Financial Account Transfer to Living Trust Vermont Form

What is the Financial Account Transfer To Living Trust Vermont

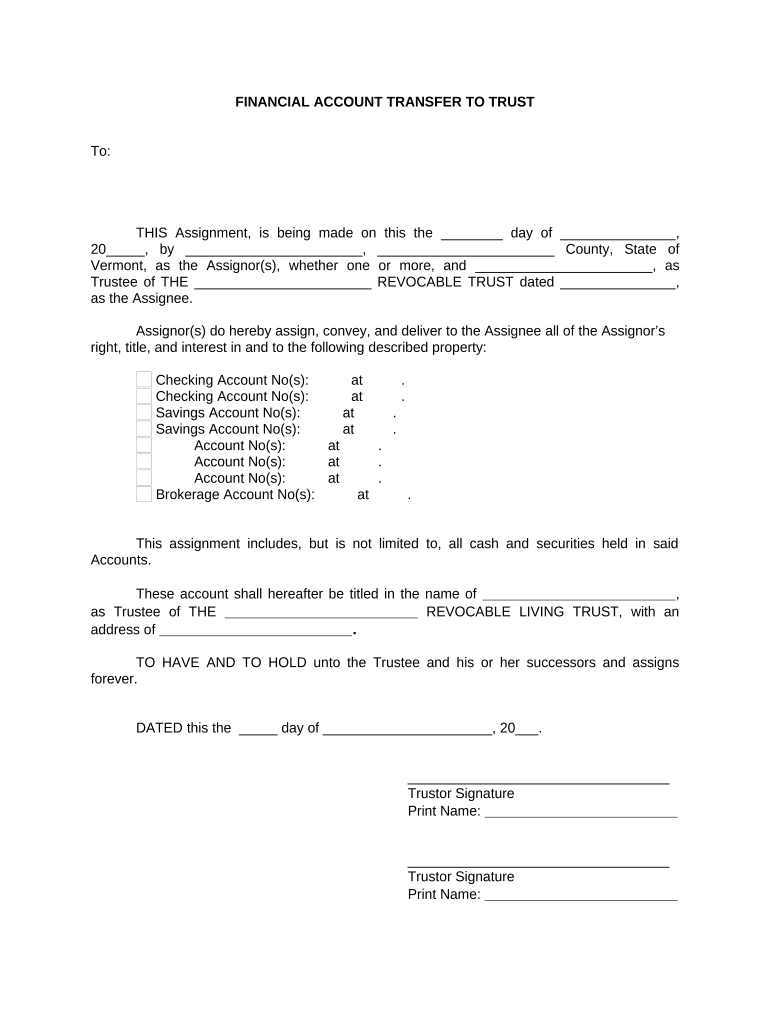

The Financial Account Transfer To Living Trust Vermont is a legal document used to transfer ownership of financial accounts into a living trust. This process allows individuals to manage their assets during their lifetime and ensure a smooth transition upon their passing. By transferring accounts such as bank accounts, investment accounts, and retirement accounts into a living trust, individuals can avoid probate, maintain privacy, and provide clear instructions for asset distribution. This form is essential for anyone looking to streamline their estate planning in Vermont.

Steps to complete the Financial Account Transfer To Living Trust Vermont

Completing the Financial Account Transfer To Living Trust Vermont involves several key steps to ensure accuracy and compliance:

- Gather necessary information about the financial accounts, including account numbers and institution details.

- Review the terms of your living trust to ensure it aligns with your estate planning goals.

- Fill out the transfer form accurately, providing all required details about the accounts and the trust.

- Sign the form as required, ensuring that you follow any specific signing requirements set by the financial institution.

- Submit the completed form to the respective financial institutions for processing.

Legal use of the Financial Account Transfer To Living Trust Vermont

The legal use of the Financial Account Transfer To Living Trust Vermont is governed by state laws and regulations. This document must comply with Vermont's legal standards for trust and estate planning. It is crucial to ensure that the trust is valid and properly executed, as this will affect the legality of the transfer. Consulting with an estate planning attorney can provide guidance on the legal implications and ensure that all requirements are met for the transfer to be recognized by financial institutions.

State-specific rules for the Financial Account Transfer To Living Trust Vermont

Vermont has specific rules regarding the Financial Account Transfer To Living Trust that individuals must adhere to. These rules include the need for the trust to be properly created and executed according to Vermont law. Additionally, financial institutions may have their own requirements for accepting the transfer, such as needing a copy of the trust document or specific identification of the trustee. Understanding these state-specific regulations helps ensure a smooth transfer process.

Required Documents

To complete the Financial Account Transfer To Living Trust Vermont, several documents are typically required:

- A completed Financial Account Transfer To Living Trust form.

- A copy of the living trust document, which outlines the terms and conditions of the trust.

- Identification documents for the trustee, such as a driver's license or Social Security number.

- Any additional forms required by the financial institution, which may vary by institution.

How to use the Financial Account Transfer To Living Trust Vermont

Using the Financial Account Transfer To Living Trust Vermont involves a straightforward process. First, ensure that the living trust is established and valid. Next, gather all necessary information about the financial accounts you wish to transfer. Complete the transfer form accurately, including all required details. After signing the form, submit it to the financial institutions holding the accounts. Follow up with these institutions to confirm that the transfer has been processed successfully.

Quick guide on how to complete financial account transfer to living trust vermont

Accomplish Financial Account Transfer To Living Trust Vermont effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Handle Financial Account Transfer To Living Trust Vermont on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to modify and electronically sign Financial Account Transfer To Living Trust Vermont with ease

- Find Financial Account Transfer To Living Trust Vermont and click Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method for sharing your form—via email, text message (SMS), invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Financial Account Transfer To Living Trust Vermont to ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is involved in a Financial Account Transfer To Living Trust in Vermont?

A Financial Account Transfer To Living Trust Vermont involves officially re-titling your financial accounts, such as bank accounts and investment portfolios, into the name of the trust. This process typically requires completing specific forms provided by your financial institution and submitting them along with a copy of the trust document. It's essential to follow Vermont's legal requirements to ensure the transfer is valid and effective.

-

What are the benefits of a Financial Account Transfer To Living Trust Vermont?

The primary benefits of a Financial Account Transfer To Living Trust Vermont include avoiding probate, ensuring a seamless transition of your assets upon your death, and maintaining privacy since a living trust does not go through the public probate process. Additionally, this transfer can help minimize estate taxes and provide better control over how your assets are managed and distributed.

-

How do I start a Financial Account Transfer To Living Trust Vermont?

To initiate a Financial Account Transfer To Living Trust Vermont, begin by drafting a living trust document that outlines your wishes. Next, contact your financial institutions to inquire about their specific requirements for transferring accounts to your trust. Be prepared to provide necessary documentation, such as your trust agreement and identification.

-

Are there any costs associated with a Financial Account Transfer To Living Trust Vermont?

Yes, there may be costs associated with a Financial Account Transfer To Living Trust Vermont, which can include fees charged by your financial institutions for processing the transfer, as well as potential legal fees if you hire an attorney to create your trust. It's advisable to inquire about any and all fees before commencing the transfer process to ensure you are fully informed.

-

Can I make changes to my living trust after the Financial Account Transfer To Living Trust Vermont?

Yes, one of the advantages of a living trust is that it remains flexible. You can amend or revoke your living trust at any time, even after you have completed the Financial Account Transfer To Living Trust Vermont. Make sure to document any modifications properly to ensure they are enforceable.

-

What types of accounts can be transferred to a living trust in Vermont?

Generally, various types of financial accounts can be transferred to a living trust in Vermont, including checking and savings accounts, brokerage accounts, and certificates of deposit. However, certain accounts like retirement accounts may have specific rules regarding transfer; consider seeking legal advice for tailored guidance.

-

Is there a deadline for completing a Financial Account Transfer To Living Trust Vermont?

There is no strict deadline for completing a Financial Account Transfer To Living Trust Vermont, but it is advisable to do so during your lifetime to ensure your assets are managed according to your wishes at the time of your passing. Delaying the transfer can lead to complications regarding estate management and distribution.

Get more for Financial Account Transfer To Living Trust Vermont

- Colorado new state resident packageus legal forms

- Limited partnership or llc is the grantor or form

- Control number co sdeed 8 11 form

- Control number co sdeed 8 15 form

- Legal advice on divorcepage 1 avvo form

- Title changes and reassessment of real propertya people form

- Three 3 individuals to l form

- Individual to limited liability form

Find out other Financial Account Transfer To Living Trust Vermont

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract