Form ST 101215New York State and Local Annual Sales and 2015

What is the Form ST 101215 New York State And Local Annual Sales And

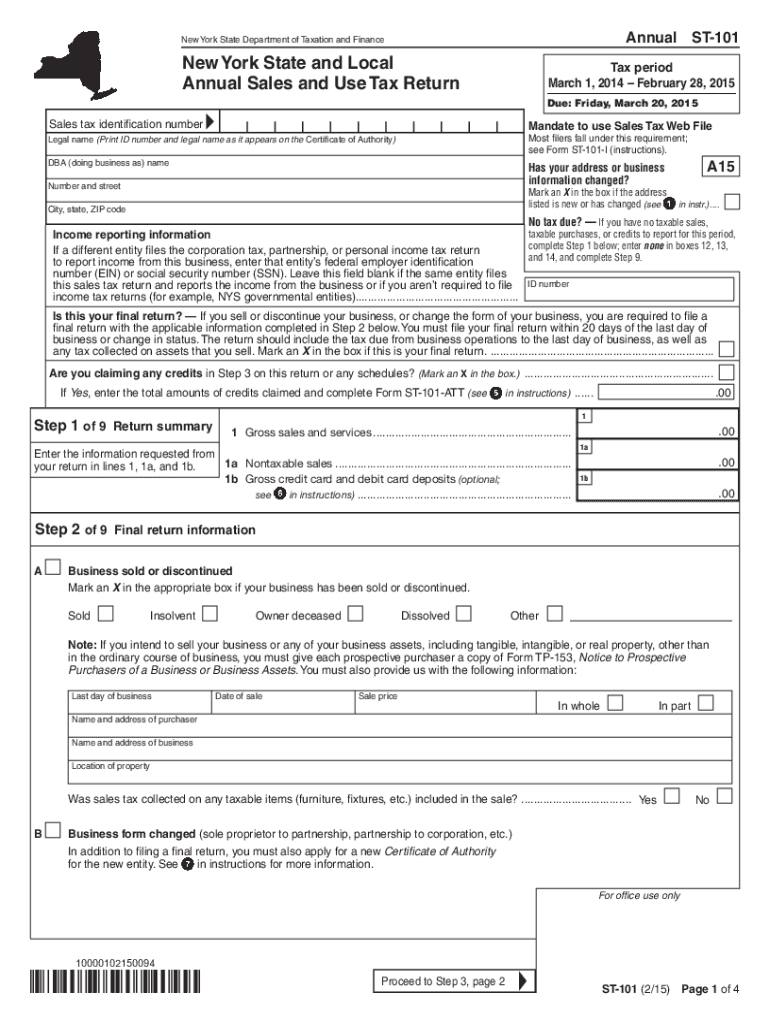

The Form ST 101215 is a crucial document used in New York State for reporting annual sales and compensating local sales tax. This form is essential for businesses that operate within the state and are required to report their sales tax obligations. It helps ensure compliance with state tax regulations and facilitates accurate tax collection. By completing this form, businesses can provide necessary information regarding their sales and any exemptions they may qualify for, thereby ensuring they meet their legal obligations.

How to use the Form ST 101215 New York State And Local Annual Sales And

Using the Form ST 101215 involves several steps to ensure accurate completion and submission. First, gather all relevant sales data for the reporting period. This includes total sales, taxable sales, and any exempt sales. Next, carefully fill out the form, ensuring all sections are completed accurately. After completing the form, review it for any errors or omissions before submission. It is advisable to keep a copy of the completed form for your records. This form can be submitted electronically or via traditional mail, depending on your preference and the specific requirements set by the New York State Department of Taxation and Finance.

Steps to complete the Form ST 101215 New York State And Local Annual Sales And

Completing the Form ST 101215 requires attention to detail and adherence to specific guidelines. Follow these steps for successful completion:

- Gather all sales records for the reporting year, including invoices and receipts.

- Determine the total sales amount, distinguishing between taxable and exempt sales.

- Fill in the required fields on the form, including your business information and sales figures.

- Calculate the total sales tax due based on the reported sales figures.

- Review the completed form for accuracy, ensuring all calculations are correct.

- Submit the form by the designated deadline, either electronically or by mail.

Legal use of the Form ST 101215 New York State And Local Annual Sales And

The legal use of the Form ST 101215 is governed by New York State tax laws. It is essential for businesses to complete and submit this form accurately to avoid penalties. The form serves as a declaration of sales and tax collected, which is legally binding when submitted. Failure to comply with the submission requirements can lead to fines or audits by the state tax authority. Therefore, understanding the legal implications of this form is critical for maintaining compliance and protecting your business interests.

Filing Deadlines / Important Dates

Filing deadlines for the Form ST 101215 are critical to ensure compliance with New York State tax regulations. Typically, the form must be filed annually, with specific deadlines set by the New York State Department of Taxation and Finance. It is important to stay informed about these dates to avoid late fees or penalties. Businesses should mark their calendars with the filing deadline and ensure that all necessary information is gathered and submitted on time.

Form Submission Methods (Online / Mail / In-Person)

The Form ST 101215 can be submitted through various methods, providing flexibility for businesses. Options include:

- Online Submission: Businesses can file the form electronically through the New York State Department of Taxation and Finance website.

- Mail Submission: The completed form can be printed and mailed to the appropriate address specified by the state.

- In-Person Submission: Some businesses may choose to deliver the form in person at local tax offices, ensuring immediate confirmation of receipt.

Quick guide on how to complete form st 101215new york state and local annual sales and

Complete Form ST 101215New York State And Local Annual Sales And effortlessly on any gadget

Web-based document management has become increasingly favored by both organizations and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, enabling you to acquire the appropriate form and securely keep it online. airSlate SignNow equips you with all the resources necessary to generate, alter, and eSign your documents swiftly without hold-ups. Handle Form ST 101215New York State And Local Annual Sales And on any gadget with airSlate SignNow Android or iOS applications and streamline any document-centric process today.

How to alter and eSign Form ST 101215New York State And Local Annual Sales And without any hassle

- Find Form ST 101215New York State And Local Annual Sales And and click Get Form to begin.

- Employ the tools we offer to complete your form.

- Mark pertinent sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign feature, which takes just moments and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or by downloading it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign Form ST 101215New York State And Local Annual Sales And and ensure outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form st 101215new york state and local annual sales and

Create this form in 5 minutes!

How to create an eSignature for the form st 101215new york state and local annual sales and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form ST 101215 New York State And Local Annual Sales And?

Form ST 101215 New York State And Local Annual Sales And is a tax form required by businesses in New York to report their annual sales and related tax information. Using airSlate SignNow, you can easily eSign and manage this document digitally, streamlining the process and ensuring compliance.

-

How can airSlate SignNow help with Form ST 101215 New York State And Local Annual Sales And?

airSlate SignNow offers a user-friendly interface to fill out and eSign Form ST 101215 New York State And Local Annual Sales And efficiently. Our platform ensures that your documents are secure and legally binding, making tax reporting simpler and more efficient.

-

What are the pricing plans for using airSlate SignNow?

airSlate SignNow provides competitive pricing plans that cater to various business needs. With flexible subscription options, you will have access to the features necessary for managing documents like Form ST 101215 New York State And Local Annual Sales And without breaking the bank.

-

Can I integrate airSlate SignNow with other software tools?

Yes, airSlate SignNow offers seamless integrations with popular software tools to enhance your workflow. Whether you're using accounting, CRM, or project management software, you can easily link them to manage Form ST 101215 New York State And Local Annual Sales And and other documents.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides robust features like document templates, eSignature capabilities, and real-time tracking. These features simplify the management of important documents, including Form ST 101215 New York State And Local Annual Sales And, making your business operations more efficient.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely! airSlate SignNow employs bank-level encryption and complies with industry security standards to protect your sensitive documents. You can confidently fill out and eSign Form ST 101215 New York State And Local Annual Sales And, knowing your information is secure.

-

Can I customize Form ST 101215 New York State And Local Annual Sales And templates in airSlate SignNow?

Yes, airSlate SignNow allows you to create and customize templates for Form ST 101215 New York State And Local Annual Sales And. This feature saves time and ensures that all necessary fields are included, making the form-filling process more efficient for your business.

Get more for Form ST 101215New York State And Local Annual Sales And

- Acceptable behaviour contract template form

- Dd form 2957 vietnam war commemoration after action report 20160408 draft

- Church certificate of election as a pdf file church of the nazarene form

- Download form 101499 colonial life

- Authorized representative form

- Notice of removal template 5766816 form

- Trustage com paymybill form

- 409 multi surface cleaner sds form

Find out other Form ST 101215New York State And Local Annual Sales And

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document