Form ST 101 New York State and Local Annual Sales and Use Tax Return Revised 224 2024-2026

Understanding the ST 101 Tax Form

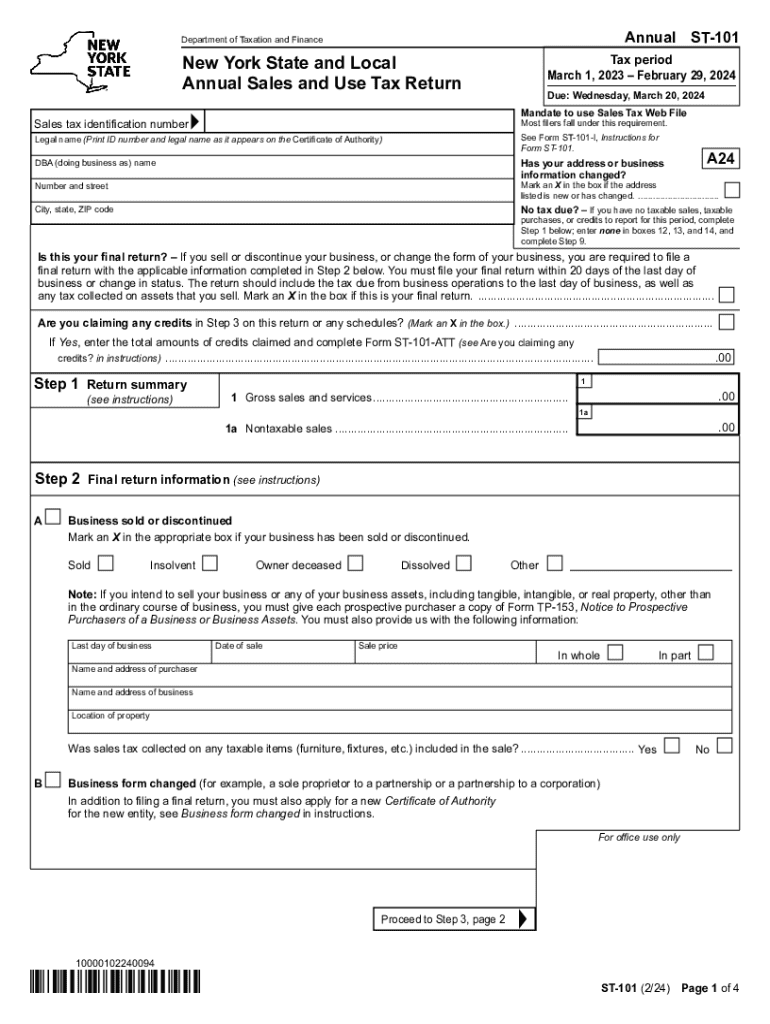

The ST 101 tax form, officially known as the New York State and Local Annual Sales and Use Tax Return, is a crucial document for businesses operating in New York. This form is used to report sales and use tax collected during the year. It is essential for ensuring compliance with state tax regulations and for accurately calculating the amount of tax owed to the state. The form is revised periodically, with the latest version being the Revised 224. Businesses must familiarize themselves with the structure and requirements of this form to avoid penalties and ensure proper tax reporting.

Steps to Complete the ST 101 Tax Form

Completing the ST 101 tax form requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial records, including sales receipts and purchase invoices.

- Determine the total sales and use tax collected during the reporting period.

- Fill out the form accurately, including all required fields such as business information and tax amounts.

- Review the completed form for accuracy, ensuring all calculations are correct.

- Submit the form by the deadline, either electronically or via mail, depending on your preference.

Obtaining the ST 101 Tax Form

The ST 101 tax form can be obtained through various channels. It is available for download from the official New York State Department of Taxation and Finance website. Additionally, businesses can request a physical copy by contacting the department directly. It is advisable to ensure that you are using the most current version of the form to avoid any compliance issues.

Legal Use of the ST 101 Tax Form

The ST 101 tax form is legally required for businesses that collect sales tax in New York. It serves as a formal declaration of the sales and use tax collected during the year. Proper use of this form helps businesses comply with state tax laws and avoid potential legal issues. Filing the form accurately and on time is essential to maintain good standing with tax authorities.

Key Elements of the ST 101 Tax Form

Understanding the key elements of the ST 101 tax form is vital for accurate completion. Important sections include:

- Business Information: This section requires the business name, address, and identification numbers.

- Sales Tax Collected: Here, businesses report the total sales tax collected from customers.

- Deductions: This section allows for reporting any exempt sales or other deductions applicable.

- Total Tax Due: The final calculation of the total sales tax owed to the state is recorded here.

Filing Deadlines and Important Dates

Timely filing of the ST 101 tax form is crucial to avoid penalties. The filing deadline is typically set for the end of the month following the end of the reporting year. For example, if the reporting year ends on December 31, the form must be filed by January 31 of the following year. It is important to keep track of these dates to ensure compliance and avoid late fees.

Create this form in 5 minutes or less

Find and fill out the correct form st 101 new york state and local annual sales and use tax return revised 224

Create this form in 5 minutes!

How to create an eSignature for the form st 101 new york state and local annual sales and use tax return revised 224

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the st 101 tax form and why is it important?

The st 101 tax form is a crucial document used for sales tax exemption in various states. It allows businesses to purchase goods without paying sales tax, provided they meet certain criteria. Understanding the st 101 tax form is essential for companies looking to optimize their tax liabilities and ensure compliance with state regulations.

-

How can airSlate SignNow help with the st 101 tax process?

airSlate SignNow streamlines the process of managing the st 101 tax form by allowing users to easily create, send, and eSign documents. This ensures that all necessary forms are completed accurately and efficiently, reducing the risk of errors. With airSlate SignNow, businesses can focus on their core operations while ensuring compliance with st 101 tax requirements.

-

What features does airSlate SignNow offer for managing st 101 tax forms?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for st 101 tax forms. These tools help businesses manage their documents effectively and ensure that all necessary signatures are obtained promptly. Additionally, the platform provides a user-friendly interface that simplifies the entire process.

-

Is airSlate SignNow cost-effective for handling st 101 tax documentation?

Yes, airSlate SignNow is a cost-effective solution for managing st 101 tax documentation. With flexible pricing plans, businesses can choose an option that fits their budget while still accessing powerful features. This affordability makes it an ideal choice for companies of all sizes looking to streamline their tax processes.

-

Can airSlate SignNow integrate with other software for st 101 tax management?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, enhancing the management of st 101 tax forms. This connectivity allows for seamless data transfer and ensures that all tax-related documents are easily accessible. Integrating with existing systems can signNowly improve efficiency and accuracy in handling st 101 tax documentation.

-

What are the benefits of using airSlate SignNow for st 101 tax forms?

Using airSlate SignNow for st 101 tax forms provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. The platform's eSigning capabilities ensure that documents are signed quickly, while its tracking features keep users informed of the document status. Overall, airSlate SignNow simplifies the st 101 tax process, allowing businesses to save time and resources.

-

How secure is airSlate SignNow when handling st 101 tax documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect st 101 tax documents. This ensures that sensitive information remains confidential and secure throughout the signing process. Businesses can trust airSlate SignNow to handle their tax documentation with the utmost care and security.

Get more for Form ST 101 New York State And Local Annual Sales And Use Tax Return Revised 224

- Determination and order on petition for temporary guardianship wisconsin form

- Wisconsin temporary guardianship 497430989 form

- Wisconsin temporary guardianship 497430990 form

- Wisconsin temporary guardianship form

- Wisconsin temporary guardianship 497430992 form

- Petition guardianship minor form

- Order notice hearing 497430994 form

- Wisconsin guardianship 497430995 form

Find out other Form ST 101 New York State And Local Annual Sales And Use Tax Return Revised 224

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself