M1CD, Child and Dependent Care Credit M1CD, Child and Dependent Care Credit Form

Understanding the M1CD, Child And Dependent Care Credit

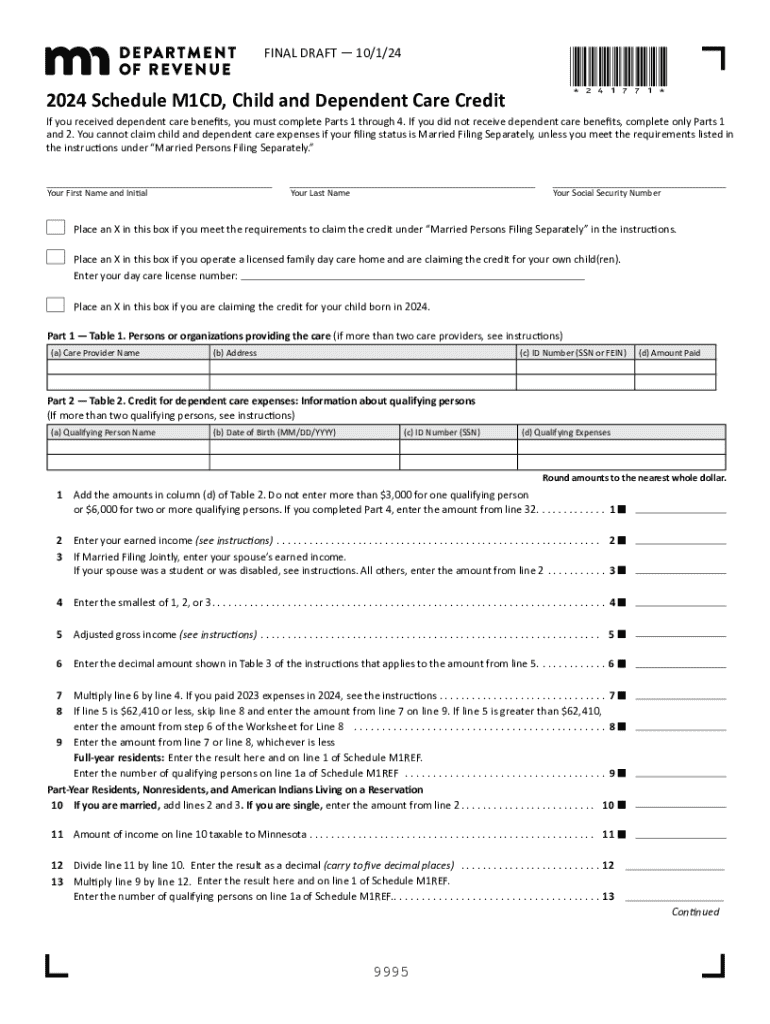

The M1CD, Child And Dependent Care Credit, is a tax credit designed to assist taxpayers in covering the costs of care for their children or dependents while they work or look for work. This credit can significantly reduce the tax burden for families, allowing them to allocate more resources toward essential needs. The credit applies to expenses incurred for the care of children under the age of thirteen or for dependents who are physically or mentally incapable of self-care.

Eligibility Criteria for the M1CD, Child And Dependent Care Credit

To qualify for the M1CD, Child And Dependent Care Credit, taxpayers must meet specific criteria. Eligible taxpayers include those who have earned income and are responsible for paying care expenses for qualifying individuals. The care must be provided so that the taxpayer can work or seek employment. Additionally, the care provider cannot be a relative of the child or dependent. It is essential to ensure that all eligibility requirements are met to maximize the credit amount.

Steps to Complete the M1CD, Child And Dependent Care Credit

Completing the M1CD, Child And Dependent Care Credit involves several steps. First, gather all necessary documentation, including receipts for care expenses and the provider’s information. Next, fill out the M1CD form accurately, ensuring all required fields are completed. Calculate the credit amount based on your qualifying expenses and follow the instructions for submission. It is advisable to keep copies of all documents for your records.

Required Documents for the M1CD, Child And Dependent Care Credit

When applying for the M1CD, Child And Dependent Care Credit, certain documents are necessary to support your claim. These typically include:

- Receipts or invoices from care providers.

- The provider’s name, address, and taxpayer identification number.

- Proof of your earned income, such as W-2 forms or pay stubs.

- Documentation of the dependent’s age and relationship to you.

Having these documents ready will facilitate a smoother application process.

Filing Deadlines for the M1CD, Child And Dependent Care Credit

It is crucial to be aware of the filing deadlines related to the M1CD, Child And Dependent Care Credit. Typically, the deadline aligns with the federal income tax filing deadline, which is usually April fifteenth. However, if you file for an extension, you may have additional time to submit your claim. Always verify the specific dates for the tax year you are filing to ensure compliance.

IRS Guidelines for the M1CD, Child And Dependent Care Credit

The IRS provides comprehensive guidelines for claiming the M1CD, Child And Dependent Care Credit. Taxpayers should refer to IRS Publication 503, which outlines the rules for this credit, including eligibility requirements, qualifying expenses, and how to calculate the credit. Staying informed about these guidelines helps ensure that you claim the credit correctly and avoid potential issues with your tax return.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the m1cd child and dependent care credit m1cd child and dependent care credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the M1CD, Child And Dependent Care Credit?

The M1CD, Child And Dependent Care Credit is a tax credit designed to help families offset the costs of child and dependent care. This credit can signNowly reduce your tax liability, making it easier for parents to manage work and family responsibilities. Understanding this credit is essential for maximizing your tax benefits.

-

How can I qualify for the M1CD, Child And Dependent Care Credit?

To qualify for the M1CD, Child And Dependent Care Credit, you must have incurred expenses for the care of a qualifying child or dependent while you worked or looked for work. Additionally, your income level and the amount of care expenses will determine the credit amount. It's important to review the eligibility criteria to ensure you can take advantage of this benefit.

-

What are the benefits of using airSlate SignNow for M1CD, Child And Dependent Care Credit documentation?

Using airSlate SignNow simplifies the process of managing documents related to the M1CD, Child And Dependent Care Credit. Our platform allows you to easily send, sign, and store important documents securely. This efficiency can save you time and reduce stress during tax season.

-

Are there any costs associated with airSlate SignNow for M1CD, Child And Dependent Care Credit services?

airSlate SignNow offers a cost-effective solution for managing your M1CD, Child And Dependent Care Credit documentation. Our pricing plans are designed to fit various budgets, ensuring that you can access essential features without breaking the bank. You can choose a plan that best suits your needs.

-

Can I integrate airSlate SignNow with other software for M1CD, Child And Dependent Care Credit?

Yes, airSlate SignNow offers seamless integrations with various software applications that can assist with the M1CD, Child And Dependent Care Credit process. This allows you to streamline your workflow and enhance productivity by connecting your existing tools with our eSigning solution.

-

What features does airSlate SignNow provide for managing M1CD, Child And Dependent Care Credit documents?

airSlate SignNow provides a range of features tailored for managing M1CD, Child And Dependent Care Credit documents, including customizable templates, secure eSigning, and document tracking. These features ensure that your documents are handled efficiently and securely, making the tax process smoother.

-

How does airSlate SignNow ensure the security of my M1CD, Child And Dependent Care Credit documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your M1CD, Child And Dependent Care Credit documents. This ensures that your sensitive information remains confidential and safe from unauthorized access.

Get more for M1CD, Child And Dependent Care Credit M1CD, Child And Dependent Care Credit

- Virginia husband wife form

- Va property agreement form

- Va agreement form 497427990

- Amendment to postnuptial property agreement virginia virginia form

- Quitclaim deed from husband and wife to an individual virginia form

- Virginia husband wife 497427993 form

- Quitclaim deed from husband and wife to three individuals virginia form

- Virginia quitclaim 497427995 form

Find out other M1CD, Child And Dependent Care Credit M1CD, Child And Dependent Care Credit

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later