various software applications. This includes CRM systems, cloud storage services, and productivity tools, enabling you to streamline your workflow. Integrating the m4np form with your existing tools enhances collaboration and efficiency.

-

Is the m4np form secure for sensitive information?

Absolutely, the m4np form is designed with security in mind. airSlate SignNow employs advanced encryption and security protocols to protect your sensitive information. This ensures that all data shared through the m4np form remains confidential and secure.

-

How can I track the status of the m4np form?

With airSlate SignNow, you can easily track the status of the m4np form in real-time. The platform provides notifications and updates on when the form is sent, viewed, and signed. This feature helps you stay informed and manage your documents effectively.

Get more for M4np, Unrelated Business Income Tax Return

Find out other M4np, Unrelated Business Income Tax Return

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy