Ny St 101 2022

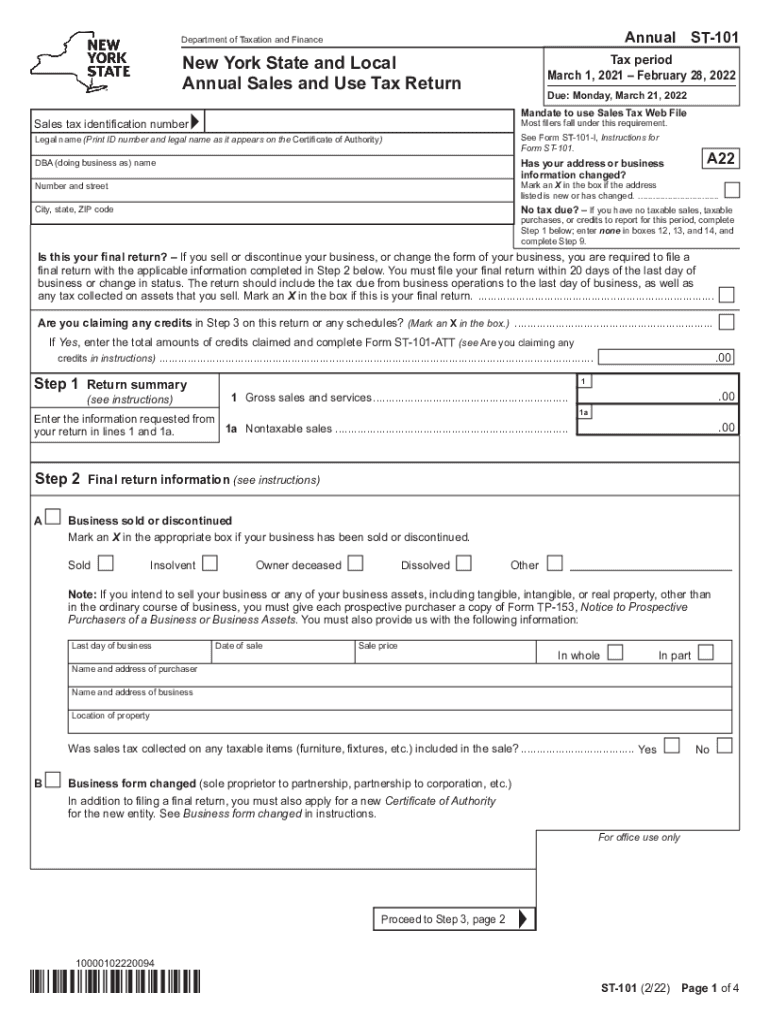

What is the NY ST 101?

The NY ST 101 is a tax form used in New York State for reporting local annual sales tax. This form is essential for businesses that collect sales tax from customers and need to remit it to the state. The NY ST 101 is specifically designed to provide a comprehensive overview of sales tax collected, allowing for accurate reporting and compliance with state regulations. It is crucial for businesses to understand the importance of this form to ensure they meet their tax obligations and avoid penalties.

Steps to complete the NY ST 101

Completing the NY ST 101 involves several key steps to ensure accuracy and compliance. First, gather all necessary sales records and documentation, including receipts and invoices. Next, calculate the total sales tax collected during the reporting period. This total should reflect all taxable sales made. Once you have the total, fill out the form with the required information, including your business name, address, and the total sales tax collected. After completing the form, review it for accuracy before submitting it to the appropriate state agency.

Legal use of the NY ST 101

The NY ST 101 is legally binding when filled out correctly and submitted on time. To ensure its legal validity, businesses must comply with state regulations regarding sales tax collection and reporting. This includes accurately reporting all sales and using a reliable method for submitting the form, such as electronic filing. Additionally, maintaining records of sales transactions is essential for legal compliance and may be required in case of an audit.

Filing Deadlines / Important Dates

Filing deadlines for the NY ST 101 are critical for businesses to avoid penalties. Typically, the form must be submitted quarterly, with specific due dates depending on the end of the reporting period. It is important for businesses to keep track of these deadlines to ensure timely submission. Failure to file by the deadline can result in late fees and interest on unpaid taxes, which can significantly increase the total amount owed.

Required Documents

To complete the NY ST 101, businesses must have several documents on hand. These include sales records, receipts, and any relevant invoices that detail taxable sales. Additionally, businesses should maintain a record of any exemptions claimed during the reporting period. Having these documents readily available not only aids in accurately completing the form but also supports compliance in the event of an audit.

Form Submission Methods (Online / Mail / In-Person)

The NY ST 101 can be submitted through various methods to accommodate different business needs. Businesses have the option to file the form online, which is often the most efficient method. Alternatively, the form can be mailed to the appropriate state agency or submitted in person at designated locations. Each method has its own requirements and timelines, so businesses should choose the one that best fits their operational processes.

Penalties for Non-Compliance

Non-compliance with the NY ST 101 can lead to significant penalties for businesses. These penalties may include late fees, interest on unpaid taxes, and potential legal action for continued non-compliance. It is essential for businesses to understand the implications of failing to file the form accurately and on time. Regularly reviewing sales tax obligations and maintaining compliance can help mitigate these risks and ensure smooth operations.

Quick guide on how to complete ny st 101

Complete Ny St 101 seamlessly on any device

Web-based document management has become increasingly favored by companies and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any interruptions. Manage Ny St 101 on any operating system with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and electronically sign Ny St 101 with ease

- Find Ny St 101 and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a standard handwritten signature.

- Verify the details and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, lengthy form searches, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your preference. Edit and electronically sign Ny St 101 and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ny st 101

Create this form in 5 minutes!

How to create an eSignature for the ny st 101

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ny st 101 form and how can airSlate SignNow help with it?

The ny st 101 form is a New York State Sales and Use Tax Return form. airSlate SignNow simplifies the process of completing and submitting the ny st 101 by allowing businesses to electronically fill out, sign, and send the document directly from the platform, saving time and ensuring accuracy.

-

How does airSlate SignNow ensure compliance when handling the ny st 101?

airSlate SignNow includes features designed to help ensure compliance with state regulations, including those for the ny st 101. With secure storage, version control, and audit trails, users can maintain proper records and demonstrate adherence to New York State tax laws.

-

What are the pricing options for using airSlate SignNow to manage the ny st 101?

airSlate SignNow offers a variety of pricing plans to accommodate different business sizes and needs when managing documents like the ny st 101. Pricing is competitive, making it an affordable solution for businesses looking to efficiently handle their tax returns without breaking the bank.

-

What are the key features of airSlate SignNow for handling the ny st 101?

Key features of airSlate SignNow for the ny st 101 include electronic signatures, customizable templates, document tracking, and integration with popular business applications. These features streamline the preparation and submission of tax documents while enhancing overall productivity.

-

Can I integrate airSlate SignNow with my existing accounting software for ny st 101 management?

Yes, airSlate SignNow offers seamless integrations with various accounting software, which can facilitate the management of the ny st 101 form. This allows for a smoother workflow by automatically importing data and reducing the need for manual entry, minimizing errors and saving time.

-

Is airSlate SignNow secure for handling sensitive information related to the ny st 101?

Absolutely. airSlate SignNow employs top-notch security measures, including encryption and secure data storage, to protect sensitive information associated with the ny st 101. Businesses can confidently manage their documents knowing that their data is safe and secure.

-

What benefits does airSlate SignNow offer for businesses filing the ny st 101?

Using airSlate SignNow to file the ny st 101 provides several benefits, including enhanced efficiency, reduced paperwork, and improved collaboration among team members. The platform's user-friendly interface allows businesses to quickly complete and submit forms, ensuring deadlines are met easily.

Get more for Ny St 101

- Super teacher worksheets answer key form

- Act seating chart form

- Sollicitatieformulier hema pdf

- Seizure log sheet form

- Singapore visa application for citizens of nigeria singapore visa application for citizens of nigeria form

- Ccl 0093 how to fill out form

- Easi form magellan provider s home page

- Director contract template form

Find out other Ny St 101

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document