Instructions for Form it 2105 Estimated Income Tax Payment Voucher for Individuals New York State, New York City, Yonkers MCTMT

Understanding Form IT-2105

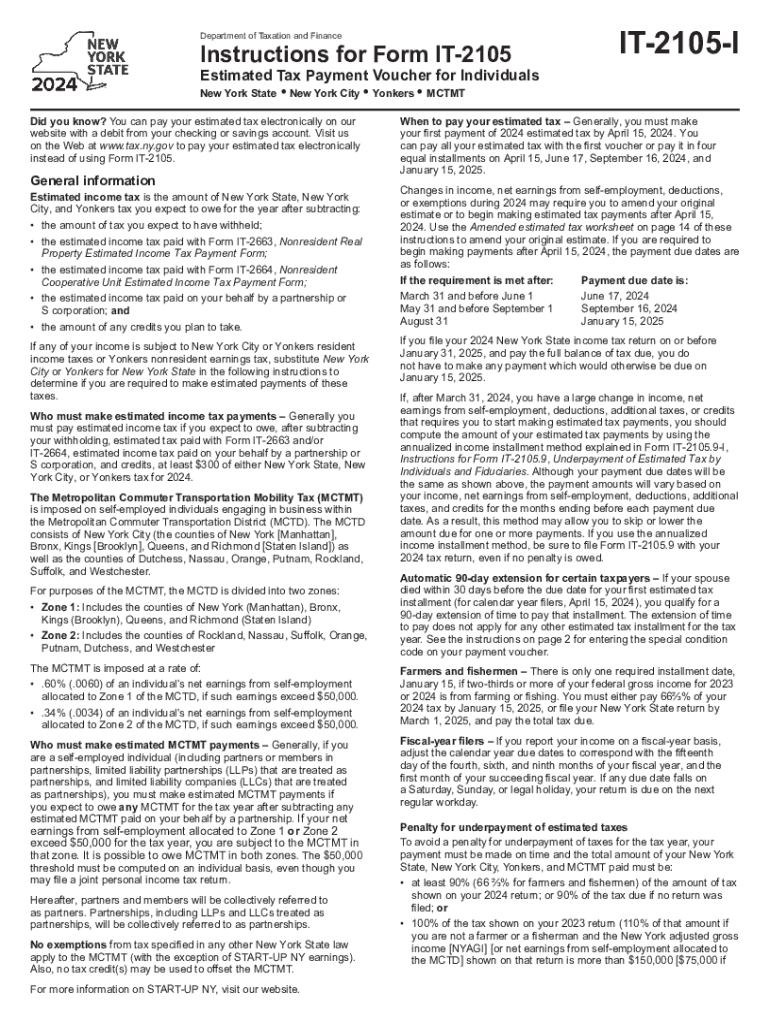

Form IT-2105 is the Estimated Income Tax Payment Voucher for individuals in New York State, specifically addressing tax obligations for New York City and Yonkers residents. This form is essential for taxpayers who expect to owe tax of $300 or more when filing their annual tax return. It allows individuals to make estimated tax payments throughout the year, ensuring compliance with state and local tax requirements.

How to Use Form IT-2105

Using Form IT-2105 involves several key steps. First, determine your estimated tax liability for the year based on your income, deductions, and credits. Then, complete the form by providing your personal information, including your name, address, and Social Security number. After calculating the amount owed, submit the form along with your payment to the appropriate tax authority. Ensure that you keep a copy for your records.

Steps to Complete Form IT-2105

Completing Form IT-2105 requires careful attention to detail. Follow these steps:

- Gather necessary documents, such as income statements and previous tax returns.

- Calculate your estimated income tax for the year.

- Fill out your personal information at the top of the form.

- Enter the calculated estimated tax amount in the designated section.

- Choose your payment method and include payment if submitting by mail.

- Review the form for accuracy before submission.

Filing Deadlines for Form IT-2105

It is crucial to be aware of the filing deadlines for Form IT-2105 to avoid penalties. Generally, estimated tax payments are due quarterly. The due dates are typically April 15, June 15, September 15, and January 15 of the following year. Mark these dates on your calendar to ensure timely submissions and compliance with New York State tax laws.

Required Documents for Form IT-2105

Before completing Form IT-2105, gather the following documents:

- Income statements, such as W-2s or 1099s.

- Records of any deductions or credits you plan to claim.

- Previous year’s tax return for reference.

Having these documents on hand will streamline the process of estimating your tax liability and completing the form accurately.

Penalties for Non-Compliance with Form IT-2105

Failure to file Form IT-2105 or to make the required estimated tax payments can result in penalties. New York State imposes interest on unpaid taxes, as well as a penalty for underpayment. It is advisable to stay informed about your tax obligations and to file the form on time to avoid these consequences.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for form it 2105 estimated income tax payment voucher for individuals new york state new york city yonkers mctmt 708423387

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Instructions For Form IT 2105 Estimated Income Tax Payment Voucher For Individuals New York State, New York City, Yonkers MCTMT Year Tax?

The Instructions For Form IT 2105 Estimated Income Tax Payment Voucher For Individuals New York State, New York City, Yonkers MCTMT Year Tax provide detailed guidance on how to complete the form accurately. This includes information on eligibility, payment deadlines, and how to calculate your estimated tax payments. Following these instructions ensures compliance with state tax regulations.

-

How can airSlate SignNow help with the Instructions For Form IT 2105?

airSlate SignNow simplifies the process of completing the Instructions For Form IT 2105 Estimated Income Tax Payment Voucher For Individuals New York State, New York City, Yonkers MCTMT Year Tax by providing an intuitive platform for eSigning and document management. Users can easily fill out the form, sign it electronically, and send it securely. This streamlines the tax payment process and reduces the risk of errors.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents like the Instructions For Form IT 2105 Estimated Income Tax Payment Voucher For Individuals New York State, New York City, Yonkers MCTMT Year Tax. These features enhance efficiency and ensure that all documents are handled securely and in compliance with regulations.

-

Is there a cost associated with using airSlate SignNow for tax forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and provides access to features that simplify the completion of forms like the Instructions For Form IT 2105 Estimated Income Tax Payment Voucher For Individuals New York State, New York City, Yonkers MCTMT Year Tax. Investing in this solution can save time and reduce the hassle of tax preparation.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software, making it easier to manage the Instructions For Form IT 2105 Estimated Income Tax Payment Voucher For Individuals New York State, New York City, Yonkers MCTMT Year Tax. This integration allows for a smoother workflow and ensures that all necessary documents are readily available for filing.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents like the Instructions For Form IT 2105 Estimated Income Tax Payment Voucher For Individuals New York State, New York City, Yonkers MCTMT Year Tax offers numerous benefits. These include increased efficiency, reduced paperwork, and enhanced security for sensitive information. Additionally, the platform's user-friendly interface makes it accessible for individuals and businesses alike.

-

How secure is airSlate SignNow for handling tax documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect documents like the Instructions For Form IT 2105 Estimated Income Tax Payment Voucher For Individuals New York State, New York City, Yonkers MCTMT Year Tax. Users can trust that their sensitive tax information is safeguarded throughout the signing and submission process.

Get more for Instructions For Form IT 2105 Estimated Income Tax Payment Voucher For Individuals New York State, New York City, Yonkers MCTMT

- Wi formation 497430475

- Wi company form

- Wisconsin operating form

- Wisconsin articles organization form

- Wisconsin liability company form

- Renunciation and disclaimer of property from will by testate wisconsin form

- Wisconsin public lien form

- Quitclaim deed from individual to husband and wife wisconsin form

Find out other Instructions For Form IT 2105 Estimated Income Tax Payment Voucher For Individuals New York State, New York City, Yonkers MCTMT

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors