PTAX 300 H Application for Hospital Property Tax Exemption 2018-2026

What is the PTAX 300 H Application For Hospital Property Tax Exemption

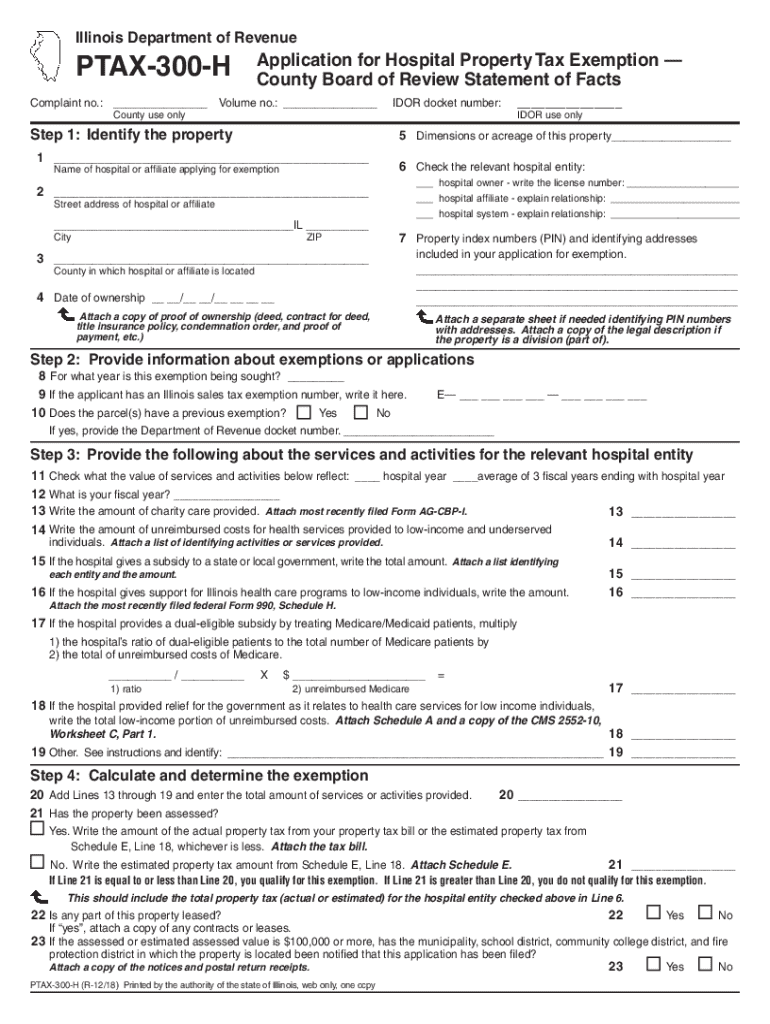

The PTAX 300 H Application For Hospital Property Tax Exemption is a specific form used by hospitals in the United States to apply for property tax exemptions. This application is essential for healthcare facilities seeking to reduce their tax liabilities on properties used for charitable purposes. The form outlines the criteria that must be met to qualify for the exemption, including the nature of the services provided and the financial status of the hospital.

Steps to complete the PTAX 300 H Application For Hospital Property Tax Exemption

Completing the PTAX 300 H Application involves several key steps. First, gather all necessary documentation that supports your eligibility for the exemption. This includes financial statements, proof of nonprofit status, and details about the services provided to the community. Next, fill out the application form accurately, ensuring that all sections are completed and that the information provided is truthful. After completing the form, review it for any errors or omissions before submission.

Eligibility Criteria

To qualify for the PTAX 300 H Application For Hospital Property Tax Exemption, hospitals must meet specific eligibility criteria. Generally, the facility must be a nonprofit organization, providing medical services that benefit the community. Additionally, the property in question must be used primarily for charitable purposes. Hospitals should also demonstrate financial need, showing that the exemption is necessary for maintaining operations and providing services.

Required Documents

When submitting the PTAX 300 H Application, several documents are required to support your claim. These typically include:

- Proof of nonprofit status, such as IRS determination letters.

- Financial statements for the past few years, including balance sheets and income statements.

- Documentation of services provided to the community, highlighting charitable activities.

- Any additional information requested by the local tax authority.

Form Submission Methods

The PTAX 300 H Application can be submitted through various methods, depending on the local tax authority's requirements. Common submission methods include:

- Online submission through the tax authority's website.

- Mailing a physical copy of the application to the designated office.

- In-person submission at the local tax office, which may allow for immediate feedback or assistance.

Application Process & Approval Time

The application process for the PTAX 300 H typically involves a review by the local tax authority. After submission, applicants can expect a waiting period for approval, which may vary based on the jurisdiction. Generally, the review process can take several weeks to a few months. It is advisable for applicants to follow up with the tax authority to check on the status of their application and provide any additional information if requested.

Create this form in 5 minutes or less

Find and fill out the correct ptax 300 h application for hospital property tax exemption

Create this form in 5 minutes!

How to create an eSignature for the ptax 300 h application for hospital property tax exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PTAX 300 H Application For Hospital Property Tax Exemption?

The PTAX 300 H Application For Hospital Property Tax Exemption is a form used by hospitals to apply for property tax exemptions in Illinois. This application helps eligible hospitals reduce their tax burden, allowing them to allocate more resources towards patient care and services.

-

How can airSlate SignNow assist with the PTAX 300 H Application For Hospital Property Tax Exemption?

airSlate SignNow streamlines the process of completing and submitting the PTAX 300 H Application For Hospital Property Tax Exemption. Our platform allows you to easily fill out, sign, and send the application electronically, ensuring a faster and more efficient submission process.

-

What are the benefits of using airSlate SignNow for the PTAX 300 H Application For Hospital Property Tax Exemption?

Using airSlate SignNow for the PTAX 300 H Application For Hospital Property Tax Exemption offers several benefits, including reduced paperwork, faster processing times, and enhanced security for sensitive information. Our solution is designed to simplify the application process, making it easier for hospitals to focus on their core mission.

-

Is there a cost associated with using airSlate SignNow for the PTAX 300 H Application For Hospital Property Tax Exemption?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including options for hospitals looking to manage the PTAX 300 H Application For Hospital Property Tax Exemption. Our plans are cost-effective and designed to provide value through efficient document management and eSigning capabilities.

-

Can airSlate SignNow integrate with other software for the PTAX 300 H Application For Hospital Property Tax Exemption?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions, enhancing your workflow when handling the PTAX 300 H Application For Hospital Property Tax Exemption. This integration allows for better data management and ensures that all relevant information is easily accessible.

-

What features does airSlate SignNow offer for managing the PTAX 300 H Application For Hospital Property Tax Exemption?

airSlate SignNow provides features such as customizable templates, secure eSigning, and real-time tracking for the PTAX 300 H Application For Hospital Property Tax Exemption. These features help ensure that your application is completed accurately and submitted on time.

-

How secure is the information submitted through airSlate SignNow for the PTAX 300 H Application For Hospital Property Tax Exemption?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect all information submitted through the PTAX 300 H Application For Hospital Property Tax Exemption, ensuring that sensitive data remains confidential and secure.

Get more for PTAX 300 H Application For Hospital Property Tax Exemption

- Painting contract for contractor wisconsin form

- Trim carpenter contract for contractor wisconsin form

- Fencing contract for contractor wisconsin form

- Hvac contract for contractor wisconsin form

- Landscape contract for contractor wisconsin form

- Commercial contract for contractor wisconsin form

- Excavator contract for contractor wisconsin form

- Renovation contract for contractor wisconsin form

Find out other PTAX 300 H Application For Hospital Property Tax Exemption

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online