Form M11h

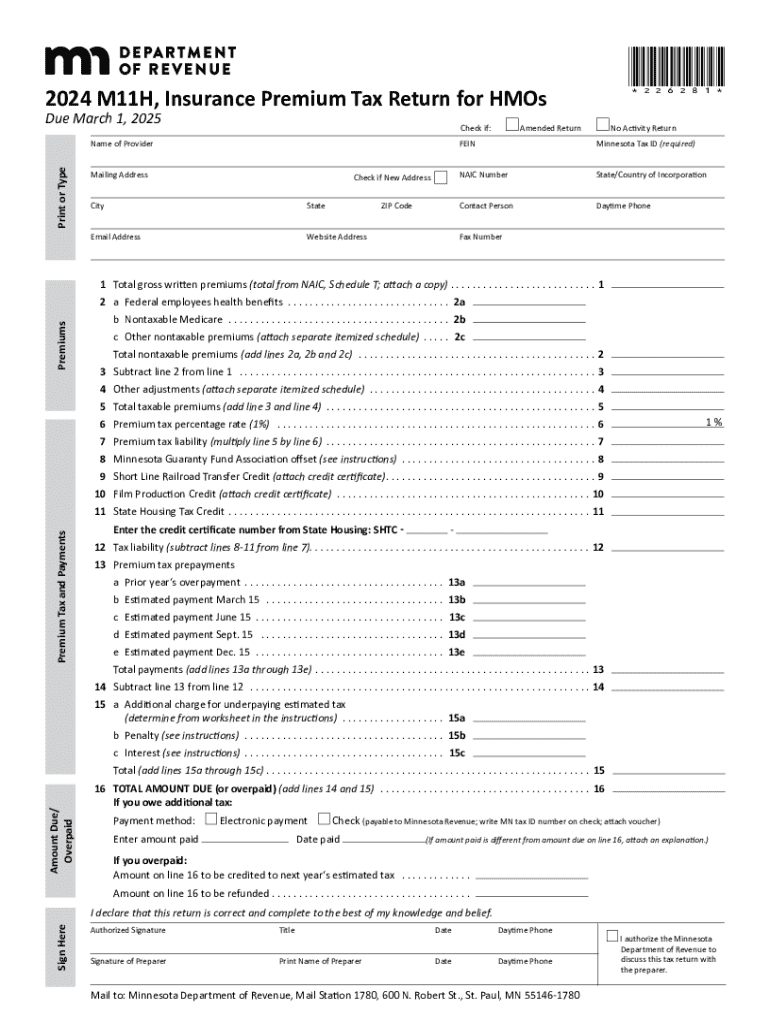

What is the Form M11h

The Form M11h is a specific document used in various administrative processes. It is essential for individuals and businesses to understand its purpose and application. This form typically relates to specific regulatory or compliance requirements, ensuring that necessary information is collected and submitted to the relevant authorities. Understanding the Form M11h is crucial for maintaining compliance and avoiding potential legal issues.

How to use the Form M11h

Using the Form M11h involves several steps to ensure accurate completion. First, gather all necessary information required for the form, including personal details, business information, and any supporting documents. Next, carefully fill out the form, ensuring that all fields are completed accurately to avoid delays or rejections. Once completed, review the form for any errors before submission. Depending on the requirements, the form can be submitted electronically or via traditional mail.

Steps to complete the Form M11h

Completing the Form M11h requires attention to detail. Follow these steps:

- Gather all relevant information and documents needed for the form.

- Read the instructions carefully to understand the requirements.

- Fill out the form completely, ensuring accuracy in all entries.

- Review the completed form for any mistakes or omissions.

- Submit the form according to the specified submission methods.

Legal use of the Form M11h

The legal use of the Form M11h is critical for compliance with applicable regulations. This form may be required by government agencies or other regulatory bodies, and failure to use it correctly can result in penalties. It is important to understand the legal implications of the information provided on the form and to ensure that it is submitted within the required timelines to avoid any legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Form M11h can vary based on the specific requirements of the agency or organization requesting the form. It is essential to be aware of these deadlines to ensure timely submission. Missing a deadline may result in penalties or complications in processing. Always check for the most current deadlines and plan accordingly to ensure compliance.

Required Documents

When completing the Form M11h, certain documents may be required to support the information provided. Commonly required documents may include identification, proof of residency, or business registration details. Having these documents ready can facilitate a smoother completion process and help avoid delays in submission.

Form Submission Methods (Online / Mail / In-Person)

The Form M11h can typically be submitted through various methods, including online platforms, traditional mail, or in-person submissions. Each method may have different processing times and requirements. Online submissions are often faster and may provide immediate confirmation of receipt, while mail submissions can take longer. In-person submissions may be necessary for certain situations, depending on the specific requirements of the agency involved.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form m11h

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form M11h and how can airSlate SignNow help with it?

Form M11h is a specific document used for various business processes. airSlate SignNow simplifies the completion and signing of Form M11h by providing an intuitive platform that allows users to send, sign, and manage documents electronically, ensuring efficiency and compliance.

-

Is there a cost associated with using airSlate SignNow for Form M11h?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that streamline the process of handling Form M11h, making it a cost-effective solution for businesses of all sizes.

-

What features does airSlate SignNow offer for managing Form M11h?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure eSignature capabilities specifically designed for documents like Form M11h. These features enhance productivity and ensure that your documents are handled efficiently.

-

Can I integrate airSlate SignNow with other applications for Form M11h?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing you to manage Form M11h alongside your existing tools. This integration capability enhances workflow efficiency and ensures that all your documents are easily accessible.

-

How does airSlate SignNow ensure the security of Form M11h?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and compliance measures to protect your Form M11h and other sensitive documents, ensuring that your data remains safe throughout the signing process.

-

What are the benefits of using airSlate SignNow for Form M11h?

Using airSlate SignNow for Form M11h offers numerous benefits, including faster turnaround times, reduced paperwork, and improved accuracy. The platform's user-friendly interface makes it easy for anyone to manage their documents efficiently.

-

Is airSlate SignNow suitable for small businesses handling Form M11h?

Yes, airSlate SignNow is designed to cater to businesses of all sizes, including small businesses. Its affordable pricing and robust features make it an ideal choice for small businesses looking to streamline their processes related to Form M11h.

Get more for Form M11h

- Installment promissory note document form

- Confessed judgment 497337649 form

- Unsafe living conditions form

- Odometer statement 497337651 form

- Affidavit as to principals competence at time of granting power of attorney form

- Transferring death form

- Adverse possession affidavit north carolina form

- Right way agreement sample form

Find out other Form M11h

- eSignature Montana Home Loan Application Online

- eSignature New Hampshire Home Loan Application Online

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online